Why poor employee financial education is detrimental to your business

The financial wellbeing of your employees has a bigger impact than you may think. In this article, we are going to take a look at why now is the time to invest in their financial education and to review your employee benefits package.

The welfare of employees has been a sustained concern for companies for a couple of decades now. Happy employees are productive employees. Not only that, they are loyal too.

In recent times, employers have seen that it’s not enough to focus only on employees’ physical wellbeing. Slowly but surely there has been a shift towards recognising the benefits of mental wellbeing in the workplace too.

Addressing employee financial wellbeing is now firmly on the business agenda

There is now a greater understanding of how financial stress plays a part in the overall wellness of employees. This means that taking care of employee financial wellbeing is becoming increasingly important.

Companies are realising that some employees need assistance when it comes to managing their finances in a healthy and sustainable way. Just as employees may need guidance in relation to physical and mental health, they require education and guidance with their finances too.

What is financial education?

Before looking at how financial education affects the workplace, it’s essential to have an understanding of what this actually entails.

Financial education is about helping your employees get to a stage where they are financially literate. They have an understanding of money, how to handle it, and how to budget.

Employees who are financially literate understand:

- The potential issues caused by debt

- How to manage borrowing responsibly

- The importance of savings

- The risks and benefits of investments

- The need for a plan to cope with financial emergencies

- How to manage unexpected expenses without getting into debt

The aim of a financial education programme is to create individuals who are financially well and resilient.

Being financially well and resilient means different things to different people. But overall it means that those people understand how money works and how to use it wisely.

They are more conscious of their spending habits and create new, positive, habits. Saving, for example, is a great financial habit to develop.

3 ways that poor financial education negatively impacts your business

It might surprise you to know that there’s a link between the financial literacy of your employees and their success at work.

If your employees lack understanding of financial matters, it has a significant impact on their work. For you, this means that you’re unlikely to be getting the very best out of them in the workplace.

When employees are not financially literate, correctly managing money becomes incredibly challenging. Budgeting a whole month of expenses at once requires considerable planning. When those plans don’t exist, or go out of the window half way through the month, employees are left in a difficult financial position.

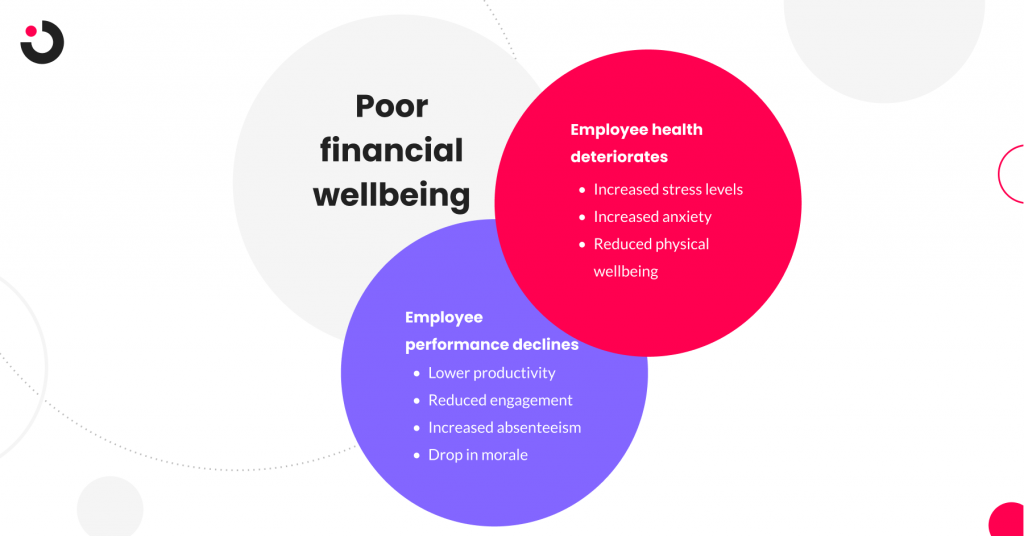

Poor spending habits and an inability to save leads to financial stress. The impacts of financial stress are many, but the key issues that this creates for your company include:

1. Reduced productivity: 4 million days are lost in the UK every year due to financial stress

Financial stress invariably means that your employees are unable to fully focus at work.

Employees who lack financial education struggle to manage their money on a day to day basis. This creates frequent challenges they need to overcome, for example paying a bill that becomes due.

At work, these employees may seem distant, disengaged, or need time out during the working day to manage their financial pressures. Whether this is researching payday loans or phoning creditors, these activities limit their performance at work.

The bottom line is that a lack of financial literacy in your employees costs you as a business. According to research carried out by Aegon, the pension provider, 4 million days are lost every year in the UK due to financial stress (Aegon, Financial Wellbeing Index 2021).

Wouldn’t it be great if you could implement measures to reduce financial stress and have all of those hours back in your business?

2. Financial ill-health increases absence rates

Employees who are experiencing financial stress aren’t just less able to perform at work. They are genuinely stressed and suffering as a result.

There is a direct link between financial stress and mental health. Poor financial literacy often leads to poor mental health. In fact, poor mental health can lead to financial stress too.

Employees who are stressed because of their finances are more likely to be absent from work. Attending medical appointments, calling in sick, or even needing time off due to stress are all common results of employees struggling with their finances.

In fact, 19% of employers reported an increase in absenteeism attributable to poor financial wellbeing (Close Brothers’ Financial Wellbeing Index 2019).

3. Presenteeism: Ill health in disguise

There are times when your employees may be at work while suffering from financial stress. The impact on their mental health means that they are unlikely to be performing well.

Known as presenteeism, there are cases when employees are present but not fully functioning. In the US, this mental state costs businesses $150 billion a year.

A UK study found that 84% of employers observed presenteeism during the pandemic according to the CIPD and SimplyHealth’s annual report.

Sustained presenteeism, whether this is poor physical or mental wellbeing, can limit an employee’s ability to succeed in the workplace. This can make succession planning difficult and lead to increased recruitment costs.

The benefits of financial education

It’s clear that a lack of financial education has a detrimental impact for employees and the companies they work for. It’s no surprise then that having a workforce that is financially educated brings your company benefits.

The benefits are not necessarily seen instantly. Financial education is a process and leads to positive habits that are developed over time.

The positive impacts that your business will see by starting this journey include:

- Increased employee productivity

- Reduced employee stress

- A well-rested workforce

- Easier career planning and progression

Increased productivity

By guiding your employees towards manage their finances more effectively, you’ll find that they have renewed focus. This can have a positive impact on their performance and increase their productivity.

Employees who aren’t worrying about paying their bills are also likely to be more engaged and happier overall. Financial stress, like other stresses, leads to poor quality sleep. Tired employees struggle to concentrate, and worryingly this can lead to workplace accidents and mistakes. Feeling tired limits levels of enthusiasm too, making them less likely to join in with their team.

Where employees obtain financial management skills, there is a clear and positive change. Waiting for payday isn’t so stressful because that employee has budgeted for the month and they know they have enough to cover everything.

Reduced employee stress

Financial education plays a key role in helping to avoid financial stress.

As we have seen, this stress can have an impact on productivity but it is also a driving factor in increased absenteeism. Being more financial literate does away with this.

With increased financial education behind them, your employees are better informed to make positive financial decisions that will help them instead of hinder them.

Financial education is also a great way to kickstart new healthy financial habits that, in the long term, see a reduction in financial stress.

A well-rested workforce

Do you know what your employees do on their days off? Do you know how they spend their annual leave? There may be polite small talk in passing, but showing a real interest can be quite revealing.

Employees who are experiencing financial stress never get any downtime. They work while balancing the stress of their financial worries. Then they finish work and are often entirely consumed by those worries. There is no recovery time.

In contrast, those who are financially well as a result of financial education are more likely to have developed better habits. As a result, they:

- Enjoy their time away from work

- Have the money to spend money on leisure activities

- Can relax more because their finances are in order

- Are less worried about money

The result? They return to work fully recharged and ready to go.

Renewed focus on career planning and progression

Employees who lack financial education are more focused on day to day money issues. They’re often living from one payday to the next. As a result, they may struggle to do any sort of long-term planning. It’s hard to focus on career development and promotions when an employee’s thoughts are preoccupied with financial stress.

An increase in financial literacy helps reduce financial stress and enhances employee focus on work. With finances planned and stable, they can start to look at the future. This future will be with an organisation that has assisted them to achieve a state of financial wellbeing.

The benefits to your employees are obvious. The benefit to your organisation is that suddenly succession planning becomes much easier when you have a focused and motivated workforce.

Tips on implementing financial education initiatives

The benefits of a workforce that is financially literate are clear, but you may be wondering how to achieve this in your organisation.

Financial education can form an integral part of your overall financial wellbeing strategy. A financial wellbeing strategy creates a culture within the workplace where finances are something that are both discussed and understood.

You can increase the financial literacy of your employees by taking steps such as:

- Giving employees access to impartial financial advice

- Arranging online financial education courses

- Organising groups sessions on key topics like budgeting, borrowing, and saving

- Providing benefits and perks that promote financial wellbeing

How Openwage can assist

Openwage is a financial wellbeing solution that gives employees access to their wages before payday. It’s our mission to increase the financial wellbeing of employees by giving them access to the money they’ve already earned.

Learn more about Openwage and how you can start offering your employees on-demand access to their pay.