What is financial resilience, and why does it matter to employers?

As an employer, getting the best out of every single member of your team is vital. Poor productivity, absenteeism, and high staff turnover cost companies millions every year. In this article, we’ll explore the topic of financial resilience and why it’s important for your business to address it by increasing your employees’ financial wellbeing.

The financial wellness of your employees may not be the first thing that springs to mind when thinking about workplace performance. You may even consider financial wellbeing and therefore financial resilience a personal matter.

That would certainly account for the 49% of businesses that have no financial wellbeing programme in place for their staff (according to a survey by the CIPD).

It’s understandable that many are left wondering about the true link between an employee’s financial wellness and their performance at work. A UK financial capability study found that 18 million working hours are lost to financial stress in the UK every year.

What is financial resilience?

Simply put, financial resilience is how able your staff can deal with, and recover from, a temporary financial issue. This may be in the form of a repair bill or a financial setback, like an expensive emergency.

What financial resilience isn’t is a knee-jerk reaction to such a crisis. This type of reaction could result in your employees resorting to high-cost credit. Examples of this include credit cards or even payday loans.

These so-called ‘solutions’ are in no way in the best interests of employees’ financial wellbeing.

In the context of HR, it’s important to understand how these choices can lead your employees into a downwards financial spiral.

What does it mean to be financially resilient?

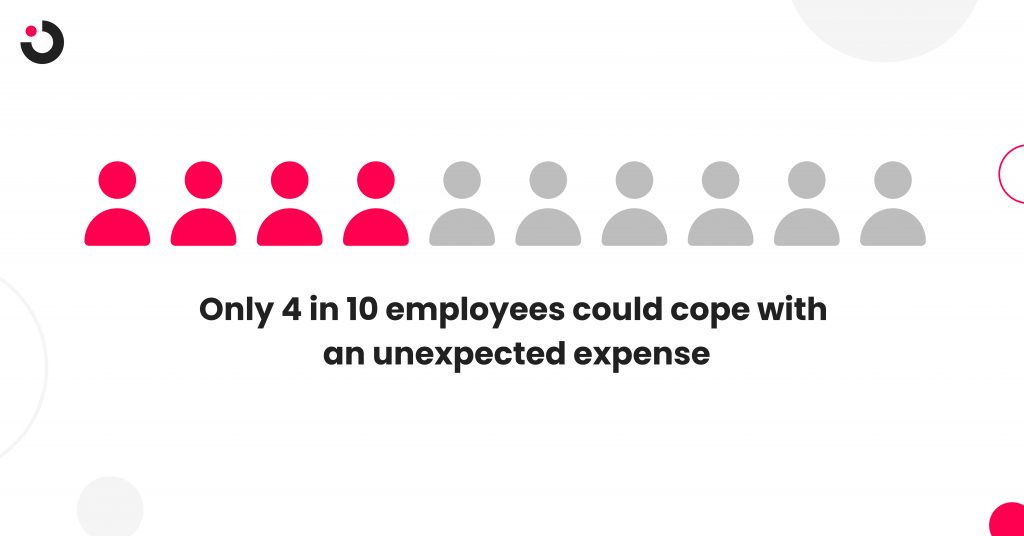

A research report shows that only 40% of employees feel prepared for unexpected financial costs or a significant reduction in their income. Financial resilience can help employees feel and be more prepared for this type of situation.

Financial resilience means that employees have a long-term financial strategy in place. It means that unexpected events are in fact planned for in advance.

Importantly, employees that are financially resilient don’t end up in the vicious cycle associated with payday loans. They are able to cope with financial setbacks quickly and sensibly while also increasing their financial wellbeing.

Financial resilience isn’t simply about savings

But there is more to financial resilience than simply having savings. It means having a plan in place to be able to access funds as and when they are required.

By fine-tuning their financial wellness, employees can ensure that they can pay their bills, have access to an emergency fund, and manage their money effectively. These steps help employees avoid reacting impulsively in the moment.

How your employees’ financial wellness affects your business?

Increased absenteeism

There is a direct correlation between your employees’ financial resilience and how they deal with workplace challenges.

It’s surprisingly common for employees who are facing financial worries to be absent from the workplace. In fact, research shows that the cost to UK businesses of absenteeism due to financial stresses stands at £15.2 billion a year.

This high level of absence amongst employees can be more fully understood when you consider the link between money stresses and mental health.

A survey by the Money and Mental Health Policy Institute indicates that there are some 1.5 million people in the UK whose mental health is suffering due to financial stress. When workplace challenges arise in addition to financial worries, it’s simply too much for some employees and they can’t face coming into work.

Reduced productivity

It’s not just absenteeism that is caused by a lack of financial resilience.

HR teams understand the need for employees to be productive. The aim is to get the best out of each individual. When your employees attend work with the burden of financial stresses on their shoulders, they simply aren’t productive.

48% of employees are distracted by money worries while at work according to a PwC report on employee financial wellness.

This means that in your drive to develop your employees, financial wellbeing and (therefore financial resilience) must play a key role.

Many employees are uncomfortable directly approaching a member of HR to discuss their financial issues. However, implementing a financial wellness programme makes the subject much easier to broach.

The result? An increase in productivity and a substantial reduction in absenteeism.

Long-term benefits of financial wellness

A business cannot simply survive in the here and now. They need plans for long-term growth and development. Your employees are integral to your business’ success.

Business sustainability means employee empowerment and allowing for an environment where they feel they can prosper. It also means that you need to stand out from the crowd when it comes to attracting new talent.

Financial wellness programmes fortify recruitment efforts

In today’s job market, the top talent can pick and choose their next career move.

The cost of recruiting can be substantial. This increases when you are looking for someone to fill a position at a higher level.

HR teams play a key role in the development of existing employees. Once someone with potential has been identified, the next step is to ensure that they stay with the company.

In-house development opportunities mean that you can shape your future leaders.

Showing an active interest in your employees’ financial wellbeing can make a positive difference in retaining these employees. It can encourage them to stay longer, helping you reduce recruitment costs in the long-term.

Understand your employees financial needs

One thing that’s clear is that what employees expect from an employer changes. One generation to the next has very distinct wants, needs, and expectations.

The future, right now, is Generation Z. For this generation, a pay packet once a month just isn’t enough. They need to feel part of something and they need to feel valued. This can be achieved by promoting their financial wellness by offering targeted employee perks.

This mindset shift is what your business needs to ensure that it continues to attract the talent of the future.

What does a financial wellbeing programme involve?

Human resources play a vital role when it comes to implementing and managing major changes.

When it comes to supporting your employees’ financial wellness, there are active steps that an organisation can take to increase employee financial resilience.

Exactly what a financial wellbeing programme is may well vary from business to business, but here are some of the things that you would expect to see:

1. Access to financial education

While HR has a key role to play, employees must take responsibility for their finances.

Providing them with access to online financial education means that they can do this. There are so many topics that can be covered, as well as giving access to webinars, and useful resources like budgeting calculators.

2. Access to an impartial financial advisor

A company can arrange for all employees to have access to a suitably-qualified – and importantly impartial – financial advisor. Financial advice should be on a one-to-one basis and allow employees to discuss anything from their current finances to retirement plans.

3. Measuring financial resilience

Employees may not understand the concept of financial wellbeing. Information sessions and resources can enlighten them.

There are many ways to measure financial wellness among your employees. But something simple to implement is a questionnaire that allows employees to measure their levels of financial wellness themselves before and after any programmes are implemented.

4. On-demand access to pay

Your employees may be struggling to make their pay stretch until the next payday.

Monthly pay cycles cause significant stress for employees and can harm their financial wellness. An employee’s ability to access their pay when they decide can significantly reduce stress and avoid the need to resort to payday lenders.

The Openwage solution

A key part of financial resilience is having the ability to turn to a source of funds when a financial setback happens.

When your employees face unexpected bills or emergencies that mean they are short of money, you can help. You can help reduce their financial stress and boost their overall wellbeing by offering them a solution.

Instead of inadvertently pushing them towards payday loans or other forms of high-cost credit, you can provide a safer and more cost-effective solution.

Empowering your employees with funds that they can tap into as and when they are needed is something that you, as an employer, can offer. This will directly impact your employees’ financial wellbeing and benefit your business.

Importantly, offering your employees a helping hand when times are tough will help you attract the best talent, increase staff retention, and reduce staff absence.

How does Openwage work?

Allowing your employees to access on-demand pay is free for employers. Openwage offers a very simple solution that’s easy and fast to integrate into your business operations.

- Employees use the Openwage app to access their earned pay on-demand pay and transfer it instantly into their bank account.

- We send funds directly to your employees so there is no impact on your cashflow or payroll.

- You’ll receive reports detailing your employees’ engagement with the scheme so you can assess take-up.

Offering on-demand pay will bring your company its own rewards. Contact us to find out how your business could benefit from Openwage.