Flexible pay: 5 ways your business can save money by paying employees on-demand

The impact of COVID-19 has caused a mass exodus from workplaces with lounges, dining rooms, and kitchens becoming the new workspace for many. The need to juggle caring responsibilities while working created an urgent need for alternate working patterns and employers rose to the challenge.

Flexible working can take many forms, including part-time working, compressed hours, job-sharing, and remote working. The pandemic further strengthened the demand for flexible working that had been running in the background since it became legal for all employees to make a flexible working request (not just parents and carers).

Why do employees love flexible working?

Flexible working has many benefits but in some cases it can be a real lifeline. For example, flexible working can be hugely beneficial for workers with caring responsibilities or mental health problems such as anxiety.

The flexibility in when (and often where) people work their hours helps them retain a high-degree of control over their working lives. This allows them to leave space for other aspects of their lives to achieve a healthy work-life balance.

Parents in particular place high value on flexible working. For example, flexible arrangements such as staggered start times can help parents manage childcare responsibilities more easily.

When it comes to working from home, not having to commute means nursery or school drop-offs and pick-ups are more achievable and allow parents to spend more time with their children.

On-demand working is the new flexible working

The firmly established view of flexible working largely revolves around when workers do their work. More recently, remote working is also edging into this space with many companies announcing their commitment to building a ‘remote first’ workforce.

The rise of the gig economy, which includes companies like Uber, Deliveroo and Yodel, has created a new concept: on-demand working.

On-demand working allows workers (who may be temporary, contract firm workers, or independent contractors) to decide when to work. This allows them to create a work schedule that fits their life, rather than having to fit their life around work.

This highly flexible way to work gives workers the freedom they crave to live the life they want. If they need to work less, then they can. Equally, they can pick up more work as the need arises, for example if they need some extra funds or have more time to spare.

Flexible pay: The missing ingredient

Despite large swathes of UK employers supporting flexible working arrangements, this flexibility does not extend to the way employees are paid. The vast majority of employers pay their employees on a monthly basis.

When it comes to salaries and wages, most companies are extremely rigid with how often they pay their employees.

So why are employers open to flexible working, but overlook flexible pay?

The benefits of flexible pay for employers

By extending the flexibility you already give your employees to the way you pay them, you are promoting the financial wellness of your employees. Not just that, you’re also opening the door to many other benefits that will help to reduce your business costs.

Here are the top 5 reasons why offering flexible pay makes sound business sense:

1. Attract talent by standing out from your competitors

Integrating on-demand pay as one of your employee benefits is a great way to stand out from others in your sector.

Although financial wellness may have strong links to levels of pay, when you want to attract the best talent then the salary on offer isn’t everything. In highly competitive industries, having attractive benefits can nudge more candidate in your direction.

Companies that show that they care about their employees are more likely to attract the very best when it comes to talent. Good news travels, so if you’re offering a great benefit then candidates and existing employees are likely to share this information.

The key takeaway here is are that on-demand pay can help you recruit more easily, because it’s a new benefit that many employers haven’t explored fully yet.

2. More engaged employees help increase retention rates

You already know that retaining your employees is hugely important for minimising recruitment costs. Creating a culture that encourages your employees to stay is a big win for your business.

By offering on-demand pay, you will be openly demonstrating that your business cares about employee financial wellbeing. Employees love to feel looked after by their employers, and it will promote a positive attitude towards you as their employer.

As positive feelings increase, employees become more engaged. This leads to them committing to your business and much more likely to stay. Retaining talent saves on recruitment costs but it also makes it easier to put succession plans in place.

3. Regular reward for pay creates happier, more productive employees

For your business to operate efficiently, it relies on your employees being productive. Poor productivity causes your business to lose money. This is either because tasks remain incomplete or because you need to increase your workforce to complete them.

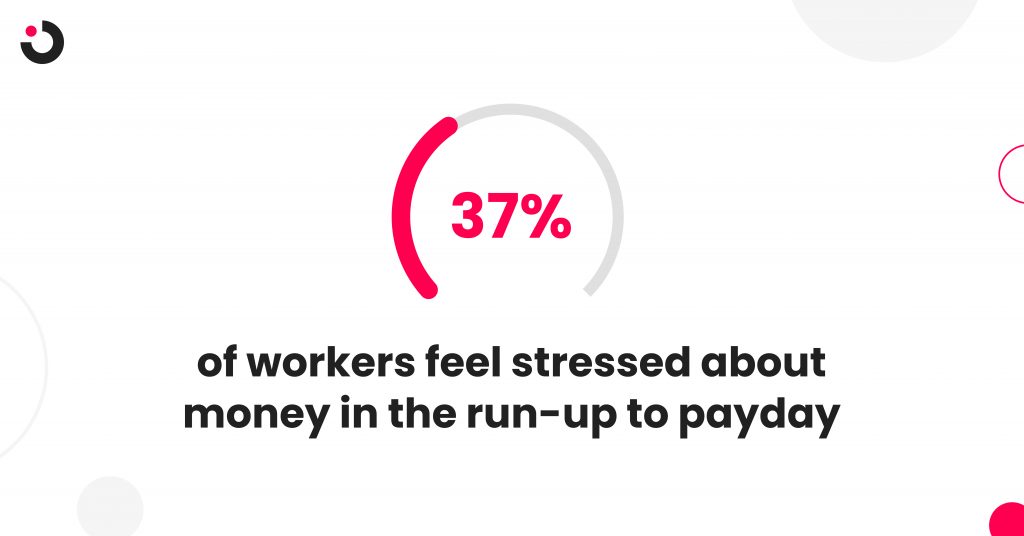

Common sense dictates that when your employees are distracted then their levels of productivity fall. What bigger distraction than the worry of not being able to pay for essentials like food and rent?

A lack of financial wellbeing can see employees disappearing to make personal calls when they should be working. It can also see them generally unable to concentrate, known as ‘presenteeism’.

On-demand pay allows employees to access a portion of their gross monthly salary that they’ve earned so far, meaning that they are less likely to feel stressed about money. This increase in financial wellbeing has a positive effect on productivity too, which is great news for your business.

4. On-demand pay reduces absenteeism

Employees who are under financial stress are more likely to be absent from work than those that are financially well.

There is a link between financial pressures and instances of anxiety and depression. These are both conditions that can lead to long term absence. The cost implications to a business can be significant.

So when it comes to money worries, then on-demand pay can really make a positive difference. Employees who can access their money when they need it feel more in control of their financial situation.

Money worries can be extremely damaging to individuals and lead to increased levels of absenteeism. This is especially true among those who experience mental health problems like anxiety and depression as a result of poor financial wellbeing.

It has been reported that in 2020 alone, absenteeism cost UK employers £14 billion. What’s more, almost a fifth (19%) of employers reported an increase in absenteeism attributable to poor financial wellbeing (Close Brothers’ Financial Wellbeing Index 2019).

As well as the cost implications, the absence of your employees impacts those who remain at work. Colleagues may have to pick up the slack and cover for those who are absent. This can place increased pressure on your employees and can create problems for your business too.

5. More financially resilient employees make better business decisions

With on-demand pay (also known as a salary advance and earned wage access), employees can get paid in smaller amounts more frequently, accessing their earnings as they need them. This can help employees avoid the need to turn to credit cards and payday loans when an unexpected financial requirements comes up.

On-demand pay enables employees to cope with financial shocks, like suddenly needing a large amount of cash for something they didn’t see coming. Being financially resilient translates to your business, too.

Having a can-do, positive and resilient frame of mind helps employees focus on their work, with higher levels of concentration. That means costly mistakes are far less likely to happen.

An overall boost to your business

It is clear that by engaging with employees about their finances you can benefit your business. Concentrating on the financial wellbeing and financial resilience of your employees allows them to create better financial habits.

In turn, you will create a healthier, happier, and more productive workforce. The areas where your business can benefit are all tangible in their results and give a sound business case for implementing change.

How to offer your employees on-demand pay

Businesses tend to offer monthly pay because:

1) This is what they have always done and;

2) Because it suits their existing systems and processes.

However understanding the potential gains from offering a more flexible pay strategy is vital for forward-thinking employers. Couple this with a solution that costs employers nothing and doesn’t affect cash flow, then on-demand pay suddenly becomes very interesting.

Openwage is simple and free for employers

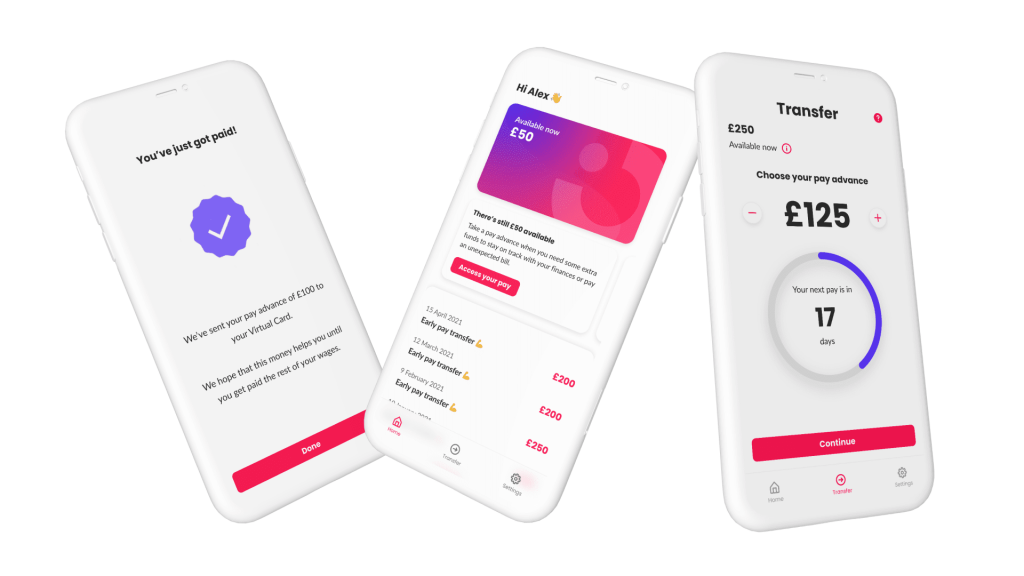

Using Openwage doesn’t cost your company anything. There is zero cost to your business and employees only pay a small fee. Importantly, there’s no impact on your cash flow because we fund all payments to your employees.

Employees can access up to 50% of their gross monthly salary. So if an employee is one week into their pay period, then they can access up to 50% of what you have earned for that week.

Want to know more?

If you want to know more about how adopting a more flexible pay strategy can help your business reduce unnecessary costs, arrange a call with us by getting in touch.

An HR manager’s guide to measuring financial wellness

The financial wellness of employees is a hot topic. It’s hot for a reason. Employers are increasingly aware of how financial wellbeing impacts their business. But to improve the financial wellness of their employees, HR teams need effective ways of measuring it.

In business, we are all working towards key performance indicators, or metrics. These allow organisations to measure what’s important to a company to ensure it’s achieving in all business-critical areas.

Methods to measure profit, waste, and employee performance have been around for decades. In addition, businesses can measure the productivity of their employees as well as recording metrics like absence and retention rates. These last metrics are particularly relevant to financial wellbeing.

Measuring financial wellness

It’s relatively easy to monitor and record areas where there are tangible results.

But when it comes to the financial wellness of employees, this initially presents a challenge. Not least because for many employers, the concept of employee financial wellbeing is still relatively new.

Invariably, HR managers will play a major role in any financial wellbeing initiatives. This means that it’s necessary to lead from the front and for HR managers to educate their teams.

Understanding the concept, therefore, is the first step. Once this is fully understood, then it becomes clear that there are key business impacts that can be recorded and measured.

What is financial wellness?

Before measuring financial wellness, it’s necessary to understand what financial wellness is.

Financially-well employees:

- Can comfortably manage their day-to-day expenses

- Are not stressed about their finances

- Don’t have problem debt

- Have sufficient savings so they don’t worry about unexpected costs

- Enjoy life because they have the financial freedom to make choices

- Are free to retire when then choose

In contrast, employees that are not financially well may:

- Struggle to pay for anything over and above their normal monthly expenses

- Be stressed or anxious about their financial situation

- Have got into problem debt

- Not have a savings buffer to fall back on in an emergency

Which employees are likely to be financially well?

Identifying employees who are struggling with their financial wellbeing is not always simple.

This is because it’s too easy to assume that employees in higher positions and therefore on a higher salary will be financially well. Conversely, the assumption is that those receiving a lower wage will struggle financially.

The reality is that financial wellness varies across all pay scales. In fact, you are just as likely to find a highly-paid employee struggling with their finances as you are a lower-paid one.

Understanding that poor financial health can affect anyone, however much they are paid, is vital. This will ensure that employees at all levels are given adequate support.

Why should employers be interested in measuring financial wellness?

Monitoring financial wellness requires an investment of time and employers want to see a return on this investment.

It may not be immediately obvious what the business case is for companies to promote financial wellbeing. But business leaders need to see metrics that clearly demonstrate that investing in employee financial wellbeing is worthwhile.

Here’s the key take-away: Once businesses understand the impact of poor employee financial wellbeing, it becomes clear that this is already having a detrimental effect on existing levels of performance.

There is strong evidence that shows that employee financial wellbeing is connected to many other areas in the workplace. Now, let’s look at these:

Proving the link

Employee financial wellness impacts several areas of HR, all of which are usually monitored by HR teams. That’s why understanding how each of these areas are impacted by employee financial wellbeing is the first step towards making improvements.

1. Absenteeism

When an employee is under financial stress they are more likely to be absent from work. This could be because they need time to deal with their financial situation, like talking to their bank or a loan provider.

However, more worrying is the link between financial stress and mental health. Worrying about money can have a negative effect on our mental health. Poor mental health can make managing money even harder. This creates a cycle that can be hard to escape.

Someone absent from work that is under financial stress could be facing mental health challenges. Research shows a clear link between finances and mental wellbeing.

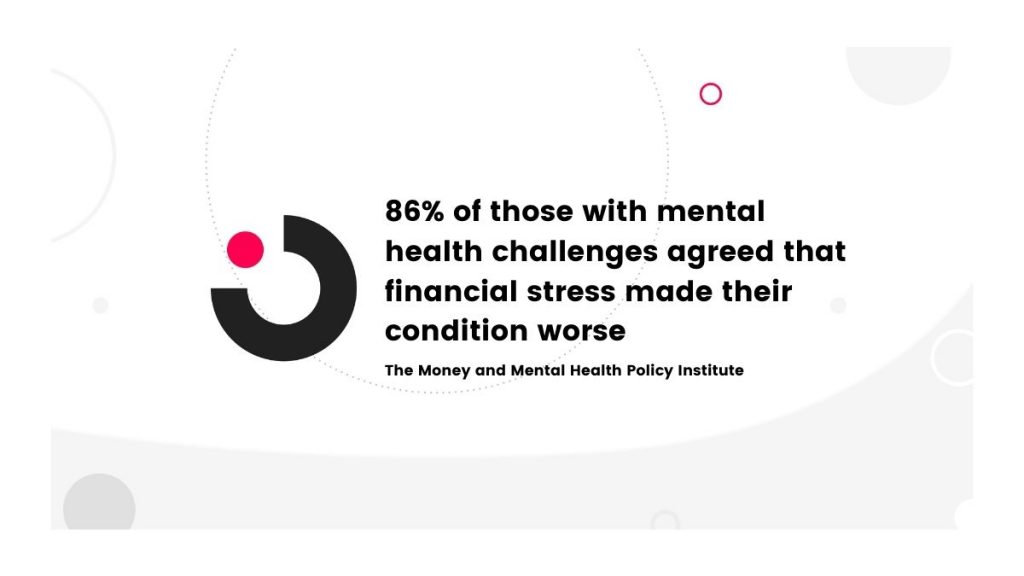

86% of respondents to a Money and Mental Health survey with experience of mental health problems said that their financial situation had made their mental health problems worse.

2. Productivity

Financial stress can be extremely distracting in the workplace. Being distracted makes it harder to concentrate, and this has a negative effect on productivity.

Missing targets and can have far-reaching impacts, for example customer retention. Understandably, employers are keen to maintain and even increase productivity levels.

A study by Warwick University found that happy employees were 12% more productive. It’s clear that financial worries severely impact our happiness, so tackling financial stress facilitates increased productivity.

3. Employee retention

Benefits packages that promote physical and mental health can help employees enjoy a better work-life balance. But what about their financial health?

Providing some sort of financial wellness support to employees can help employees feel valued and cared for by their company. This can promote loyalty among employees and have a dramatic impact on retention.

In summary, when employees feel that their needs are being met, then they are more likely to stay with their employer.

4. Attracting talent

The very best talent has always been able to choose the company that they work for. As a result, while the salary on offer is a key consideration, talented individuals look well beyond this.

Today’s workforce is now firmly focused on a great workplace culture and a clear path for career progression. However more recently, employees are closely comparing benefits packages on offer. This can be a deciding factor when choosing which job to either apply for or accept.

That’s why offering the best possible benefits package should already be one of your priorities. Financial wellbeing perks are growing in popularity and can really help your company stand out.

The importance of a financial wellbeing strategy

Simply acknowledging your employees’ financial wellness is not enough. HR teams need to clearly show that they are taking this aspect of their employees’ lives seriously.

A financial wellbeing strategy can take many forms, but here are some of the main elements to consider including:

- Encourage a culture where employees are comfortable talking to you about their financial health

- Provide access to financial education to improve financial literacy

- Upgrade your benefits package with a financial wellbeing product, such as Openwage

- Encourage financial resilience so employees can cope with financial shocks

- Key metrics to measure financial wellness

Read our previous article for more ideas on tackling financial wellbeing at work.

How to measure your employees’ financial wellness

With a financial wellness strategy in place, the results need to be measurable.

Here are 6 key ways that HR teams can measure financial wellness. Using them in combination can create a highly detailed picture of how successful your financial wellbeing strategy is.

1) Employee take-up

A strategy to increase financial wellbeing cannot be forced on employees. There needs to be buy-in from them to make it work. Getting employee buy-in will boost take-up and that’s a great metric to measure.

This is because measuring the number of employees who participate in initiatives or access resources allows you to assess whether your strategy is on target.

For example, HR teams can monitor how many employees access online training. Or how many choose to book time with an impartial financial advisor or counsellor organised by the company.

When it comes to using Openwage to access earnings before payday, monitoring take-up becomes a breeze. Monthly reports show (anonymously) how many employees access their pay, and how much they transfer.

2) Engagement and satisfaction surveys

Satisfaction surveys provide a snapshot showing how employees feel about your business at one particular moment.

Looking more closely, surveys can give insights into how happy your employees are and how they feel about the organisation. HR teams can also use surveys to assess engagement, by asking questions around passion and commitment.

Of course, happiness and engagement directly affect each other and the ideal is to have employees who are both satisfied and feel connected to your company in multiple ways.

Surveys conducted in the right way asking the sensitive questions can provide a measure of how your employees are feeling. You can then draw out insights relating to their financial wellness.

3) Informal discussions with employees

While surveys can give a formalised view of how your employees are feeling, an informal chat can often reveal far more.

Encouraging a workplace culture where your employees are comfortable talking to both HR and the management team is important. This means you can promote open conversations about financial health.

With the right guidance, managers can feel confident having informal discussions with employees about financial wellness. But you may want to consider offering training sessions for managers. Training could help them have supportive conversations about money and offer tools to help them.

4) Productivity levels

As we have already explored, employees experiencing financial stress tend to be less productive.

If productivity levels start to increase after implementing your financial wellness strategy, then it could be a sign that it’s having a positive effect.

On the other hand, if productivity drops or plateaus, then perhaps it’s time to review and tweak your financial wellbeing strategy.

5) Absenteeism

Employees experiencing a financial crisis are stressed. Sometimes that stress can become so overwhelming that the very thought of work is too much.

Stress has serious consequences on physical and mental health, as well as the impact of lost working time for businesses.

Absence rates can be a good indicator of the effectiveness of your financial wellbeing. However it’s important to drill down into the data to uncover the most common causes of absenteeism and tackle those specifically.

6) Employee retention

Employees who are struggling with their financial wellbeing will have different priorities. This may include increasing their take-home pay or even securing a pay advance.

If your company isn’t meeting these needs, then there is an increased chance that that employee will leave your organisation. This is because they may be focused on securing a higher-paid position or joining an organisation that offers financial wellbeing initiatives.

Offering fair rates of pay is a given. However, offering financial wellbeing initiatives as part of your benefits package is a great way to both attract and retain talent.

For those who do leave, exit interviews are critical to exploring the reasons why. If this flags issues with your current strategy, you have the perfect opportunity to tweak it.

Final thoughts

“Wealth is the ability to fully experience life.”

Henry David Thoreau

Financial wellness leads to better overall health. Being financially well brings many benefits, not least the ability to enjoy life more.

Measuring financial wellness doesn’t have to be complicated. But it is important if your organisation genuinely wants to effect positive change. There’s no point implementing a poorly-thought out strategy that simply gets ignored.

Check out our other articles on our blog page and follow us on social media to see our latest articles, insights, and company news.

How does financial wellbeing relate to the workplace?

Record numbers of employers are implementing measures to improve their employees’ wellbeing to create a happier workforce. But financial wellbeing is often missed out of these initiatives. Perhaps that’s because many HR professionals are still unsure about how employee financial wellbeing relates to the workplace.

It has become almost an expectation that workplaces take steps to protect their employees’ physical health.

This can take the form of things that help them keep fit and healthy such as discounted gym memberships. It may also include either free or discounted private health care.

In the last few years, the number of employers offering employees access to counselling services has jumped. HR teams everywhere have recognised that mental health is just as important as physical health when it comes to effective performance.

HR teams that are at the forefront of employee wellbeing have also realised that financial wellness matters too.

Employees with low levels of financially wellbeing can have serious consequences for a business. Understanding these consequences and what measures you can take to avoid them benefits your business (and employees) in multiple ways.

Let’s delve into the concept of your employees’ financial wellbeing and the type of issues they may be facing.

What does financial wellbeing mean?

Financial wellbeing is a term that has grown in popularity. As is often the case with buzzwords and phrases, these are banded around but not always understood.

So, what exactly is financial wellbeing?

Financial wellbeing comes as a result of a person’s financial capabilities (for example knowledge, resources, and attitudes) and behaviours (the spending decisions they make and ability to cope with a financial shock).

Being financially capable and making the right decisions leads to wellness.

Financial wellness means your employees are able to meet their expenses each month, feel financially secure, and can cope with a unexpected financial requirement (also known as financial resilience).

Positive signs that your employees are financially well include:

- The ability to manage their day to day finances

- Sufficient funds to deal with unexpected financial events

- Being comfortable and able to enjoy their lives

- Having a plan in place to look after their long-term financial health

How many of your employees are financially well?

Often, employees give the impression that their financial wellness is in check.

This might be true, or it might not be the full story. In fact, many of us don’t entirely understand what financial wellness means.

When asked to look at financial wellbeing in detail, the responses of your employees may surprise you. Post-pandemic research by the CIPD into the financial wellness of employees revealed that:

- 40% of people feel they do not have good control of their money or manage it well.

- Only half of working-age people are paying into a pension or have a previous pension.

- Among those who already have a heavy debt burden (measured as missing three key debt repayment deadlines in the last six months), 81% have sought no advice and 33% cannot imagine doing so.

Financial wellbeing isn’t just down to the salary your employees receive. In fact, financial wellbeing isn’t directly correlated to how much someone earns at all.

For example, someone who earns what could be considered a lower wage can have higher rates of financial wellness than those who are paid much more. This could be because they make considered financial choices and have savings to deal with unexpected bills or situations.

In contrast, someone who earns a high salary isn’t necessarily financially well. A lack of time can be a huge barrier to someone’s financial wellness. Planning, researching, and considering financial options takes time. Plus we all feel society’s pressure to ‘live for today’.

With the above in mind, it would be a mistake to assume that the financial wellbeing of your employees is good simply because they are paid market-leading salaries.

Signs of financial distress

Poor financial wellbeing is characterised by many different behaviours. However, some behaviours are not solely attributable to financial distress. Some of the signs that an employee may be struggling with their finances include:

- Asking for a pay rise

- Talking about their debts

- Relying on credit cards or overdraft facilities

- Using payday loans

- Struggling to keep up with rent/mortgage payments

- Asking for a pay advance

- Consistently asking for overtime

- Appearing anxious or even depressed

- Taking personal calls regularly

Of course, some of the above points in isolation do not necessarily mean that someone is facing financial difficulties.

When an employee is seeking a pay rise it could be as simple as they believe that they are worth more than they are currently being paid. However, when you combine this with constantly asking for overtime, then it becomes clearer that an employee may be struggling.

One huge concern when it comes to the financial wellness of your employees is payday loans.

Payday loans have often been the last resort for those who are in a financially unstable situation. Most people realise that the interest rates and fees on these loans are extortionate. But the fact that they take out these loans despite this is a clear sign of financial distress.

How work creates financial burdens

Social events

Employers quite rightly want to engage their employees and often organise social events to promote togetherness and camaraderie. Work-organised social events take many forms, from a quiet drink down the pub to a full scale ball.

While social events can do wonders for team building, they can cause significant stress for employees whose financial situation is precarious.

The pressure to attend a work-organised social event can put undue pressure on employees to spend money they had already allocated for bills or an important payment. The Christmas party is an excellent example.

Business expenses

Another aspect of work that can impact an employee’s financial wellbeing is expenses.

There are times when businesses expect their employees to meet the costs of fuel to travel to another location, parking, or phone bills. In general, an employer would always reimburse these. However, this is usually a month down the line.

If your employees are already struggling financially, having to cover expenses (if only temporarily) can create an additional and unwelcome financial burden.

How financial wellbeing affects us at work

Employee financial wellbeing is often overlooked, or only given a cursory glance by employers.

But the organisations that take time to focus on their employees’ financial wellbeing put themselves in a better position on many levels.

As an HR professional, you know that a successful business is built on its people. That’s why employers should take some responsibility for the financial wellbeing of their employees.

It’s vital to understand the impact of your employees’ financial wellness on your operations. Solely focusing on the bottom line will often lead to problems.

Your employees’ financial wellbeing is more closely linked to your business performance than you think. Some of the biggest challenges that businesses face associated with poor financial wellbeing include:

Decrease in productivity

22% of employers experience a decrease in productivity due to poor employee financial wellbeing.

Close Brothers’ Financial Wellbeing Index 2019

Unpaid debts, a reduction in household income, and making their money stretch until payday are genuine concerns for many employees. But employees cannot switch these worries off just because they’re at work.

Many employees will find themselves being consumed by money worries and unable to focus on their work. Perhaps they need to deal with these issues by calling creditors and lenders during working hours, meaning they have less time to do their work.

You may notice employees missing targets that they previously reached. Being less productive can really hinder an organisation’s growth.

Increase in absenteeism

19% of employers reported an increase in absenteeism attributable to poor financial wellbeing.

Close Brothers’ Financial Wellbeing Index 2019

Poor financial wellbeing also leads to your employees taking more sick days. This may be down to the fact that they need time to deal with practicalities.

However, more commonly, an employee’s financial stress is having an impact on their mental health. Money worries can quickly lead to anxiety and depression. This may result in long-term absence.

Elevated turnover rates

Poor financial wellbeing is causing 22% of employers to experience higher turnover rates.

Close Brothers’ Financial Wellbeing Index 2019

Recruitment costs are substantial, to say the least. Once you have talent in place, it’s expensive to replace.

So if your employees are struggling in terms of financial wellness you may find that they leave to join other businesses. This could be because they are seeking higher pay or a job where they are paid more frequently than they are at present.

It’s important to note that the increase in remote working can make it more difficult to spot signs of financial pressures among your employees. This makes it vital for HR teams to take positive action towards giving employees the help they need to improve their financial wellbeing.

Financial wellbeing best practice for HR teams

After realising the importance of financial wellbeing, employers are keen to take steps to support their employees.

Taking action to support your employees’ financial wellbeing can be hugely beneficial on a business level. Organisations that have a financial wellbeing strategy in place are likely to experience:

- An increase in productivity

- Reduction in absenteeism

- Lower staff turnover

Here are the most effective steps that HR teams can take to promote financial wellness:

1. Encourage open conversations

Ensure that your workplace culture centres around openness and honesty.

Lead from the front and show your employees that talking about finances isn’t just okay, but is actively encouraged.

Communicate that your employees can and should seek assistance and advice from management teams without fear or shame.

2. Provide financial education

One of the fundamental building blocks of financial wellbeing is financial education.

Key lessons for employees centre around how to save, how to budget, building an emergency fund, and having a financial plan in place that covers retirement.

3. Review your benefits package

Benefits packages tend to focus on employees’ physical health although there is a shift towards encompassing mental health too.

One thing that is often missing from benefits packages is initiatives that focus on financial wellbeing.

You can stand out from the crowd by making sure that your organisation offers financial wellbeing programmes or perks. This could include access to financial advisors or even online training to boost employee financial education.

4. Break the monthly payment cycle

With some employees struggling to make it from one month to the next, why not add some flexibility to how they are paid?

Paying your employees once a month is beneficial for your business. But it’s not always best for your employees and their financial wellness. In fact, monthly pay cycles can be hugely stressful for employees.

Using Openwage enables your employees to access their pay more regularly. It can help them avoid bank balance peaks and troughs that can make employees feel financially vulnerable.

5. Issue expense cards

Expecting employees to pay for business expenses and then get reimbursed later is a financial pressure that’s easy to fix.

Why not provide employees with expense cards? This means they can meet business expenses without having to pay for them themselves. It’s a convenient solution to managing employee expenses.

6. Offer a salary savings scheme

Part of financial wellness includes the ability to save. Savings schemes are a great way to encourage employees to plan for the future. These schemes work by deducting a percentage of your employees’ pay at source and transferring them to a savings scheme.

Final thoughts

If you’re reading to the very end of this article, then you’re probably aware that your organisation could do more for your employees’ financial wellbeing. This is a useful article about how to tackle financial wellness at work that outlines some of the fundamental principles of tackling financial wellbeing.

Check out our other articles on our blog page and follow us on social media to see our latest articles, insights, and company news.

What is employee experience and why is it important?

As a leading company in your sector, you understand that your people are key to your success. For that reason it’s important to ensure your employees have a positive experience so they can do their best work and achieve great results. But what exactly is employee experience and why should your business invest in your employee experience?

We understand that as a business, often your primary focus is on your customers. After all, it’s your customers that buy your products or services. Without your customers, you have no business to speak of. That explains the rapid increase in customer service training that organisations employ.

Customer experience (CX) has long been at the forefront of leaders’ minds. Now, the realisation has dawned that EX is just as important for a whole host of other reasons.

What is employee experience?

On a simple level, EX is everything that an employee experiences at work. It is about what your employees see, feel, and encounter in the workplace.

EX is made up of:

- The physical space around employees (the home office for many of us)

- An employee’s work-life balance

- The leadership of the company and their team

- How technology is used

- How engaged an employee is with their company

- Benefits package including salary

- Employee support e.g. wellbeing initiatives, training programmes

EX is not just an HR function. Creating and supporting the EX goes far beyond HR. Ensuring that employees are cared for at every touchpoint during the journey with a company is no small task, but it is essential.

There are links to recruitment, leadership, and succession planning, as well as other factors like financial wellness and financial education. We’ll cover these later in the article.

What is an employee experience team?

An EX team is a team of specialists. It’s a team that, with the right individuals onboard, can have a dramatic impact on your workforce and your company’s bottom line.

By understanding the leadership team/worker relationship, an EX team can completely transform how your employees feel. Some aspects that an EX team should be responsible for include:

- Creating an EX framework

- Building a culture of trust

- Designing ways to measure EX

- Taking a proactive approach to employee wellbeing, including their financial wellness

- Giving employees a voice in the organization

- Asking for employee feedback to provide insights into improvements

Who’s in an employee experience team?

When it comes to your EX team, it’s important to realise that this is not a one-person role.

Just as your HR department will have differing levels, so must your EX team. Of course, the extent of your team will depend largely upon the size of your organisation, but typical roles include:

- Director of Employee Experience

- Head of Employee Experience

- Employee Experience Manager

- Employee Engagement Assistants

Ensuring that you have the right people in the right role is vital to the success of your EX team.

Employee experience vs employee engagement

Some believe that the terms employee experience and employee engagement are interchangeable. Let’s look at both:

Employee engagement

This is all about creating the right conditions for your workforce. It means an environment where employees are able to perform to their best ability every day.

To be successful, employee engagement requires commitment from your business. It also requires your employees to commit to and support your company’s goals and vision. Employee engagement tends to be measured at a particular moment in time.

Employee experience

This goes beyond how your employees feel at one particular moment. EX takes into consideration all that they see, hear, feel, and believe throughout their employee journey. This means ensuring that every touchpoint along the way provides a positive experience.

A natural by-product of a great EX is increased employee engagement. So while the two are separate there is a close link and even some overlap.

What do employees expect from your company?

If you want the best from your employees, getting the EX right is key. Money is no longer the primary motivating factor behind career decisions so as a company you need to provide far more than a good salary.

Here are some of the areas that your employees consider when consider their their experience at your company:

- Fairness in the company (decisions, salaries, behaviours etc)

- The values or ethos of an organisation

- Being equipped with the tools they need to do their job

- The physical workspace

- Being listened to and opportunities to contribute

- Their wellbeing, including financial wellbeing

- Rewards and recognition

- Benefits package

- The leadership style of the company

- Development and training opportunities

Knowing these aspects of your business form part of the EX means that you can take steps to address each of them, through your EX team, to perfect each of them.

Top tips for creating a great employee experience

When it comes to creating the optimum EX within your company, there are a few simple points to consider. Keeping these points in mind when investing in your employee experience can return huge benefits for your company in terms of employee engagement, a by-product of which is higher levels of retention.

Getting the EX right will also help your recruitment efforts. When you have attracted the top talent, you need to do everything to retain that talent.

Here are 6 top tips for creating a successful EX:

1. Effective onboarding

EX begins at the recruitment stage. In fact, it begins with your job advert.

The workplace is competitive and top talent has the choice of where to work. The application process is the first touchpoint in the employee journey. Getting this right, followed by effective onboarding leads to a happier employee.

Expertly on-boarded employees are motivated and inspired to deliver excellent work for your company. Get the on-boarding process wrong and you risk low morale and losing employees to another company

2. Look after your employees’ interests

Today’s employees are far more focused on work-life balance than a decade ago. While no longer live exclusively for our work, the financial aspect of work remains hugely important.

Looking after your employees’ financial wellbeing is an element of EX that is often overlooked. But when employees bring financial stress into the workplace, it can have a detrimental effect on their work and your wider company.

3. Talk (and listen) to your employees

Although it may sound like a cliché, an open-door policy works. Using this encourages transparency and with this comes trust.

Frequent and open communication allows employees and employers to give feedback and lets employees be heard. Understanding how your employees feel will provide you with (often simple) solutions to improve their pain points.

Small things make a big difference to employees. Don’t wait until they leave to find out.

4. Make your employees feel valued

Each time an organisational decision is made, you need to think about your employees.

- Has the time been taken to consider the impact on them?

- Has there been clear communication to keep them involved and feeling valued?

- How will your employees perceive the change?

- How will you manage the changes in a way that keeps employees engaged?

5. Keep pace with new employee benefits

When it comes to employee retention, being seen as a company with enviable employee perks goes a long way. It also helps with the recruitment stage.

This could include offering financial education and assisting your employees to reach a place of financial wellness.

6. Provide learning and development opportunities

Employees need to feel they are making progress and working towards their future. Career progression is an important element of our work and it helps employees feel more engaged with and motivated towards their work.

Employers can support employees with development and training opportunities that not only focus on existing roles, but considers where that employee might want to go next.

The benefits of a great employee experience

For a business to implement change, there must of course be a business case. This means that CEOs and HR leaders will be keen to know the business impact of implementing an EX team and what the potential benefits are before choosing to invest in employee experience.

Companies that invest in employee experience outperform those that don’t

We now know that EX boosts employee engagement. Studies show that companies with highly-engaged employees are 21% more profitable than those with a disengaged workforce. This is because a better EX leads to greater productivity and lower staff turnover rates.

Happy employees = more productive employees

Employees surrounded by a positive EX are more productive because they feel more positive about their workplace and their job. A study by LinkedIn found that EX increases productivity by 71%. Productive employees get better results.

However feeling happy at work is also dependent on an employees’ financial wellness so offering perks such as pay on demand can really help with this.

Employee experience reduces staff turnover

The EX is crucial to retaining employees. An employee that enjoys working for your company will always stay longer than someone who dreads coming to work everyday.

LinkedIn found that EX boosts retention by 77%. So if high turnover rates are affecting your business, then investing in your EX would be a smart move.

Employee experience boosts recruitment

One of the clear benefits of an EX team is that companies who invest in EX are perceived as better places to work. Having this sort of accolade will help you attract talent as individuals are drawn to working for companies that promise a fulfilling experience.

How employee experience promotes business sustainability

Investing in employee experience means that your company is setting itself up for long-term success.

When a company invests in building a strong employer brand it leads to attracting the right people for the right vacancies. Ensuring that these people go through an effective onboarding process means that they are likely to quickly become part of the team and be working towards the same goals.

EX assists your company when it comes to succession planning too. With an increase in employee retention, you will hold on to your talent and will fill internal positions with ease.

When employees can see that they are part of a succession plan and that there are clear opportunities to progress, they work hard. They ensure that they improve relationships within the company and this leads to more collaborative working and inspiration.

The benefits of investing in your company’s employee experience are far-ranging. This is a part of your business you simply cannot ignore. So if you haven’t already got an EX team, then it’s time to start writing that business case.

Check out our other articles on our blog page and follow us on social media to see our latest articles, insights, and company news.

6 ways to use HR tech to drive recruitment success

Human resources (HR) is one of the most exciting applications of technology. HR tech is a fast-expanding area and businesses of all sizes and from all sectors can reap the rewards, especially in recruitment. Let’s take a look at how companies are leveraging HR tech to enhance the recruitment process and drive business success.

HR tech is big business. The future of work is inextricably linked to technology and taking advantage of this brings benefits to both a company and future employees.

A major role of any HR department is recruitment. Using HR tech can not only help companies secure the very best talent, it can provide invaluable assistance during the various stages of recruitment, from vacancy to on-boarding.

You’re probably already tracking your cost-per-hire rates, and you’ll know that this is a key metric for HR teams. Substantial recruitment costs makes employee retention all the more important once you complete the recruitment process. That’s why it’s important to recognise and address your employee needs.

The use of HR tech helps businesses by minimising costs, saving time, and ensuring that you hire the right person for the right position right from the beginning. Here are some of the top examples of HR teach at its best:

1. Recruit using innovative employee benefits

When it comes to attracting the top talent to your company, it’s not all about the salary. Potential employees are also interested in the employee benefits that are on offer. It’s these employee benefits alongside the salary that create the whole package.

Positioning yourself as a company that has enviable employee benefits makes you more attractive to potential employees. We’ve uncovered some of the best employee benefits that you can offer:

- Subscriptions to apps that promote mental health and wellbeing, for example Headspace

- The opportunity to work remotely

- Providing tech tools that allow employees to manage their money, for example budgeting apps

- Enrolling employees into saving schemes

- Allowing employees flexible access to their pay through services like Openwage

Employee benefits linked to finance can have a major impact on recruitment and retention. However, while many employers are addressing the need to focus on their employees’ health and wellbeing, financial wellbeing is often overlooked.

Such high rates of financial stress will inevitably have an impact on employees’ work performance. Being distracted and using work time to manage their financial affairs can be the result. Even more worryingly is that financial burdens impact our mental health too.

That’s why employee benefits that promote financial wellbeing like pay advance schemes are rising in popularity. Solutions like Openwage allow your employees to access their pay when they need it, for example for an unexpected bill or emergency repair.

By taking steps to improve your employees’ financial wellbeing, you are likely to see a positive change in your teams. Without the distractions and worries of financial burdens, they can focus more on their work, bringing a productivity boost and the benefits associated with this.

2. LinkedIn: A recruiter’s dream (when leveraged correctly)

Often referred to as the business version of Facebook, LinkedIn is an invaluable and incredibly powerful tool in terms of HR tech. There are several ways that this platform can assist you and we’ve outlined the top ways you can leverage LinkedIn for recruitment:

Showcase your company

An effective LinkedIn company page brings many benefits. It may be the first impression a potential candidate has of your organisation. It’s also a chance to make your company shine and communicate the best things about working for you.

Ensuring that your company page is professional and appealing can encourage potential applicants to take the next step. Don’t forget to communicate your ethos and the story behind your company too. Employees love working for companies that do social good.

Recruit using LinkedIn groups

When you’re looking to recruit, you need to encourage talent to come to you.

Understanding how LinkedIn groups work means that you can post a job vacancy and be more confident that you’ll receive enquiries and applications from the right people.

Knowing the types of groups that your ideal candidates are likely to be members of can give your recruitment drive a real boost. But be sure to check the rules of any group you want to post in, so that you don’t break LinkedIn group etiquette.

Consider LinkedIn premium

While LinkedIn is free, there is the option to upgrade to the premium version. This allows you to carry out highly targeted searches meaning you can find the best potential candidates.

LinkedIn Premium also allows more freedom when it comes to sending messages. In fact, LinkedIn states that 87% of passive candidates are open to a new opportunity. Using premium allows you to access this untapped resource.

3. HR chatbots: On-brand, time-efficient communication

HR tech has developed to the stage where chatbots are now a vital element of the recruitment process. This is an area that is superbly suited to chatbots and an excellent application for this new type of technology.

Any HR professional will agree that when it comes to recruitment, basic tasks put a drain on the majority of their time. Answering routine questions and keeping people informed about what stage of the recruitment process they’ve reached are two of the most time-consuming tasks.

Communication is of course an essential part of recruitment, but also very time-consuming. This means that there is less time to focus on the strongest candidates and to ensure that they are the right fit for the company.

HR chatbots can increase productivity in HR teams, but also have wider benefits for your company and candidates too.

Answer routine recruitment enquiries

If a potential candidate has a basic query relating to employee benefits or the salary, wouldn’t it be better if you could automate these responses? This is where chatbots come in.

By using chatbots to respond to routine questions, you could focus your time and energy on more important aspects of recruitment like candidate interviews. HR chatbots can be programmed to respond to a whole host of questions relating to your company. They can also provide answers to candidates’ questions about the job itself.

When leveraged correctly, HR chatbots used in this way can ensure every candidate receives accurate and on-brand information.

Respond to screening questions

Screening candidates allows you to focus on the best candidates for the role. Importantly, this process also allows employees to screen your company, to see if the role matches their needs and skillset. No candidate likes to waste their time on a job application for a role that simply isn’t right for them.

An effective screening process saves time and effort on both sides – the company and the candidate. Using a chatbot to manage basic screening questions can be a huge time saver for your HR team and gives candidates a professional impression of your company.

The onboarding process

If you want employee engagement and high levels of retention, the onboarding process is vital. We are not suggesting that this be carried out by a chatbot. The human element is critical for new starters to feel part of the company and it cannot be replicated by a chatbot.

However, for basic queries that new employees have, for example regarding policies, a chatbot can be a major help. This is especially valuable for aspects of a new job like the pension scheme where providing easy-to-understand and correct information is imperative.

4. Recruitment automation: Enhance the employee experience

Automating processes always leads to increased efficiency. HR tech has now made this possible for recruitment too.

The future of work deploys automation to give a better employee experience as well as saving time and effort for HR teams. These are the ways that automation can be used to best effect:

Pre-screening and ranking information

Rather than face hours of wading through CVs when many will be entirely inappropriate, you can use HR tech to pre-screen your applicants.

Using set questions, you can filter down to the candidates where a physical review of their CV or LinkedIn profile and cover letter is worthwhile. Some HR software will also rank the candidates according to the answers that they have provided to allow you to prioritise.

Recruitment process updates

Keeping candidates informed about where their application is in the recruitment process is simply a courtesy we all expect. No candidate likes to feel forgotten about, whether they end up joining your organisation or not.

New employees and even candidates could post reviews your application process in public forums and even social media. Candidates may even assume you’re not interested in they haven’t heard back promptly after applying. So you should prioritise giving your candidates a positive and timely experience.

However, communicating with every candidate is arduous and time-consuming.

Automated emails save you time, give candidates a good impression of your company, and ensure they don’t leave the process because they think you’re not interested. They also keep candidates updated in real-time and make them feel valued by your company.

Employee checks

There are job roles that require certain information from their employees. This might involve HR requesting numerous financial or DBS checks on every new joiner.

New employee checks are another activity that could easily be carried out more efficiently using HR tech. This frees-up your HR team to work on other areas.

5. Artificial intelligence (AI): A data-first approach to recruitment

AI has long been a part of our lives. Where it is now being leveraged to great effect is in recruitment.

Using AI allows HR teams to save time and help with decisions. Here are some of the ways that AI can be implemented in recruitment:

Pre-screening

AI can be used to examine applications and extract data points. By understanding the requirements of the vacancy, AI focuses on keywords, key phrases, and anything else that it is asked to do. This saves the need to filter through endless CVs to find the right candidates to interview.

Removal of bias

HR tech removes part of the human element and because of that, human bias. We all have biases, but they differ among every one of us. Interestingly, we are often unaware of our biases, but they influence our decisions.

Using AI in the recruitment process removes biases and ensures fairness. AI is not there to replace recruiters, only to enhance the process.

Interview screening

Where HR tech can really come into its own is the analyses of a candidate’s interview. AI can pick up on a candidate’s tone of voice and even their body language. Analysing such aspects can give a fuller picture of the candidate in front of you and help you make decisions about which candidates to move forward with.

6. Remote interviews

The pandemic has caused video meetings to skyrocket, and this has also been the case with interviews.

Video calling allows you to conduct interviews without requiring the candidate to travel to your place of work. This saves your candidates both time and money. Importantly, it also brings benefits to your company too.

Knowing that there is no need to travel for an interview can encourage the very best talent to apply for a position, regardless of distance.

Your company could be missing out on the best candidates purely because of how far they would need to travel for the interview. If they don’t get the job, they feel they have wasted their time and money.

Remote interviews conducted by video make your company accessible and encourage applications. This opens your company up to a global workforce.

The future of work

The future of work involves the use of technology to a greater extent than we are yet to experience. Yet already HR tech is revolutionising the recruitment process for organisations, effectively streamlining it and improving efficiency.

Recruiting the wrong person can be a costly mistake in multiple ways. That’s why it’s important to deploy the right technologies in the most appropriate way. This will not only save you time and effort, but also minimise the chances of making a poor recruitment decision.

Check out our other articles on our blog page and follow us on social media to see our latest articles, insights, and company news.

What is financial resilience, and why does it matter to employers?

As an employer, getting the best out of every single member of your team is vital. Poor productivity, absenteeism, and high staff turnover cost companies millions every year. In this article, we’ll explore the topic of financial resilience and why it’s important for your business to address it by increasing your employees’ financial wellbeing.

The financial wellness of your employees may not be the first thing that springs to mind when thinking about workplace performance. You may even consider financial wellbeing and therefore financial resilience a personal matter.

That would certainly account for the 49% of businesses that have no financial wellbeing programme in place for their staff (according to a survey by the CIPD).

It’s understandable that many are left wondering about the true link between an employee’s financial wellness and their performance at work. A UK financial capability study found that 18 million working hours are lost to financial stress in the UK every year.

What is financial resilience?

Simply put, financial resilience is how able your staff can deal with, and recover from, a temporary financial issue. This may be in the form of a repair bill or a financial setback, like an expensive emergency.

What financial resilience isn’t is a knee-jerk reaction to such a crisis. This type of reaction could result in your employees resorting to high-cost credit. Examples of this include credit cards or even payday loans.

These so-called ‘solutions’ are in no way in the best interests of employees’ financial wellbeing.

In the context of HR, it’s important to understand how these choices can lead your employees into a downwards financial spiral.

What does it mean to be financially resilient?

A research report shows that only 40% of employees feel prepared for unexpected financial costs or a significant reduction in their income. Financial resilience can help employees feel and be more prepared for this type of situation.

Financial resilience means that employees have a long-term financial strategy in place. It means that unexpected events are in fact planned for in advance.

Importantly, employees that are financially resilient don’t end up in the vicious cycle associated with payday loans. They are able to cope with financial setbacks quickly and sensibly while also increasing their financial wellbeing.

Financial resilience isn’t simply about savings

But there is more to financial resilience than simply having savings. It means having a plan in place to be able to access funds as and when they are required.

By fine-tuning their financial wellness, employees can ensure that they can pay their bills, have access to an emergency fund, and manage their money effectively. These steps help employees avoid reacting impulsively in the moment.

How your employees’ financial wellness affects your business?

Increased absenteeism

There is a direct correlation between your employees’ financial resilience and how they deal with workplace challenges.

It’s surprisingly common for employees who are facing financial worries to be absent from the workplace. In fact, research shows that the cost to UK businesses of absenteeism due to financial stresses stands at £15.2 billion a year.

This high level of absence amongst employees can be more fully understood when you consider the link between money stresses and mental health.

A survey by the Money and Mental Health Policy Institute indicates that there are some 1.5 million people in the UK whose mental health is suffering due to financial stress. When workplace challenges arise in addition to financial worries, it’s simply too much for some employees and they can’t face coming into work.

Reduced productivity

It’s not just absenteeism that is caused by a lack of financial resilience.

HR teams understand the need for employees to be productive. The aim is to get the best out of each individual. When your employees attend work with the burden of financial stresses on their shoulders, they simply aren’t productive.

48% of employees are distracted by money worries while at work according to a PwC report on employee financial wellness.

This means that in your drive to develop your employees, financial wellbeing and (therefore financial resilience) must play a key role.

Many employees are uncomfortable directly approaching a member of HR to discuss their financial issues. However, implementing a financial wellness programme makes the subject much easier to broach.

The result? An increase in productivity and a substantial reduction in absenteeism.

Long-term benefits of financial wellness

A business cannot simply survive in the here and now. They need plans for long-term growth and development. Your employees are integral to your business’ success.

Business sustainability means employee empowerment and allowing for an environment where they feel they can prosper. It also means that you need to stand out from the crowd when it comes to attracting new talent.

Financial wellness programmes fortify recruitment efforts

In today’s job market, the top talent can pick and choose their next career move.

The cost of recruiting can be substantial. This increases when you are looking for someone to fill a position at a higher level.

HR teams play a key role in the development of existing employees. Once someone with potential has been identified, the next step is to ensure that they stay with the company.

In-house development opportunities mean that you can shape your future leaders.

Showing an active interest in your employees’ financial wellbeing can make a positive difference in retaining these employees. It can encourage them to stay longer, helping you reduce recruitment costs in the long-term.

Understand your employees financial needs

One thing that’s clear is that what employees expect from an employer changes. One generation to the next has very distinct wants, needs, and expectations.

The future, right now, is Generation Z. For this generation, a pay packet once a month just isn’t enough. They need to feel part of something and they need to feel valued. This can be achieved by promoting their financial wellness by offering targeted employee perks.

This mindset shift is what your business needs to ensure that it continues to attract the talent of the future.

What does a financial wellbeing programme involve?

Human resources play a vital role when it comes to implementing and managing major changes.

When it comes to supporting your employees’ financial wellness, there are active steps that an organisation can take to increase employee financial resilience.

Exactly what a financial wellbeing programme is may well vary from business to business, but here are some of the things that you would expect to see:

1. Access to financial education

While HR has a key role to play, employees must take responsibility for their finances.

Providing them with access to online financial education means that they can do this. There are so many topics that can be covered, as well as giving access to webinars, and useful resources like budgeting calculators.

2. Access to an impartial financial advisor

A company can arrange for all employees to have access to a suitably-qualified – and importantly impartial – financial advisor. Financial advice should be on a one-to-one basis and allow employees to discuss anything from their current finances to retirement plans.

3. Measuring financial resilience

Employees may not understand the concept of financial wellbeing. Information sessions and resources can enlighten them.

There are many ways to measure financial wellness among your employees. But something simple to implement is a questionnaire that allows employees to measure their levels of financial wellness themselves before and after any programmes are implemented.

4. On-demand access to pay

Your employees may be struggling to make their pay stretch until the next payday.

Monthly pay cycles cause significant stress for employees and can harm their financial wellness. An employee’s ability to access their pay when they decide can significantly reduce stress and avoid the need to resort to payday lenders.

The Openwage solution

A key part of financial resilience is having the ability to turn to a source of funds when a financial setback happens.

When your employees face unexpected bills or emergencies that mean they are short of money, you can help. You can help reduce their financial stress and boost their overall wellbeing by offering them a solution.

Instead of inadvertently pushing them towards payday loans or other forms of high-cost credit, you can provide a safer and more cost-effective solution.

Empowering your employees with funds that they can tap into as and when they are needed is something that you, as an employer, can offer. This will directly impact your employees’ financial wellbeing and benefit your business.

Importantly, offering your employees a helping hand when times are tough will help you attract the best talent, increase staff retention, and reduce staff absence.

How does Openwage work?

Allowing your employees to access on-demand pay is free for employers. Openwage offers a very simple solution that’s easy and fast to integrate into your business operations.

- Employees use the Openwage app to access their earned pay on-demand pay and transfer it instantly into their bank account.

- We send funds directly to your employees so there is no impact on your cashflow or payroll.

- You’ll receive reports detailing your employees’ engagement with the scheme so you can assess take-up.

Offering on-demand pay will bring your company its own rewards. Contact us to find out how your business could benefit from Openwage.

Financial wellness: 4 ways to tackle financial wellbeing at work

What are some of the ways that employers can tackle financial wellbeing at work? With 58% of employees reporting that they feel financially stressed, now is the time to make positive steps to promote financial wellbeing among employees.

If you’re looking to increase employee retention, increase productivity, and reduce absenteeism, then focusing on your employee’s financial wellbeing could be the answer.

Reportedly 1.5 million people are experiencing debt problems that are leading to mental health concerns. It’s not surprising that this is having an impact at work.

Research shows that almost half of all employees have concerns over their personal finances and this spills over into the workplace. There is a direct correlation between mental wellness and financial wellness and this needs to be recognised in the workplace.

A huge barrier has been broken down in terms of discussing mental health. Now, the same needs to happen with financial health.

Unbelievably, financial stress costs UK businesses around £15.2 billion a year. This is down to loss in productivity, absenteeism, and replacing employees who leave.

At Openwage, we want to help you to change those statistics. We want to help you to become a company at the forefront when it comes to your employees’ financial wellness. So, let’s have a look at some of the actions your business can take.

1. Open the lines of communication

To begin addressing issues around financial wellbeing, the first step is to get your employees talking. This is a challenge, because many of us shy away from talking about what is often a sensitive topic.

Remove the shame associated with money problems

With this in mind, it’s down to companies to instigate a cultural change.

A move away from feelings of shame and towards ones of positivity and support, knowing that help is at hand. Of course, such a change needs to be led from the top, but the business case for such a change shouldn’t make this difficult.

The bottom line has to take priority. But let’s not forget the impact of your people on your bottom line.

Looking after your employees’ wellness promotes loyalty to your company, meaning higher retention rates. It can also boost your brand image, making it easier to attract new talent.

Knowing this makes embracing a cultural change nothing but a common-sense approach.

Encourage informal chats

So, how do you get your employees talking?

The first step is to talk to them! Encourage conversations around financial wellness. Create posters, newsletters, and share articles focused on financial wellbeing.

Make it clear that this is an area that you as a business are concerned about. Let your employees know how they can talk about their finances.

Why not consider sessions around financial education where questions can be asked? Could there be a less formal approach with a coffee and a chat?

Ultimately, the approach that you decide to take should be appropriate for your employees and their needs.

What matters is that you demonstrate to your employees that they can talk about their financial wellbeing openly and without fear of being judged.

2. Invest in financial education

A study by the CIPD shows that one in five employees would appreciate impartial financial guidance from their employer.

Providing financial education is a great way to tackle financial wellbeing at work. It shows that an organisation cares, but it also encourages learning and the fostering of responsibility.

While as an employer you can’t manage your employees’ finances, you can equip them with the knowledge and tools to do this for themselves.

Assess your employees’ financial needs

A diverse workforce means that there is likely to be a great variance when it comes to your employees’ understanding of financial wellness. Even when there is some crossover, employees will still have different needs.

The needs of Generation Z will not be the same as Millennials or older generations. For example, younger employees may be more interested in long-term investments or paying off student loans.

Compare this with older employees who are approaching retirement and are focused on financial security.

Providing financial education

So how do you provide financial education to your workforce? There’s many ways you can do this, but you may have to be creative if some or all of your team work at home. Here’s a few ideas:

Call in an expert

You could partner with an impartial financial expert who can have one-to-one consultations with your employees. They could hold talks or even host a Q+A session where employees can submit questions in advance to avoid any feelings of embarrassment.

Provide online training

This could contain resources that can be read in an employees own time. Links to calculators, spreadsheets, and useful guides that help people manage their money better would be a great start.

Signpost to other organisations

Don’t forget to remind employees about where they can get help and support.

There are a multitude of organisations including Money Advice Service that can offer support around money and debt. There are numerous free services available so don’t let your employees fall into the trap of paying for support or advice.

3. Provide benefits that promote financial wellness

When it comes to tackling your employees’ financial wellbeing at work, one obvious starting point is often employee benefits.

It’s common for companies to offer employee discounts as a perk. This helps employees save money and makes them feel valued and potentially more loyal to your company.

Beyond discounts, other employee benefits worthy of consideration include:

- Childcare vouchers

- Subsidised memberships

- Annual leave buy-back schemes

- Life insurance policies

- Workplace savings scheme

- Pay advances

This is a starting point to explore exactly what your employees would benefit from. As we have seen, different generations will have different needs.

A healthy balance of employee benefits allows a company to cater for a broad range of people at different stages of their life.

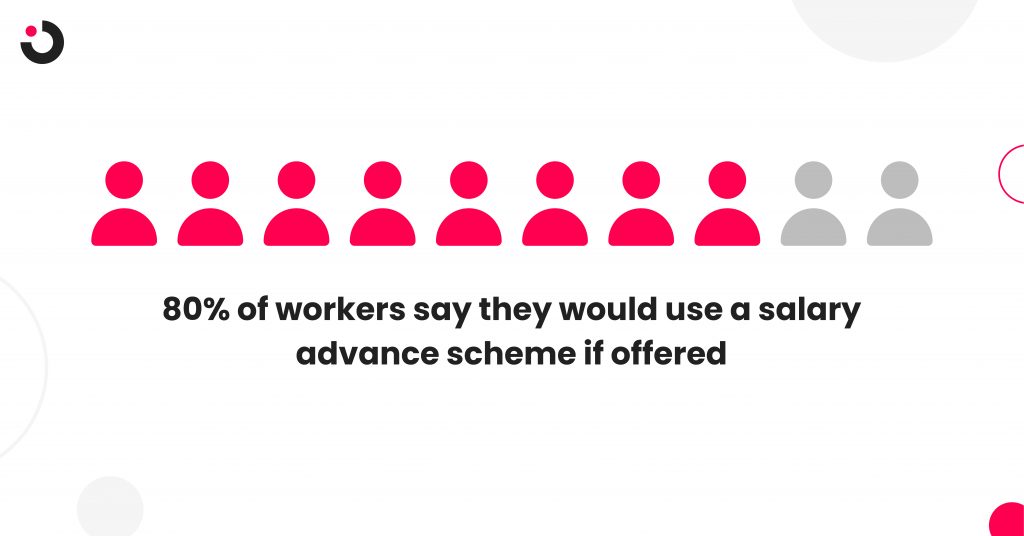

One employee benefit that is gaining popularity around the world is flexibility in pay schedules also know as pay advances. Essentially, this means empowering employees to decide when they receive some of their pay.

Flexible pay, also called on-demand pay, pay advances, and salary advances help reduce stress associated with having to wait for payday. For example, when an expected bill arrives.

Flexible pay cycles

The importance of employee financial wellbeing is on the rise. Employers are beginning to recognise this too.

Businesses that understand the concept of financial wellness also understand the direct impact that it has on their organisations. Those that embrace financial education do so in pursuit of increased productivity, increased employee retention, and a reduction in absence.

A key step towards this is by addressing the issue created by monthly pay cycles. Yes, it works for your business in terms of reducing the administrative burden of the alternatives, but monthly pay cycles don’t work for your employees. Openwage offers a win-win solution that benefits everyone.

What is Openwage?

Openwage allows your employees to access their pay as they earn it. Employees can request their earned pay at any point in the month, for example to cover an unexpected expense or bill.

This helps employees smooth the gap between income and expenses, and leads to less financial stress because they don’t have to make all of their pay last the whole month.

No payroll impact

Importantly, Openwage integrates with your existing payroll. Employees receive their pay advance directly from Openwage, so there’s no cashflow impact for your business.

No more high-cost credit

Pay on demand is not a loan. Openwage is a smarter alternative to payday loans, credit cards and overdrafts. This is because employees don’t pay any interest when they transfer on-demand pay.

4. Encourage financial resilience

Another great way to tackle financial wellbeing at work is to focus on financial resilience.

Financial reliance stems from having a long-term strategy in place to deal with financial requirements including emergencies.

There are many aspects to financial resilience. Here are the key areas and some tips on how you can empower your employees to become more financially resilient.

Good grounding in financial education

Financial education can help teach your employees the importance of remaining resilient in terms of their finances. Financial resilience refers to the ability to deal with, or recover from, a financial emergency or set-back.

This might be an unexpected bill or having to replace an expensive (but essential) household appliance.