Workplace trends: 10 predictions for 2022

What will the workplace look like in 2022? We share our workplace predictions to highlight some of the trends that will feature heavily in 2022.

All workplaces naturally evolve. However, in the wake of COVID-19, the rate of change has exploded.

The future of work reveals a different landscape. What we have experienced over the last 18 months or so has been a power shift in the relationship between employers and employees.

Employees are demanding more. As a result, workplaces must both listen and act to successfully attract and retain the best talent going forward.

Here’s a look at ten workplace trends for 2022:

1. Employers will work harder to combat ‘The Great Resignation’

Employees now expect more from their employer. If they don’t receive what they expect, employees are far more willing to simply walk away and secure employment elsewhere.

According to a report by recruiter Randstad UK in 2021, 69% of employees are confident that they can easily secure a job elsewhere. 25% are planning to do so within the next 3-6 months.

Typically, the number of employees looking to change jobs within this timeframe would be as low as 11%. So the increase is certainly significant.

The sectors most affected by ‘The Great Resignation’ include:

- Manufacturing

- Construction

- Hospitality

- Logistics

Many employers are feeling the effects of increased employee turnover rates. But by re-aligning employee rewards, benefits, and working conditions with employees’ needs it’s possible to increase engagement and loyalty.

2. Hybrid working: A divide will emerge

The COVID-19 pandemic led to an unprecedented shift towards home working. The Government’s message was clear; everyone who could should work from home.

Since the return to the office, many employers have adopted hybrid working, with varying mixes of home and office working.

Many employees welcome the flexibility that comes with home working. Yet insightful research by the Office for National Statistics (ONS) suggests a divide has emerged between home and office workers.

The ONS’‘Homeworking hours, rewards and opportunities in the UK: 2011 to 2020’ report reveals that employees mainly working remotely were:

- Less than half as likely to be promoted

- 38% less likely to receive a bonus

This is hard to understand when the same reports also reveals that those working from home:

- Had lower levels of absenteeism

- Worked more unpaid overtime

- Were more likely to work into the evening

Employers must address this growing divide between the way that homeworkers are perceived to prevent potential favouritism towards office workers.

3. Employees will retrain to beat automation

The pandemic has forced employers and employees to adapt. Unable to fulfil face-to-face roles, many employers adopted online working and discovered a whole new way of collaborating.

Employees had to change too. In some cases, elements of employees’ roles were absorbed due to the growth in automation. Employees responded by expanding their knowledge and skills, and even retraining to enter a different occupation.

This trend towards professional development and re-training is actually perfectly timed. A report from McKinsey & Company in 2020 reported that by 2030 around 14% of the world’s workforce will lose their jobs because of automation or AI.

4. Employees will fight more for what they want

The job market has transformed in the wake of COVID-19. Now, more than ever, employees have the confidence to ask for more when it comes to their jobs.

Employees are demanding greater flexibility, better benefits, an improved work-life balance, and increased pay. This is a trend set to continue well into 2022.

Driving this confidence to become more demanding is the record number of job vacancies in the UK. 1.1 million vacancies were recorded between August and October 2021.

With such high volumes of vacancies, employees have a greater choice when it comes to getting another job if their current employer isn’t meeting their needs.

5. Salaries are on the rise

The job market evolution has also put increased pressure to boost salaries to retain talent.

During the pandemic, some workers had pay rates frozen. But now we have emerged from the cycle of lockdowns, employees are no longer willing to accept this.

The Government is set to increase the living wage to £9.50 an hour from April 2022. This is in part due to rising inflation.

Beyond this, many sectors are forecasting pay rises. Research indicates that employees will receive an average pay increase of 2.9% in 2022. Employees in the media, leisure, and hospitality sectors are anticipated to benefit from the highest increases.

6. Employers need to ‘rehire’ their employees

With ‘The Great Resignation’ of 2021 came an increase in employee turnover.

Employment uncertainty plagued people last year on account of the COVID-19 pandemic. Then in 2021, greater stability emerged for many sectors along with increased vacancies and a deep desire for a better work-life balance.

All of these factors led to lower rates of employee retention. This is unlikely to change in 2022.

As a result, employers will need to effectively rehire their existing employees by revisiting their rewards and benefits packages. This will re-engage employees at risk of leaving for a better opportunity.

7. Wellbeing weeks: The antidote to burnout?

This is one of the most concerning workplace trends set to happen in 2022.

Pandemic-driven home working brought flexibility and a sense of freedom to many. However a more unwelcome consequence has also emerged.

Almost half of managers surveyed are worried that their staff may be at an increased risk of burnout because of the change in working patterns as a result of the pandemic.

Increased rates of burnout is partly due to the fact that more of us are working at home. With this, boundaries between home life and work life have become blurred. Smarter technology means we’re always connected.

That’s why 2021 has seen a trend for wellbeing weeks. This is essentially when a company shuts down for a week and forces employees to take time off. LinkedIn and dating app Bumble were among several UK companies that provided staff with so-called ‘burnout breaks’.

Some UK companies have also taken a different route to addressing burnout, by offering unlimited annual leave.

8. Increased engagement: A culture of listening

The future of work is where employees have a voice. Employees have a fundamental need to feel listened to and for their employer to take onboard their feedback.

Increasing numbers of employers are turning to employee surveys to understand the impact that the pandemic has had on employees.

Employee surveys are a valuable resource because they have two main benefits:

- They give employees a voice, which helps them feel valued.

- They give employers valuable knowledge in how their employees are feeling and what they can do to boost engagement.

Resources such as Gartner’s recommended questions for employee surveys may be useful to help identify the most important areas to cover when it comes to an employee survey.

With resources like this at their fingertips, employers in 2022 that act on employee feedback are more likely to have a workforce that feels valued and listened to. Improving core areas of employment, such as benefits and pay, makes it more likely that employees will remain loyal and stay with your business.

9. More employers will build artificial intelligence into work processes

We’re seeing more and more automation in the workplace. Of course, this was unavoidable. And this shift towards automation will only continue to grow in 2022.

It’s an uncertain time for the UK economy right now. As a result, some organisations are planning to transform their operations to deal with the lasting consequences of Brexit and COVID-19.

Adopting artificial intelligence and automation allows businesses to work smarter by redesigning work processes. In fact, research by McKinsey and Company revealed that two-thirds of businesses are looking to increase their investment in this area.

Call centres, grocery stores, and warehouses are already using automation with impressive results. Just take a look at Amazon’s fulfilment centres that use algorithms to speed up the packing process.

10. Tech will be integrated into wellbeing strategies

Given the concern around employee burnout, another workplace trend will see employers embracing innovative ways to monitor their employees’ wellbeing.

Wearable tech such as smartwatches can track heart rates and body temperature. Using smartphone apps, employees can be encouraged to report their mood and essentially act as a warning if things take a wrong turn.

This type of technology allows employers to monitor employee physical and mental wellbeing. In 2022, employers are likely to embrace wearable technology. But will employees be as keen?

Workplace trends for 2022: What can employers do to prepare?

It’s evident that there are three major driving factors behind workplace trends in 2022:

- Lasting work behaviours adopted to cope with the COVID-19 pandemic

- Impact of Brexit on everything from supply chains to financial support

- Technological advances like AI

While businesses know how to handle risk, not everything can be foreseen. That’s why the most successful employers are those with a people strategy that filters through to every aspect of their business.

How we can help

When it comes to boosting employee engagement and reducing turnover rates, offering your employees on-demand pay can be a win-win solution.

On-demand pay allows employees to access a portion of their earnings when they want to cover unexpected costs. This financial buffer helps to reduce financial stress which can distract employees and lead to increased rates of absenteeism.

If you would like to find out more about how on-demand pay could help your employees with zero cost to your business, please contact us.

Employee turnover: Insights & tips to help increase retention

Employee turnover is a major concern for today’s businesses with labour shortages and unfilled vacancies filling the headlines. In this article, we’ll explore the consequences of employee turnover and what businesses can do to encourage employees to stay longer.

One of the main reasons your company may be looking for ways to reduce employee turnover is the sheer cost involved. Research from Oxford Economics and Unum found that replacing an employee (with a salary of £25,000 per year) costs on average £30,614.

While employee turnover varies massively by sector, the UK average turnover rate sits at 15%. Data from the Office of National Statistics highlights the sectors that suffer the most from employee turnover. These include:

- Retail

- Catering

- Telesales and call centres

- Healthcare

These figures reveal that retail (33%) and healthcare (30%) experience the highest rates of employee turnover.

From a long-term perspective, these rates of turnover are unsustainable. This is especially true in the health sector where a lack of resources literally puts lives at risk.

Without taking action to reduce employee turnover, the financial (and often wider) impact in these sectors will only continue to grow.

Employee turnover: Reasons employees leave

There are a multitude of reasons why employees leave their jobs. Knowing which of these reasons are most prominent among your ex-employees is key to addressing the issue of turnover.

Although turnover by sector varies, there are still clear patterns across industries. One report suggests that the top reasons for employees leaving have hardly changed over the last nine years.

The top causes of employee turnover are:

- Limited career opportunities

- Poor work-life balance

- Lack of flexibility

Let’s delve deeper into these reasons and others.

Limited career opportunities

Career-driven employees are hungry for opportunities to develop their skills and progress through the company. Understanding your employees’ motivations when it comes to their career goals means you can provide them with opportunities that will satisfy them.

If your company has a rigid organisational structure and managers who aren’t willing to help their employees progress, then you risk losing your most motivated employees and driving up your rate of turnover.

Poor work-life balance

Achieving a good work-life balance tops many employees’ lists when it comes to what they want from their job.

Happier employees are more productive. But even more importantly, employees who have the time and energy for hobbies, relaxing with family, and to pursue other passions are generally in better health, both physically and mentally.

Employees who feel like they lack control over their work, have to meet unrealistic demands, and are stressed are less likely to achieve a healthy work-life balance. These employees are at risk of finding another company that does help them achieve the life they want to live.

Lack of flexibility

More than ever, employees value flexibility when it comes to their job. This means that they appreciate a company that offers flexibility in terms of time off, working hours, and even flexible pay (also called on-demand pay).

Those companies that offer a good level of flexibility are likely to have lower rates of employee turnover.

COVID-19 led to millions of previously office-bound employees enjoying a sense of flexibility by working at home. While many are now heading back to the office, there are still employees who prefer the flexibility of their home office and to avoid a daily commute.

Dissatisfaction with benefits

It’s very common for employees to compare benefits packages of companies and they’ll use this information to guide their career decisions.

The most sought-after employee benefits include flexible working, a good pension, sick pay and free eye tests, surprisingly.

For detailed insights into which perks are most popular among employees, take a look at Employee Benefits’ article Jobseekers’ most sought after perks ranked.

Not being paid enough

While not right at the top of the reasons why employees leave, pay is still a big one. Employees are in a prime position to demand the rate of pay they want, and many of them are.

Employees who feel underpaid are more likely to feel undervalued by their employer. This can become a breeding ground for low morale which can have a wider impact on their teammates too.

Companies paying below-average rates for their sector may find their rate of turnover is higher than average. It’s worth bench-marking pay rates in your sector or according to specific job roles to see how your company fairs with others.

Manager behaviour

The type and personality of an employee’s manager dictates whether an employee feels supported, valued, and trusted to do their job.

Bad managers can cause turnover rates to sky-rocket. The tell-tale signs are when multiple employees from the same team consistently leave the company within a short space of time.

To address this, it’s vital to have managers who treat their employees with respect. Some management skills need to be learnt, and so training can help with this. Equally, companies need to ensure they’re hiring managers capable of leading teams in a positive way.

Poor leadership and management will often trickle down into the workforce as a whole. This can lead to a toxic culture and one that, understandably, employees won’t put up with for long.

Employee turnover negatively impacts your business

Besides the financial cost of replacing employees, there are other indirect costs that make it clear why addressing high rates of turnover should be prioritised.

- Increased pressure on your teams

- Negative impact on your employer brand

- Decreased team morale

Understand your business’ turnover triggers then act on them

With the effects of employee turnover a reality for many companies, addressing this issue often becomes a strategic priority. Let’s look at some of the ways that employers can help reduce the number of employees choosing to leave:

Employee retention tip 1: Benchmark your levels of employee turnover

The first step is to find out whether your retention rates are higher than normal or about average for your sector. To do this, HR teams need to track employee turnover levels and assess where their company sits when compared to others in their sector.

If your figures reveal that your turnover levels are around 15% or less, then that’s about average for a business in the UK. If your figures are significantly above this, then it’s a clear sign that you need to take action to remedy the issue.

Employee retention tip 2: Use exit interviews to get honest feedback

The next step is to find out what’s causing your employees to leave faster and more often than you’d like.

Information from exit interviews can be hugely valuable to your business in terms of knowing what areas to address. But getting honest feedback from leavers can be tricky. These must-ask exit interview questions from Glassdoor may help.

Employee retention tip 3: Act on what your employees are telling you

Once you have honest feedback from employees leaving your business, you’ll hopefully start to spot patterns.

You may not get the full story from feedback alone. You may need to join the dots up and use your gut instinct to identify turnover triggers in your organisation.

While every organisation will tell a different story when it comes to what’s causing employees to leave, there are some common causes as we’ve discussed above.

Employee retention tip 4: (Continuously) work on your culture

Achieving the right culture isn’t easy and it certainly isn’t an instant process. Culture requires a combined effort too, and everyone has an important role in forming it.

Neither HR teams nor managers alone should be responsible for creating the desired culture, but they can of course lead by example.

Employee retention tip 5: Re-think your benefits package

When was the last time that your business reviewed its benefits package? The trend towards remote and hybrid working means than the needs of employees have changed. Now is a great time to take stock of what you’re offering.

Many companies tend to offer employee benefits that align most closely with their goals and ethos. For example, if allowing your employees to live their best possible life is important to your company, then offering them benefits that give them flexibility is a great place to start.

A new, flexible benefit worth exploring is on-demand pay (often referred to as a salary advance or flexible pay). This is a financial wellbeing benefit that’s experiencing a boom. Crucially, on-demand pay delivers positive gains for both employers and employees.

Target employee turnover from multiple angles for the best results

It’s unlikely that there will be a silver bullet to reshaping your turnover curve. Improvements in multiple areas of your business will give you the best chance of seeing an upward turn in retention, with specific focus on the areas you know are most problematic for your company.

Making access to pay fairer: Martin Slaney, Chief Product Officer

Welcome to the first of our new series of Turbo Tales where we interview a member of the Openwage team and find out what makes them tick by asking them only four questions.

First up is our Chief Product Officer, Martin Slaney, who celebrates his first year with Openwage.

We asked Martin to reflect on his time with Openwage during the first 12 months of its existence, undoubtedly one of the most thrilling and rewarding times to be part of a startup.

What is Openwage?

Openwage was created from the vision to revitalise the financial health and resilience of working people by giving employees greater control over when they get paid.

For far too long, employees have had to wait weeks for the money they’ve earned.

This extended period between paydays results in severe financial stress when an unexpected expense comes along that shatters even the most financially-resilient person’s budget.

With the Openwage app, employees can instantly access their earnings when they need them without having to wait until payday.

This disruptive approach to paying employees offers a safe and secure alternative to high-cost short-term borrowing such as payday loans, while also boosting employees’ financial wellbeing.

From zero to launch

With our sights set on revolutionising the way we get paid, Martin set about building a remote and geographically distributed team to design, build and launch an app dedicated to helping millions of workers feel more in control of their money.

In under 12 months, our mobile app and employer portal has been completely built from the ground up thanks to an immensely talented and passionate team of individuals who all share the belief that access to earnings should be fairer.

What does Martin have to say about his first year at Openwage?

1. Tell us about your most memorable moments from the last 12 months

“Building a remote-working team and product from zero to launch against the backdrop of the pandemic has been an incredible experience.

One of the highlights for me has been seeing the effort our team puts in to constantly shape our culture. It makes me feel so proud.”

2. What would you change about the past year, if you could?

“Whilst we’ve had a few social meetups, I regret not doing more social activities with the team. Time to fix that!”

3. And what’s been the most valuable thing you’ve learnt?

“I’ve realised that constraints, plus amazing talent, breed resourcefulness and invention.”

4. Finally, any words of wisdom for others in the fintech sector?

“Keep the proposition as simple as you can but double down on user experience.

Really be super selective about the first people you hire, then trust them to do what’s best for the business.”

Great advice, Martin. And here’s to another successful and eventful year at Openwage!

Interested to hear more? Find out more about Openwage.

Why financial wellness is a must-have employee benefit

The chances are you’ve spent considerable effort on making sure your company is offering an attractive employee benefits package packed with perks and rewards. But have you thought about adding financial wellness employee benefits? In this article we’ll show you why you shouldn’t ignore the financial wellbeing of your employees any longer.

Businesses have always strived to be competitive and to stand out in their field. They’ve also learned that offering a range of benefits that employees appreciate can help reduce business costs too.

Offering attractive benefits is a useful recruitment tool. But a superb benefits packages can also help reduce employee turnover and target absenteeism levels.

A focus on physical and mental wellbeing goes some way towards achieving this. According to the CIPD’s Health and Wellbeing at Work 2021 survey report, mental health is the most common focus of health and wellbeing activity.

Financial wellbeing lacks attention in most organisations when it comes to corporate health and wellbeing activity. The pandemic has forced financial wellbeing into focus. So now we’re beginning to see the tide turning towards embracing financial wellness too.

Just as your employees come up against health challenges, they also face money worries and stress relating to their finances.

UK employees have low levels of financial resilience and capability

Levels of financial resilience in the UK are relatively low. This means that any financial shock (normally an unexpected expense or some kind of emergency) can create financial difficulties and therefore stress.

Limited savings, rising debts, and a reliance on benefits all limit someone’s financial resilience.

As a nation, we also lack financial capability. This is largely due to the limited education available in schools when it comes to managing finances and understanding areas like pensions, mortgages, and borrowing.

As a result, many people lack confidence in making financial decisions. In fact, a 2018 financial capability survey found that 47% don’t feel confident making decisions about financial products and services.

Why offer financial wellness employee benefits?

When it comes to the benefits and rewards that you currently offer, how do your employees feel about them? Only 13% of employees surveyed by the CIPD believe that their organisation has allocated enough budget to improve employee financial wellbeing.

There are clear signs that employees would like their employers to provide financial support.

So while they might not explicitly ask for it, your employees are highly likely to appreciate a greater focus on financial wellbeing benefits.

Next let’s look at the potential business gains of offering financial wellness employee benefits:

Happier employees

Worrying about money, also called financial stress, takes its toll on your employees. One of the most obvious signs of financial stress is unhappiness.

When an employee is unhappy they are unlikely to be performing at their best or collaborate as well with their colleagues.

Employees who are suffering from financial stress tend to be distracted at work too. This is usually because their worries can make it harder for them to concentrate.

Being distracted usually leads to a drop in productivity as the employee struggles to maintain focus.

But giving attention to your employees’ financial wellbeing, you can make a significant difference to their ability to manage their financial worries.

Even small steps, such as signposting to debt advice services for example could help your employees feel more in control of their finances and reduce stress. Relieving that stress allows employees to be more positive and happy. It’s been proven that happier employees are more productive.

Healthier employees

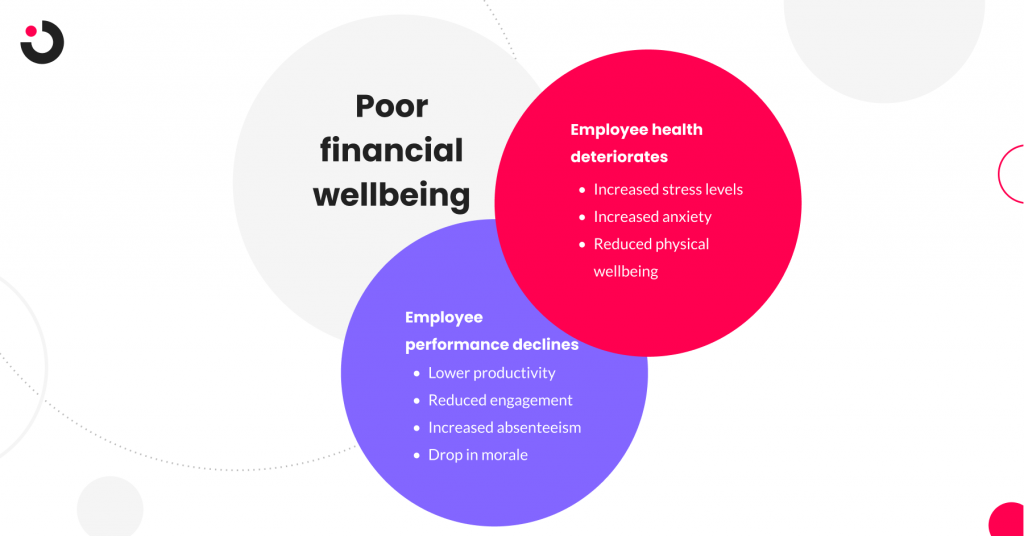

A lack of financial wellbeing can have a knock-on effect on the overall health of your employees. Like other stresses, financial stress builds up and leads to poor physical and mental health.

It’s widely recognised that stress can lead to anxiety and mental health issues. What perhaps isn’t so widely known is how this can affect a person’s physical health.

A build-up of stress starts to affect a person’s immune system, making them more likely to to pick up flu, colds, and other viruses. This means that stressed employees are more likely to be off sick.

This link between stress and absenteeism has led to businesses investing more than ever in benefits that address poor mental health.

Stand out from the crowd

Recruitment is tough right now and the job market has dramatically changed in the last 18 months. In October 2021, a report found that there were over 1 million vacancies. More than ever, candidates can afford to be selective with the job offer they accept.

Companies must start doing more to set themselves apart from their competitors. Taking a positive approach to addressing the financial wellbeing of your employees can help you do that.

Improve employee retention

With the current shortage of candidates, many employers are desperately searching for ways to boost employee retention. While bringing new talent into your organisation can be a great thing, it’s also costly. So retaining your current employees has to be a priority.

Financial wellness employee benefits have the potential to significantly and positively impact your employees’ lives. On-demand pay makes it possible for employees to access their earned pay at any time before their usual payday.

This revolutionary way to pay employees is also known as a salary advance. On-demand pay provides a safe and secure way to access some extra funds to deal with a financial emergency. Unlike credit cards, overdrafts, and payday loans, on-demand pay with Openwage isn’t a form of borrowing.

On-demand pay is also free for employers to offer to employees, so it’s a great tool for your financial wellbeing strategy.

Offering employee benefits that help them feel more in control of their finances may encourage them to stay longer with your company. Given that it can be hard to find this type of benefit, it’s a perk they may not get elsewhere.

How to support employee financial wellness with benefits

Employers are perfectly positioned to offer financial wellbeing to their employees, and it can be win-win all round. But before you can establish a way of boosting your employees’ financial wellbeing, it’s important to understand the issues that they face.

Some of the most common causes of financial stress experienced by employees include:

- No savings to deal with an emergency (like a boiler breakdown)

- Lack of ability to effectively budget

- Problem debt

- Running low on funds in the run-up to payday

Research by Close Brothers shows that 94% of employees admit to having money worries, and 77% of them say that it impacts their work performance.

Employers massively underestimate the financial wellbeing of their employees. But it’s safe to say that many of your colleagues are struggling with money worries but are too ashamed to talk about it.

There are many ways you can support your employees’ financial wellbeing. Here are a few ideas to give you inspiration:

- Open communication: Encourage employees to talk more openly about their financial wellbeing by offering different channels, like an Employee Assistance Programme.

- Financial education: Provide information sessions to boost your employees’ financial literacy covering topics such as budgeting and saving.

- Financial wellbeing benefits: Implement one or two considered financial wellbeing benefits, like on-demand pay, free private health insurance, and discounts on things everyone needs like groceries.

Read more about how to tackle financial wellbeing at work.

Can your business afford not to offer financial wellbeing employee benefits?

The potential business gains of helping to reduce financial stress among your employees is clear. What of the flip side though? If companies carry on offering the typical physical and mental health-related benefits, what can they expect?

There are substantial costs that your business is likely to incur by neglecting the financial wellbeing of your employees. Let’s look at these:

Increased absenteeism

We have already considered the impact of financial stress on your employees. We already know that this can lead to issues with both physical and mental health and therefore lead to absence.

When an employee is off sick, your business is operating below capacity. This sees other employees feeling pressured to pick up the slack. If this is a regular occurrence, this can lead to these employees also developing symptoms of stress and your absenteeism rates can grow.

Even if those left behind to pick the work do not go absent there is still going to be a major impact on their morale. As morale falls so does productivity. The end result is a workforce that, as a whole, fails to deliver.

Increased employee turnover

Just as addressing the issue of financial wellbeing can assist with employee retention, neglecting this area can make it harder to retain your employees. A better paid position, or a company that offers better perks can seem like a more attractive option when someone is feeling the financial pinch.

Perhaps it is not the amount being paid that is the issue and instead, it’s the frequency of pay that matters. The offer of weekly or fortnightly pay holds appeal to many.

Although the accepted norm has become monthly pay, the benefits of this are heavily weighted towards the employer. Monthly pay cycles cause stress for employees.

But recent technological changes have made it possible to pay employees on-demand. This shift presents an exciting opportunity to give greater freedom to employees to choose when they get paid without impacting the employer’s cashflow.

Want to know more?

If your company is interested in providing a financial wellbeing benefit that costs you nothing and can help reduce financial stress among your employees, then get in touch.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.

What is a payday loan?

For many, payday loans are a last resort for accessing funds quickly to cope with a financial emergency. In this article we’re doing a deep-dive into payday loans to help you understand exactly they are, what you need to watch out for, and what alternatives to payday loans are available.

A payday loan is a high-cost, short term loan. It’s a common solution for many people when there are bills outstanding and payday hasn’t come around yet. Other reasons people turn to payday loans include using them for one-off expenses or emergencies, such as a car or boiler breakdown.

Payday loans have remained a popular source of borrowing in the UK with loans of £50 and upwards available. Lenders offer varying terms, like rate of interest and repayment schedules.

However, payday loans should be approached with caution. If you find yourself in need of financial support and searching for this type of loan, it’s vital to understand the risks and implications of this type of borrowing.

Direct lenders vs. brokers

When it comes to applying for a payday loan, there are two routes that you can take:

- Borrow through a payday loan direct lender

- Use a broker to find a payday loan

There are some important differences you should know about.

What is a payday loan direct lender?

A direct lender is the company that loans you the money. They often provide faster decisions than brokers, so are the top choice for those in urgent need of funds.

Choosing a direct lender means you’re dealing directly with the company lending you the money. But you may not be getting the best deal. For that you either have to search around and compare, or use a broker who will do that for you.

What is a payday loan broker?

Unlike a direct lender, a payday loan broker will help you find a loan. A broker will compare loans to find the best deal for you, taking your personal circumstances into consideration. They won’t do this for free though.

Sometimes a broker will receive commission from the lender. The alternative is that the broker will charge you a fee for their assistance. This will likely be added to the loan itself and mean that you are paying more.

It’s important that you understand whether you will be charged for a broker’s service, so be sure to ask at the start and factor the cost in. They may still charge you even if you don’t end up taking out the loan.

Do I need a credit check for a payday loan?

Some payday lenders advertise that they don’t carry out a credit check on you. This seems too good to be true for those with poor credit history.

Statements like this give the impression that anyone can apply for a loan and will be accepted. Lenders that fall into this category often use headlines stating that their acceptance rate is over 95%.

Do loans without a credit check really exist?

Here’s the truth about no credit check payday loans.

Legally, creditors (another word for a lender) must assess your ability to pay back a loan before giving it to you. This is called an affordability check and it takes into account your income and outgoings.

When lenders offer you a loan without a credit check, what they actually do is carry out a soft credit check. A soft credit check, also called a soft credit search, doesn’t leave a footprint on your credit file.

Importantly for the lender, a soft credit check allows them to make a decision in principle about whether to give you the loan.

If you then decide to take out the loan, at that point the lender will carry out a hard credit check and this will be visible on your credit report.

If a creditor doesn’t carry out an affordability check then they are not complying with regulations. Irresponsible lending is when a creditor allows you to borrow more than you can afford to pay back. If this happens to you, you can make a complaint against them.

Can I still get a payday loan with bad credit?

Payday loans for people with bad credit do exist. These are often called subprime loans. So if your credit file isn’t in the best state, you may still be able to get a loan. Hold on though, there’s more to it than that.

Loans offered to people with poor credit history charge much higher rates of interest because these borrowers are considered higher risk by the lender. Subprime loans normally involve higher fees too.

When you have bad credit, high-cost short-term credit might seem like the only option available to you. Going down this route may bring some short term relief, but in the long term a payday loan is bad for your financial health.

What interest rates can I expect with a payday loan?

Before 2015, interest rates charged by payday loan lenders reached a staggering 5853% or more. Thousands of people found themselves repaying far more than they ever budgeted for.

Such high rates of interest made it impossible for some people to pay back their loans, leading them into deep debt. Something had to change.

This issue hit the news when the payday loan company Wonga went into administration. Wonga received a deluge of complaints and was being sued by customers who had been treated incorrectly. Wonga was ordered to compensate thousands for its misconduct.

Now, when it comes to comparing payday loans, you won’t find an interest rate higher than 1,500%. This is the maximum interest rate any payday loan company can charge. Effectively it’s an interest cap to protect borrowers’ financial health.

Customers comparing payday loans will often be lured by lenders offering what appears to be a low interest rate.

Lenders may advertise a daily interest rate as low as 0.8% or even lower. But the reality is that 0.8% per day adds up to 1,500% APR (APR stands for annual percentage rate).

1,500% is the maximum that they are allowed to charge, so it’s not a low rate after all.

How long do I have to repay a payday loan?

Traditionally a payday loan needs to be repaid on your next payday or within 30 days. There are now lenders that allow you to spread your repayments over two or three months. This may seem like a good idea at first.

Be aware that spreading your repayments over a longer period of time means you’ll end up paying more in interest. It’s important to understand that the longer you take to pay back a loan, the more you will end up paying.

Why are payday loans a bad idea?

Although payday loans may seem like the only way to deal with your financial emergency, there are some important things to consider before your commit yourself.

What happens if I miss a loan repayment?

Payday loans work by lending you some money for a short period of time. Soon, the loan will need to be repaid.

So, what happens if you don’t pay your loan back on time? Here are some of the things that could happen:

- You may have to pay a late payment fee.

- Your lender may let you roll over your loan (but this just results in more interest so beware).

- Debt collectors could start to contact you.

- Your credit score will go down.

What is the payday loan trap?

Perhaps the most concerning thing about payday loans is how easy it is to become trapped in a cycle of debt. This can happen very quickly unless the borrower takes preventative action.

Here’s a real-life example. Toby is £100 short towards the end of the month, so he takes out a payday loan from a direct lender.

Toby agrees to repay the loan within 30 days at an interest rate of 0.8% per day.

Come repayment day, Toby repays the £100. But he also has to pay £24 in interest. The total he owes is £124.

Toby was already short of £100 last month, and now he’s starting the next month with £124 less.

Where can Toby find the extra money this month?

You guessed it. Another payday loan.

What’s the long term impact on my credit rating?

If you take out a loan, it will show up on your credit file. It will also show your repayment history. What it won’t show is what type of loan it is, which is a positive.

However, this type of borrowing pattern rings alarm bells with other lenders. They may take this as a signal that you are a high risk borrower.

This means that when it comes to applying for mainstream credit or even a mortgage, you are unlikely to have access to the most competitive products with the most best interest rates.

Essentially, you’re more likely to have to pay higher rates of interest if you’ve taken out payday loans in the past.

How can I avoid getting into debt with a payday loan?

If you’re still considering taking out a payday loan, here are some really important things you should do:

- Explore cheaper alternatives to a payday loan. You may be able to get a salary advance through your employer via an earned wage access provider. This is a safer and cheaper alternative to high-cost payday loans. Other alternatives include asking for a loan from a family member.

- Research the payday loan company to check it’s regulated by the Financial Conduct Authority (FCA). If you’re asked to pay a fee upfront when applying for a loan or credit, it could be a scam. The FCA’s loan fee fraud article explains what to look out for and what to do if you think you’re being scammed.

- Check your budget (create a budget if you don’t already have one) and ensure that you can meet the loan repayments. We’ve created a list of financial tips that includes loads of great free resources.

- If you decide to go ahead with a payday loan, you are legally entitled to a cooling-off period of around 14 days. During this time you can cancel the loan but you may still have to pay interest and fees. Citizens Advice have a useful article about cancelling a loan or credit agreement.

- Seek impartial and free advice to help solve your financial issues. There are numerous charities and organisations that can assist, including Citizens Advice and Step Change.

Payday loan alternative: Salary advances with Openwage

On-demand pay is another term for salary advances. Here at Openwage we offer a safer, cheaper alternative to payday loans by allowing employees to access the money they’ve already earned ahead of payday.

If you’re an employee and would like your company to offer salary advances, you can refer your employer and we’ll get in touch with them on your behalf.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.

Benefits packages: Best perks to attract talent

Ready to invest the time and energy into creating a successful employee benefits package to attract talent? Then your business will reap the rewards. Read on as we share everything you need to know about creating a must-have package that job candidates will love.

There’s no escaping the fact that COVID has had a significant impact on employment. With furlough schemes, reduced wages, and uncertainty around whether a job will exist post-pandemic, the challenges have been great.

As businesses adapted to stay above water, employees faced significant change too, forcing employees to take stock. Working from home allowed employees to reassess and reflect on their priorities.

Now employees are coming back to the workplace with very different expectations.

The Great Realisation

For companies expecting to meet employee retention targets and secure the best new talent, it’s vital to understand the psychological changes that employees have experienced as a result of the pandemic.

What was once viewed as an attractive employee benefits package is likely to be less attractive now to employees. As a result, employers need to re-think their offering to create a package that better reflects today’s employees.

In this article we’ll explore four key aspects of employee benefits packages. Read on for insights into how you can tailor your offering to create a successful benefits and rewards package that will satisfy candidates so that you can attract the best talent.

1) Pay

Pay is the major player when it comes to the benefits and rewards offered by an employer, right?

The salary you’re offering is a key consideration for candidates. For most people, the higher the salary, the more attractive the job.

Securing the best candidate for your business is like winning gold at the Olympics. Substantial effort and investment is needed to prime your company to fight off the competition.

In 2020, a third of UK businesses froze pay while others cut the levels of pay on offer. In 2021, businesses have experienced a degree of recovery, but it’s not uniform across all sectors. A recent study revealed that starting salaries for employees are actually the highest they’ve been for 24 years.

Does this mean that they are in a position to review the levels of pay that they offer?

As well as being subject to pay freezes, many employees were placed on furlough at the height of the pandemic. Reduced levels of pay will have only exacerbated any financial issues that they already had.

What if your business can’t afford to increase pay?

Many businesses are still going through a recovery process and are not in a position to increase salaries. With this in mind, what can businesses offer in place of larger salaries?

- Annual leave purchase scheme

- Cycle to work scheme

- Season ticket loan scheme

- Reduced gym membership

- Discounts on days out or other leisure activities

- Non-financial perks for example on-demand pay

With energy bills set to rise, and the cost of food and fuel spiralling, employees will be highly conscious of their financial citation. Candidates will value initiatives that allow their money to go further.

2) Flexibility….and not just with your working hours

Flexibility has always been a key consideration for employees. Flexibility with their start and finish times, their place of work, or the ability to vary their working hours to care for children during school holidays are critical for many employees.

The impact of COVID has opened employees’ eyes and now many value flexibility even more.

Breaking new ground with flexibility

With employees seeking greater flexibility with their work, employers are ideally positioned to break new ground and offer a relatively new, yet exciting initiative.

Companies are comfortable with offering flexibility when it comes to the way employees work, but flexibility when it comes to paying employees is now on the rise.

On-demand pay is also called a salary advance, pay advance or earned wage access. Essentially on-demand pay allows an employee to access their earnings before payday. Typically this is to cover an unexpected expense. Learn more about how on-demand pay works.

In fact, on-demand pay doesn’t just tick the box when it comes to flexibility. Being able to decide when to get paid helps employees become less stressed about money. This can bring a much-needed boost to their financial wellbeing, which has a positive impact on employers as well as employees.

These plus points make it an attractive benefit to candidates who are craving financial flexibility. We’ll look more closely at on-demand pay as a financial wellbeing benefit later in this article.

3) Mental wellbeing

For a while now employers have supported the physical health of their employees. This has included offering benefits like medical cover, dental plans, and gym memberships.

In recent years, the link between physical and mental health has been proven. Poor physical health often accompanies poor mental health, and vice-versa.

Increased stress levels have led to an evolution in the benefits that employers offer to include support for employee mental wellbeing.

There’s a wide range of mental wellbeing benefits out there, ranging from the more traditional Employee Assistance Programmes to the more modern approach where employees can access yoga sessions and wellbeing days.

In reality though, these types of initiatives are merely scratching the surface when it comes to employee mental wellbeing. There’s so much more that can (and should) be done to support employees.

Why should your benefits package support employee mental health?

While working from home has been a positive experience for many, employers should bear in mind that this can mask problems. With a lack of interaction and no distinct boundaries between work and home, some employees will be suffering in silence. Businesses must ensure that regular communication takes place with those working from home.

Understanding the impact of poor mental health highlights just why this should be a priority for your business.

Poor mental health leads to poor physical health, issues with relationships, and eventually results in burnout.

Stressed, anxious or depressed employees aren’t good for business. Employees suffering with mental health issues are less productive and more likely to be absenteeism. And that’s not forgetting the human cost of poor mental health.

How can you join the mental wellbeing revolution?

The first step is to recognise the extent of any issues. COVID has led to people experiencing increased levels of stress and given that work is a major part of our lives, employers are in a great position to assist.

So what should your company consider when choosing mental wellbeing benefits?

1. Mental wellbeing policy

OK, so a policy alone isn’t going to directly support your employees’ mental health. But what a policy does is demonstrate your commitment to supporting employees. Communicating that employees can openly talk about their mental health issues without fear of being penalised is imperative.

Until we can bring an end to the stigma associated with mental health, employees will continue to need reassurance that struggling emotionally won’t set them back at work.

2. Mental health training for managers

Managers can be trained to spot potential issues with employees and support them. When they recognise an issue, the training will allow them to open up a discussion with that employee in a sensitive way.

The key is for managers to make employees feel comfortable and safe when talking about their mental health. You can even train your managers or other key personnel to become mental health first aiders.

3. Reward employees with feel-good benefits

Offer your employees benefits that will help them feel good. This could be an internal, policy-driven initiative for example allowing your employees to buy additional annual leave so that they can relax and recharge.

You can also provide access to digital wellbeing tools, like mindfulness and relaxation app subscriptions. Or consider a Christmas gift for staff like a spa day instead of organising a Christmas social event, which can be a financial burden for some.

Communicating all the great things you’re doing to support your employees’ mental health can go a long way with candidates who are increasingly looking for mental health support from employers.

4) Financial wellbeing

We often assume that our wellbeing takes a hit if we’re overworked, dealing with relationship issues or perhaps a life event like moving house. But stress and anxiety is the result of many things, and money (or a lack of) is one of them.

There is a clear link between mental wellbeing and financial wellbeing. One report shows that 39% of employees believe that money negatively affects their mental health. With 58% of employees reporting that they feel stressed about their finances, money worries are widespread.

The key take-away is that well over half of all workers are worrying about money – how they’re going to pay their bills, and if they have enough to tide them over.

Worrying about money doesn’t disappear when work starts. In fact, financial stress is stopping many of your employees from bringing their A-game to their work.

Performance, productivity, and focus all suffer when employees are stressed about their finances.

Now is the best time to implement a new financial wellbeing initiative

Given that some 44% of employees are unsatisfied with their benefits and rewards, it’s the ideal time to reform your company’s package based on what employees need and want.

The smartest employers are recognising that an employee benefit that combines flexibility with financial wellbeing support is likely to be well received.

If you’re not convinced about the need to address your employee’s financial wellbeing, our article explaining how financial wellbeing relates to the workplace is a good place to start.

Translating your benefits package into faster recruitment and increased retention

With your new employee benefits and rewards package ready to go, how can you help your employees make the most of it?

- Communicate your benefits clearly and regularly to your employees. Help them understand what each benefit really means for them.

- Publicise your benefits on your recruitment adverts and mention them in your interview process. Don’t wait for candidates to ask, otherwise you could risk losing them to another company that is communicating its benefits package better than you.

- Don’t forget to give complete information to new starters about benefits on offer, so they don’t miss out. It’s imperative for the onboarding process that you follow-through with everything you promised during the recruitment phase.

- Monitor take-up using data analytics. Engage employees to understand the reasons why they haven’t taken up a benefit until now.

- Try using a survey to get a clear picture of how your employees feel about the benefits they have access to. This will give you insights into which benefits are most popular and you can promote these to candidates.

- Highlight a benefit each month using internal communication channels so that employees have multiple opportunities to engage with it.

Want to know more?

If your company is interested in providing a financial wellbeing benefit that costs you nothing and can help reduce financial stress among your employees, then get in touch.

Personal finances: 6 top tips for better money management

The state of our personal finances has a major impact on our lives. Poor money management can result in stress and worry. With these 6 top tips for better money management, you can create a new sense of financial wellbeing. We’ll also show you how on-demand pay can be a useful tool for financial wellbeing.

Side-stepping poor financial habits is a vital part of keeping control of your finances. Nobody sets out to get into bad habits, but once they’re there, it can be hard to kick them.

Money mistakes cost you in more ways than one

If you ignore where your personal finances are heading, then it can lead to problem debt. Nobody wants that, or the stress and constant worry that often comes with it.

It doesn’t take many slip-ups with managing your money to set you back and make your financial goals harder to achieve. A missed payment here, a late one there, and suddenly your credit rating can take a tumble.

If you have a bad credit history, opening an account can be more difficult. If you’re saving up to buy a house, then your mortgage options might be limited too, especially if you have black marks on your credit file.

It’s important to set time aside to manage your personal finances. Get into the right frame of mind when it comes to money and you’re halfway there.

The benefits of money management

Taking control of your personal finances brings a whole host of benefits.

Missing important payments or not having enough for everyday essentials can make you feel stressed and anxious. In contrast, managing your money effectively gives you greater control and helps you feel empowered. It puts you in the driver’s seat so you can steer the direction of your life.

Being in control of your finances means that:

- Unexpected expenses don’t cause you stress because you have enough savings

- You can budget for treats for you and your family

- You can keep your credit score looking healthy by never missing a payment

- You can make long-term plans for your future such as buying a house, working less, or retiring

- You can achieve a sense of financial wellbeing

If you want to stay in control of your personal finances and ensure that you’re developing the best financial habits, here are six money management tips that can help.

Tip#1: Make a budget and stick to it

We know it might not be everyone’s cup of team. Who wants to sit down and list all your expenses when there are so many other more exciting things that you could be doing?

Admittedly, it may not be the most interesting way to spend an evening, but making a detailed personal budget is seriously worthwhile.

Take the plunge and make a budget

Making a budget is going to take some effort. Sticking to that budget is going to take even more. But when you see the benefits that it brings, you’ll understand why a good budget can be your best friend.

Developing good financial habits such as budgeting will help you:

- Feel more in control and empowered

- More likely to stay in the black – and avoid getting into debt

- Less likely to miss important payments

- Deal with unexpected costs and bills

- Secure a loan or a mortgage because you’ll have a good credit score

- Save up for treats such as holidays or a new car

- Avoid financial worry and stress

Making a budget can be fun

When these kinds of financial wins sink in, suddenly it becomes clear why the work required to create a budget is worthwhile. There are plenty of ways to inject fun into creating a budget. Get creative or try doing it with a friend.

MoneyHelper has a free budget planner that shows you a breakdown of your finances.

Tip#2: Make your budget work for you

Setting a budget that matches your salary or income is a great first step towards developing positive financial habits. If you’re going to stick to your budget though, you need to make sure that it works for you.

Budgeting is about gaining and taking control, not about going without. What works for you will be different to what works for others, so be honest about what you need and what you want.

Reflect on your expenses

Once you’ve created your budget, make time to look where your salary goes each month. Break down your spending into categories such as food, socialising, and bills. This makes your spending habits as clear as possible. It also becomes easier to see where you need to make some changes.

Sometimes looking at your spending can be a little scary. Often we don’t realise quite how much we are spending in certain areas. That is why budgeting and reviewing your spending regularly are so important when it comes to gaining financial control.

Find ways to cut your spending

With your budget in hand, it’s time to see where you could be saving money, such as:

- Travelling expenses – could you walk or cycle some of the time?

- Eating out – perhaps this could be a treat once in a while rather than every week?

- Clothes – think about what you really need

- Subscriptions – could you cancel any unused subscriptions such as gym memberships?

There is no need to deprive yourself of life’s little luxuries.

The key is to be responsible with your non-essential spending, so you can enjoy treating yourself and not leave yourself short.

Tip#3: Cut your bills

Bills are one of those things that are unavoidable. After paying your mortgage or rent payments, your bills will be the next largest monthly expense. On average we pay around £234 a month to cover these.

This figure only covers the basics such as:

- Gas

- Electricity

- Phone

- Broadband

In addition to these, there’s council tax, car insurance, and home insurance to consider. Looking at all your bills together, you’ll see that they account for a sizable portion of your outgoings.

Shop around for the best deals

Today it’s easier than ever to shop around for a better deal on your bills. The rise in comparison websites means that you can check out 100s, if not 1000s, of providers for anything you can imagine. Whether it’s insurance, energy, broadband, or phone, chances are there will be a cheaper deal out there.

Even if you’d prefer not to switch suppliers, it’s still possible to save on your bills. Phoning your supplier to ask for a better tariff can result in a significant saving over the course of a year.

Save little and often

People with good financial habits make a point of saving where they can rather than just accepting what they are currently paying. Small savings add up, so it’s always wise to check all your bills and see if you can get the same service for less elsewhere.

Tip#4: Monitor your bank account

Part of developing good money management habits involves checking your bank statements. If you don’t know what’s coming out of your bank account each month and when, you’re more likely to overspend and end up falling short when a bill is due.

Regularly checking your bank account means that you know how much you have at any given time. You can be confident that you can pay your bills on time and stick to your budget in areas like eating out or the morning coffee-run. Some banks will now allow you to set up alerts to help.

Check for low balances

These alerts will let you know when your balance goes below a certain level. They will also let you know if there are insufficient funds to cover an upcoming direct debit.

This gives you the chance to get more funds into your account and cover the payment. This helps you by allowing you to avoid missed payments (and potential charges associated with it) and protect your credit score.

Check when your bills go out

Most people have various bills coming out of their account at different times of the month. That’s fine, but it does make it harder to keep track of how much you’ve got.

You may be able to group most bills to come out at a certain point in the month. This means that you’ll be able to keep better tabs on your money.

Then, if you know that your account is running low and you’ve got a bill to pay, you can decide what happens next. Do you let the payment fail or access some of your earned pay for a fast injection of cash?

Use on-demand pay to tide you over

If you realise that you don’t have enough for an important payment or bill, you could consider using on-demand pay. Openwage gives you instant access to your earned pay for a low fee.

On-demand pay from Openwage allows you to access your earnings to settle a bill without resorting to loans or credit cards. Most of these charge extremely high interest rates and damage your credit score.

Importantly, on-demand pay isn’t not a loan or any form of credit, so there’s no interest to pay and it won’t affect your credit score.

With on-demand pay, you can tap into your salary that you’ve already earned without waiting for your usual payday. This provides a convenient way to get a little extra to tide you over.

Tip#5: Keep a financial diary

Good money management means knowing what’s around the corner, financially speaking. You can’t control unexpected expenses (although you can put money aside for them), but certain expenses come around like clockwork.

Know your upcoming expenses

By keeping a financial diary, you can track and plan for regular expenses. Generally, we know when our internet contract is due to expire, when our insurance will renew, and when the car is due its MOT. We also know when birthdays are approaching as well as any other celebrations.

Put money aside to cover them

Knowing when these events are approaching means that we can plan for them. Instead of expenses like insurance renewals creeping up on you, you’ll have time to put money aside to cover them so you won’t be left short.

Being organised pays off

Planning ahead when it comes to your expenses also puts you in a better position to negotiate with providers. You can get a better deal on your car insurance renewal if you compare prices well ahead of when your existing insurance expires.

There are times however that despite the best laid plans, you find yourself with a bill you weren’t expecting. Services like on-demand pay provide a fairer and more responsible alternative to payday loans, credit cards, and overdrafts.

Tip#6: Build up a savings pot

People in Britain have got a little better at this over the last year or so. The pandemic created 6 million ‘accidental savers’ – saving as a result of not being able to spend. If you’re one of those accidental savers, it’s a great habit well-worth continuing with.

Solve unexpected problems easily

Having savings to fall back on means that you are prepared for the unexpected. Like the moment the boiler breaks down or the car needs an urgent repair. Instead of causing stress and worry, these events can be easily-solved using your savings.

High-cost credit isn’t the answer

But not everyone has got the savings habit nailed. Without savings, some people may resort to payday loans and credit cards. These may seem a great way to deal with an emergency, but the reality is quite different. High-interest rates and unreasonable terms trap people into a vicious cycle of debt.

Use on-demand pay as a helping hand

On-demand pay is a cheaper and safer alternative to payday loans and credit cards. On-demand pay with Openwage isn’t a loan, as you can only access the money you’ve already earned. With only a small fee to pay, Openwage offers a cost-effective and responsible means to access a little extra funds ahead of payday.

Additional resources

So, now you’re equipped with these top 6 tips for better money management, you can start putting them into practice!

There are lots of useful online resources and tools to help you continue your money management journey. Check out MoneyHelper and if you need free and unbiased debt advice, StepChange is a great place to start.

Get your employer on board

If you’d like to access your salary when you need it, then why not recommend Openwage to your employer? Refer your employer (anonymously if you prefer) by completing this short form. There’s no cost for employers to offer Openwage to their employees.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.

Absenteeism: The staggeringly high cost of financial stress

To keep your business operating effectively, you need the right people in the right positions. Your organisation’s plans can soon be scuppered by absenteeism. In this article, we’ll look at how financial stress is linked to absenteeism and how you can tackle it.

There are numerous factors that drive absenteeism. Effective absence management can only exist when these factors are recognised. Beyond recognition, there also needs to be an understanding combined with a strategy to reduce absenteeism levels.

Absence management is a key tool to keep your business running smoothly. So when absence levels begin to increase, there is a ripple effect. The remaining employees begin to feel the stress of picking up their colleagues’ tasks. This can make them more likely to be absent too.

How is wellbeing related to absenteeism?

Already got a wellbeing strategy in place? Then it’s highly likely that you’ve already recognised the link between wellbeing and absenteeism.

Evidence shows that employee absenteeism reduces when their wellbeing is considered and cared for. Creating a work environment where stress is recognised and effectively managed brings its own rewards.

In contrast, the absence of considering employee wellbeing can have a devastating impact. A report by Westfield Health found that absenteeism cost UK businesses £14 billion in 2020. That was an increase of £1.3 billion on the year before.

Figures also show that during 2018, some 141.4 million working days were lost due to absenteeism with 17.5 million of those caused by poor mental health. Some of the most common causes of absence from work include:

- Stress

- Anxiety

- Depression

A major concern with these figures is that they are at an all-time high. As a result, organisations need to do more to address the causes of absenteeism.

Does financial stress impact absenteeism?

Most organisations are already addressing physical and mental wellbeing through various initiatives. Now the importance of financial wellbeing is beginning to be more widely understood.

There is an inextricable link between financial stress and absenteeism. The CIPD’s Employee Financial Wellbeing report indicates that employees in high financial stress groups averaged 6.2 full-time equivalent days lost. In contrast, those in low financial stress groups averaged 3.8 full-time equivalent days lost.

According to research by pension-provider Aegon, 4 million working days are lost each year as a result of financial stress. Addressing poor financial wellbeing will help your organisation see a reduction in absenteeism levels.

Mental health is the most common cause of long-term absence and is also one of the top reasons for short-term absence. Stress is reportedly the third most common reason for long-term absence.

Stress and poor mental health are linked to your employees’ financial wellbeing. Poor mental health can make money worries worse. Similarly, money worries can have a detrimental impact on mental health. It’s a cycle that can be hard to break without help or support.

What’s behind poor financial wellbeing?

Poor financial wellbeing can arise due to a number of reasons, including:

- Poor financial literacy or a lack of financial education

- Development of bad financial habits, like overspending and not saving

- Fluctuating income from month to month (such as those working in the gig economy)

- Series of life events e.g. job loss and marital breakdown

Life events can be a major cause of financial stress, despite being some of the happiest moments of our lives.

- Marriage (getting married can get very expensive!)

- The arrival of a new baby

- Divorce

- Poor health (and the impact this can have on someone’s ability to work)

When these get added to unexpected expenses, paying off debts, and dealing with emergencies, an employee’s financial wellbeing can take a turn for the worse.

What are organisations doing to combat absenteeism?

Absenteeism is nothing new. Most companies have already adopted strategies aimed at reducing, or at least managing, absenteeism.

Some of the current methods and tools include:

Return-to-work interviews

These are meetings that take place when an employee returns to work. Return to work interviews are used to establish whether an employee is fit and well enough to work, but they also explore the reasons behind the absence. This can help to identify patterns and give employers an opportunity to offer support to the employees.

Trigger mechanisms

These work in such a way that there are key points that trigger a certain action. They are used to highlight both levels and patterns of absence. When a certain level is reached, managers will follow the guidance and take the appropriate action.

Unpaid leave

Employees may go off sick if they experience a family emergency or have an issue with child care. So another effective absence management tool is allowing employees to take time off (in addition to annual leave) when the need arises. A flexible approach with leave means that absenteeism is reduced.

How a health and wellbeing strategy can reduce absenteeism

The mere existence of a health and wellbeing strategy has a positive impact on organisations’ employees. It shows your employees that their company cares and has their welfare at heart. This can be a powerful motivator and combat more than absenteeism alone.

There are numerous aspects of an health and wellbeing strategy. Some of the elements that you are likely to come across include:

Physical and mental health promotion

It has long been accepted and understood that a physically healthy workforce has its benefits. Fitter and healthier employees are less prone to illnesses. They are likely to be more motivated too in comparison with those with poor health. This has a direct impact on absenteeism.

Over recent years, organisations have begun to give equal consideration to their employees’ mental health. Stress, anxiety, and depression can lead to an upward trend in rates of absence. Promoting mental health has the potential to remedy this.

Creating a happy working environment

A happy workforce is a productive workforce, or so the saying goes. While productivity is another key metric for your organisation, this also has an impact on absence rates. A safe and happy working environment motivates your employees to come to work and bring their A-game.

This doesn’t take away the fact that there will be days when your employees would love nothing more than to be elsewhere. However, they are far less likely to go off sick for minor issues when they could, in reality, still be at work.

Promoting financial capability and resilience

By understanding the impact of financial stress on absence, organisations can recognise the value of addressing this in their wellbeing strategy. By promoting financial wellbeing, companies can empower their employees and make a real difference to their lives.

Offering employees on-demand pay is a great example of how a company can help its employees take control of their money. For employees, the ability to get paid when they want can significantly reduce the financial stress created by an unexpected expense. This can help build up their financial resilience.

Reducing financial stress through a financial wellbeing strategy is a great way to tackle absenteeism

Organisations can reduce their employees’ financial stress by implementing a strategy, which may include benefits such as on-demand pay.

Your organisation’s financial wellbeing strategy should focus on the needs of your employees. In general, financial literacy is a great area to focus on as this can reduce financial stress associated with poor money management.

With this in mind, here’s a few areas that a financial wellbeing strategy may address:

Healthy budgeting habits

While school teaches us maths, there’s a lot more to budgeting in real-life when the consequences of getting it wrong can be serious. Learning to budget even as an adult can have a measurable and positive impact. It can also improve levels of financial wellbeing.

Financial wellbeing during redundancy

When redundancies occur, this often leaves employees in a position that they have never experienced before.

Being without an income is extremely daunting for most people. This is mainly because of the consequences of not having a regular pay packet. Some employees who are made redundant may receive a cash lump sum.

Both of these scenarios require employees to understand how to effectively budget. Whether that’s making a lump sum last as long as possible, or drawing up a new budget based on one income rather than two.

Financing retirement

As employees reach the end of their working life, they have to make some difficult financial decisions. They need to decide on what to draw from their pension in terms of a lump sum. They also need to consider what they need to do to ensure that their pension is really working for them.

Often this is complex and some employees made need extra help and support to understand what they need to do and what the impact of those decisions are. Access to an impartial financial advisor can bring real benefits.

Importantly, employees of all ages should be aware of their pension choices and how to manage theirs effectively. It’s too late to wait until retirement is approaching to think about your pension.

Debt management

Debt is a common part of life – mortgages being a key example. It only becomes a problem when it is poorly managed. When employees are financially literate, they are more capable of understanding how to manage their debt carefully and avoid repeatedly turning to loans and other forms of credit. Employees with a good level of financial literacy are also more aware of their options in case their debts become wholly unmanageable.

Tips on tackling financial stress and absenteeism

If you’re looking to move forward and implement a financial wellbeing strategy in your company, here are some key points to consider:

- Tailor your strategy to your business, your people, and their individual needs