Practical strategies to boost employee retention in 2022

Employee retention. It’s on every HR professionals’ minds right now. With the Great Resignation upon us, 2022 is set to be a challenging time for UK employers. In this article we explore five practical employee retention strategies to support your organisation’s goals in 2022.

There’s little doubt that the pandemic is set to have a long-lasting impact on businesses and how employees approach work. First, employees had to adapt to home working. Then, they had to get used to a hybrid set-up.

All these changes mean that employees are clearer than ever when it comes to what they want. This, combined with the current buoyant labour market where employees can almost take their pick when it comes to job offers, means that retaining good staff has become the greatest HR challenge.

Employee retention and talent attraction are HR’s biggest challenges

The statistics speak for themselves:

- 60% of employers believe that employee retention is likely to impact them this year.

- 58% of businesses believe that attracting new employees will pose challenges too.

These figures were shared in Willis Towers Watson’s Reimagining Work and Rewards survey conducted at the end of 2021.

29% of employees are considering changing their jobs in the next 12 months according to a survey by Slack, the popular communications tool.

The data demonstrates the need for HR teams, more than ever, to effectively tune-in to what employees need and want. This means that as well as effective employee retention strategies, HR teams need to reassess what attracts today’s workforce and ensure they deliver this consistently.

Let’s take a look at how HR teams can effectively retain staff with these five key practical employee retention strategies.

Strategy 1: Listen to your employees

We all like to be heard, and your employees are no different. Employees must be allowed to and feel comfortable enough to express their true fears, concerns, and questions.

Listening to your employees shouldn’t be overlooked when it comes to your employee retention strategy. A global survey by UKG carried out in 2021 found that the majority (86%) of employees feel their colleagues aren’t heard fairly or equally. In fact, 63% of employees feel their voice has been ignored in some way by their manager or employer.

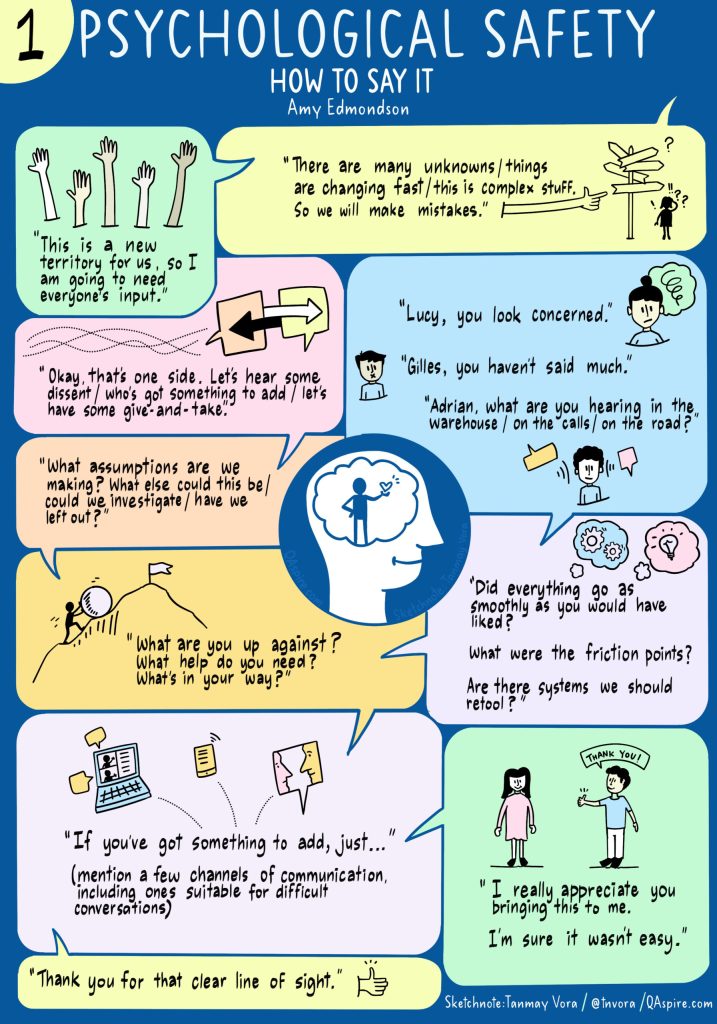

When your employees’ voices are heard, it allows them to feel that their needs are being met. Effective communication and feedback loops also help to promote psychological safety, trust, and a sense of belonging.

The result of this is that employees feel more engaged with their work and their organisation. High levels of engagement are consistently associated with higher levels of employee retention. But that’s not all businesses stand to gain from listening to their employees.

UKG’s survey also revealed that organisations are far more likely to perform well financially (88%) when their employees feel heard and engaged.

How can you help your employees feel heard?

Here are a fews ideas on how to help your employees feel heard:

- Keep in touch: Have conversations with your employees that create psychological safety.

- Don’t just wait for feedback – actively seek it. This could be in the form of employee surveys, one-to-one meetings, or using informal chats for example creating a dedicated Slack channel.

- Conduct exit interviews every time you lose a member of staff to understand the reasons and identify common themes.

- Consider conducting stay interviews to help prevent employees from leaving. Understanding what your employees’ aspirations are enables you to help them reach their goals within your organisation.

- Encourage full participation at meetings. Use strategies to prevent the loudest voices from dominating.

- Ensure that management is both visible and accessible. By publicly responding to employees’ concerns, you’ll help to create a culture of openness and trust.

Strategy 2: Invest in your people

Your employees are your greatest asset. Without them your company would be nothing.

A key employee retention strategy is to invest in your employees. This means understanding what motivates them and supporting them in their aspirations and goals. One way of doing this is to offer learning and development opportunities. By investing in your employees’ learning and development, you’re showing that you’re committing to their futures.

Continuous learning is on the horizon

Creating a continuous learning environment is one of the ways that workplaces are set to change in the next 10 years, according to a report from Gartner. Constant digital upskilling will become necessary as the pace of technological changes accelerates.

Of course, it’s important to approach learning and development in terms of company needs as well as the needs of the individual employee. Employees who feel that their organisation nurtures their skills and professional development are more likley to feel more engaged with their organisation.

By committing to your people’s learning and development, you can:

- Create a team that feels cared for and nurtured by its organisation

- Close skills gaps

- Allow employees to cope with current and future challenges

- Promote and support optimum performance

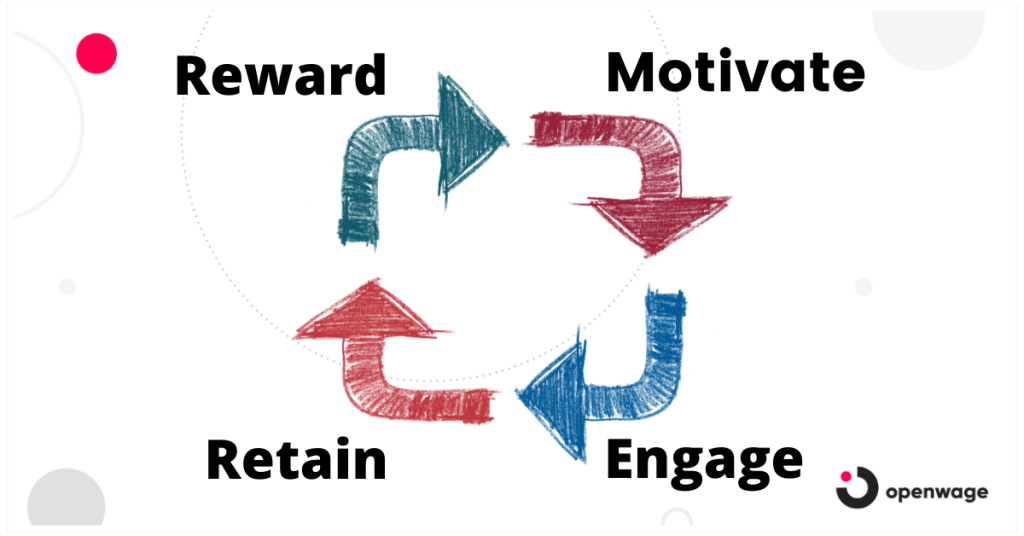

Strategy 3: Reward your employees

Your employees work hard for your business. But does recognising your employees’ efforts by giving them work perks really matter when it comes to boosting employee retention?

REBA’s The Rewards Report found that 82% of employees who felt motivated had received perks. This is interesting when you compare it to the 69% of staff who said ‘no’ they didn’t feel motivated and they didn’t receive any form of reward or recognition for a job well done.

Rewarding your employees helps motivate them to be productive and perform well. Feeling motivated is an important aspect of developing employee engagement. And here’s the big one – engaged employees are 87% less likely to leave their companies than their disengaged counterparts.

Do the work perks you offer benefit your employees and your organisation?

It’s likely that you have a diverse workforce with varying needs when it comes to benefits. For this reason, it’s important to consider what your employees will benefit most from when it comes to perks and benefits packages. But that’s not to say that your organisation can’t benefit too.

Money talks

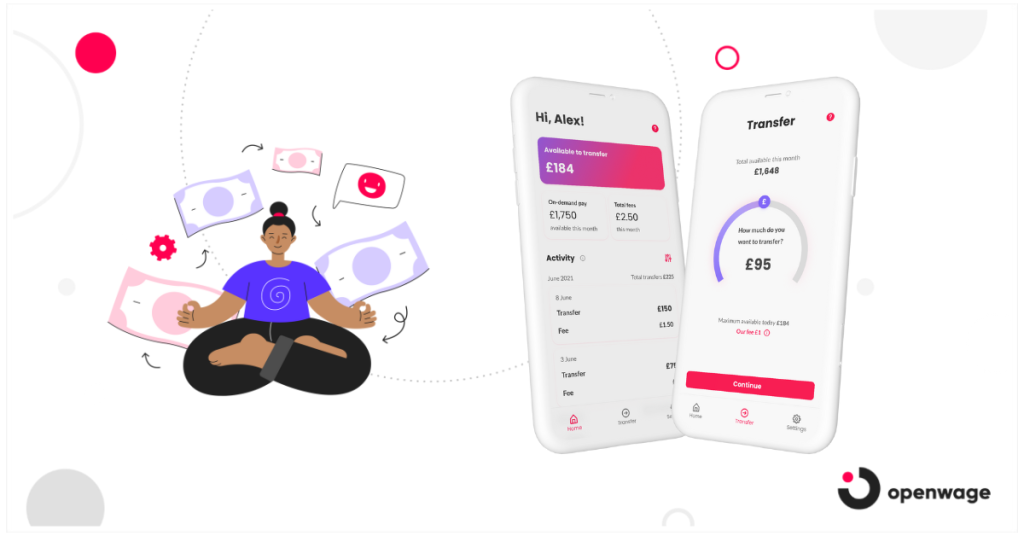

As an HR professional, you’ve probably heard of on-demand pay but it might be relatively new to you. Essentially, on-demand pay gives your employees instant access to their earned pay at any time before payday.

Rather than waiting until payday to get the money they’ve already earned, employees can take control of their finances by accessing their earnings as soon as they’ve earned them. For a low, transparent fee, employees can solve short-term cash flow problems in a few taps.

According to research published in Ernst Young’s On-demand Pay: Payroll that works for all (2020), 70% of adults regularly experience financial stress. This is often driven by a lack of savings or emergency fund. On-demand pay can help to reduce employee anxiety around financial shortfalls that can drift into the workplace and cost employers billions in lost productivity.

Offering on-demand pay to your employees benefits your organisation too. Have a read of our article that explores 5 ways that on-demand pay saves your company money.

Strategy 4: Deliver a great onboarding programme

When considering employee retention strategies, it’s important not to overlook the whole employee journey. As an organisation, you need to focus on retaining employees from day one.

Even before onboarding, your new employees have built up a picture of what it’s like to work at your organisation through communications with the HR team or perhaps their new manager. Don’t forget, it’s likely they’ve been checking you out on social media too and perhaps sites like Glassdoor too.

Those first few days and weeks are vital and can have a major impact upon whether or not a new employee stays with you or decides to pursue another opportunity.

Does effective onboarding help retain employees?

Yes. Effective onboarding increases employee retention by 82%. This adds up to a pretty good reason why it’s worth investing in your onboarding programme.

Throwing employees in at the deep end is never going to turn out well. It creates pressure from the outset and can leave employees feeling unsupported, unmotivated and ultimately disengaged.

Strategy 5: Make employees stay for the culture

Every organisation has its own culture, whether it’s created by design or develops of its own accord. When looking at employee retention strategies, it’s important to ensure that your culture is the best it can be to give employees a great employee experience. A few things to keep in mind:

- Creating a great culture is an ongoing task.

- It’s not just down to HR to create or even manage it.

- It involves every employee at every level.

Every single one of your employees plays a part in building your organisation’s culture – whether you like it or not.

What matters to individual employees may vary, but there are some common themes to address when it comes to your culture. Often, the right culture is more important than a higher salary.

Final thoughts

Retention has always been a KPI for HR teams. No business wants to lose valuable employees and all of the experience that goes with them. Nor does it want to absorb the financial consequences of employee turnover.

To be a winner in the new labour market we find ourselves in today, it’s crucial that organisations have a willingness to invest time and money into its employees. Remember, your employees are individuals and so it’s vital that your organisation tailors and tweaks its strategies accordingly. The rewards of doing so are definitely worthwhile.

Social media and financial wellbeing: Know the warning signs

Daily use of social media is impacting our lives in more ways that we think. Discussions around the impact of social media on our mental health are plentiful. But much-less talked about is the impact of social media on our financial wellbeing.

The explosive rise of social media

As of January 2021, 53 million of us in the UK are active on social media with internet users spending a staggering 145 minutes per day on average on platforms including Facebook, Instagram and TikTok.

It’s been proven that social media negatively affects our mental health, with links to increased depression, anxiety, and loneliness. Now there’s good reason to believe that social media impacts our financial wellbeing as well.

Financial wellbeing and mental health issues are closely linked

Financial wellness means feeling calm, secure, and in control of our financial future. Social media on the other hand often leaves us feeling anxious or incomplete. Know anyone who feels better after a thirty minute scroll? Neither do we.

Social media drives us to compare ourselves with others

Social media increases anxiety in several ways. Fear of missing out (FOMO) is a common complaint that leaves many of us compulsively checking our phones.

But constantly comparing ourselves is extremely harmful. Commonly known as compare and despair, measuring our lives against those represented on social media can leave us feeling anxious and depressed.

Every curated, filtered, and carefully chosen image drives the message deeper; we don’t measure up. FOMO and compare and despair encourages a state that psychologists call survival mode.

In survival mode, we don’t think clearly. We make impulsive decisions, we lose patience with long-term planning, and we’re less likely to be open to creative solutions.

Anything that negatively impacts our general happiness can have a knock-on effect on our financial wellbeing and this can affect how we are at work too.

For millennials “more than any other generation, social media and the allure to spend beyond their means could have long-term negative effects on their finances if they’re not careful.”

Paul Kelash, Vice President of Consumer Insights for Allianz

How can social media affect our financial wellbeing?

Social media affects our spending habits and behaviours in more ways than one. This is no accident – it’s been designed this way.

In a 2020 survey in the US, a whopping 88% of people said they remained out of pocket because of their social media purchases. Let’s take a closer look at how social media affects our spending.

Social media drives impulse buying

According to recent research, social media has caused a 40% increase in unplanned purchases. Even more concerning is that 57% of millennials have parted with money they hadn’t planned on spending because of something they saw on social media.

Our culture of consumerism and the ease of online shopping isn’t conducive to our financial wellbeing. But we’re not entirely to blame.

Targeted ads encourage unplanned spending

Every time we go on social media, we’re bombarded by adverts that are targeted towards our age, gender, interests, and even location. Clever marketing campaigns make it hard not to be influenced by these adverts and you’re more likely to end up buying a product that you’ve seen advertised.

Many users report that targeted content is convenient and shows them products that are genuinely relevant to their interests. But it also increases the probability of making purchases we didn’t plan on making. They make us want more than we currently have.

Apps make it easier to part with your money

The rise of social media apps also pushes us to spend. While many apps are free to use, there are a lot you have to pay for. Getting the latest app can be hugely tempting, and the data speaks for itself.

Consumer spending on apps hit $135 billion in 2021 with consumers spending 130% more on health and fitness apps in 2019 than they did in 2017.

In-app purchases are extremely easy to make due to expertly-designed tactics from app makers. The costs can quickly mount up.

Social media influencers or just adverts?

Social media influencers are constantly sharing content about products to make us feel excited about them too. This is known as social proof and it’s a clever way to make us part with our money.

It’s so successful in fact that brands everywhere are partnering with social media influencers to increase their sales.

The influencer marketing industry is due to hit $13.8bn by 2022. There’s a good reason for this – influencer recommendations are often simply paid advertising.

Over half of women on social media made purchases due to influencer posts and 82% of people trust social networks to guide their purchasing decisions according to data compiled in this article by Digital Marketing Institute.

It’s clear that social media encourages us to spend money. It uses tried and tested psychological techniques that push us to make purchases to make ourselves feel better.

Social media tips to promote your financial wellbeing

Clever advertising, influential icons, and one-click purchasing aren’t conducive to promoting our financial wellbeing. So how do we reclaim our balance?

1. Remember, social feeds are highlights

Social media isn’t the real world. This may sound obvious, but the creators of these platforms acknowledge they were specifically designed to exploit a vulnerability in human psychology.

It’s all too easy to fall into the trap of comparing our lives with others and over-spending to keep up. It’s also easy to forget that most influencer profiles are essentially paid advertising platforms.

The marketing strategies and targeted ads used on social media are designed to trigger and heighten our natural human insecurities and fears with the aim of pushing us to consume.

2. Consider taking a break from social media

A social media break or detox is a powerful way of stepping back and getting some perspective. This can be a day, a week, or even a month.

Detoxers often report that the first few days are hard and withdrawal symptoms are common. The very fact that we experience withdrawal demonstrates the power of social media as an addiction.

Like any addiction, breaking free can be challenging, but it can also be very rewarding. Once we get past the initial panic, we can look forward to feeling more creative, more self-assured, and more productive with more time to focus on what really matters to us.

Moving away from the survival mode triggered by social media will encourage us to think about our long term goals, plans, and strategies that nurture all areas of our lives, including our finances.

By removing ourselves, even temporarily, from social media, we can make decisions and choices independently, away from the push and pull of marketing and advertising. Often, we aren’t even aware of how much we’re influenced by social media until we break free from it.

3. Focus on what you want

A short social media detox empowers us to redefine what we want more clearly. When (and if) we go back online, we can be more specific about the accounts and brands we want to follow and be super selective about what influences we allow into our lives.

It’s useful to ask yourself whether your social media activity is aligned with your goals. Identify your goals first, then go back online and set the tone for your feed, making sure it’s empowering.

For example, following fast food brands might not be helpful if you’re on a fitness drive. Equally, following fashion influencers could discourage you from saving.

What are your financial goals?

Re-evaluating how we engage with social media is essential when it comes to planning our long-term financial goals and our ability to be financially resilient.

The effects of social media on our spending can make it harder than ever to budget, with constant temptation and super-fast purchasing journeys.

Recognising your triggers is a great way to help combat the thought-patterns that can lead us to spend more.

Be a thermostat, not a thermometer

While a thermostat sets the temperature, a thermometer changes itself depending on its surroundings. Consider setting the tone for your social media engagement instead of letting social media set it for you. That way, you’re more likely to remain focused on your goals and feel more capable of achieving them.

About Openwage

Openwage is an on-demand pay provider that gives employees instant access to their earnings at any time before payday. On-demand pay is great for unexpected expenses and can help alleviate financial stress.

If you’d like the flexibility to decide when you get paid, your employer will need to be signed up to Openwage. You can tell us who your employer is and we’ll get in touch with them about offering on-demand pay to you and your colleagues.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.

5 ways on-demand pay is good for your financial wellbeing

Financial wellbeing is about more than simply making ends meet. It promotes a sense of control over your money and the peace of mind that comes with being prepared for future challenges. Here we share five reasons why on-demand pay is good for your financial wellbeing.

Why you should care about you financial wellbeing

Poor financial wellbeing can have a detrimental effect on your mental health because they are intrinsically linked. The Money and Mental Health Policy Institute found that 46% of people in debt have a mental health problem. Out of that percentage, 39% said financial worries made their mental health issues worse.

How are companies supporting employee financial wellbeing?

Up until recently, employers have been focusing on supporting employees’ physical and mental wellbeing, with schemes like reduced gym membership, support helplines, and even ‘duvet days’.

Now, employers have recognised the importance of financial wellbeing. This is in part because of the negative impact on their bottom line that financially stressed employees can have.

Money worries affect how well employees perform at work, and it’s widely recognised that high-performing employees go hand-in-hand with company success. So to support employee financial wellbeing, more and more companies are offering on-demand pay as a financial wellbeing benefit to their employees.

What is on-demand pay?

On-demand pay is another term for earned wage access, early wage access, or salary advance. It’s a service that gives employees the freedom to access some of the pay they’ve already earned before their normal payday.

On-demand pay is designed to help people manage unexpected expenses or an urgent bill that can’t wait until payday.

Rising living costs and stagnant wages means financial wellbeing is more important that ever

When you consider the current financial climate, notably energy bills increasing, national insurance rises, inflation, and stagnant wages, offering on-demand pay to employees makes even more sense.

Anxiety around money is more widespread than ever and employees can’t simply forget about these worries when they’re working.

How is on-demand pay good for your financial wellbeing?

In these uncertain times when life seems to be getting more expensive, it’s more important than ever to find tools that promote your financial wellbeing by reducing financial stress or money worries.

Currently experiencing explosive popularity, on-demand pay empowers employees to:

- Break free from the financial stress caused by rigid pay cycles

- Feel more in control of their money

- Pay urgent bills without dipping into savings or resorting to expensive credit cards or predatory payday loans

Let’s break that down.

1. On-demand pay reduces anxiety about your finances

We all experience short-term cash flow issues from time to time, simply because financial surprises mean that some months you need more money than others. But monthly pay cycles are rigid and don’t allow you any financial flexibility.

Monthly pay cycles are ok if you have savings to fall back on. But data from the Money and Pensions Service shows that 11.5 million people in the UK have less than £100 in savings.

The result? Financial stress and anxiety that can affect all areas of your life, including your work.

The solution to this is to tap into the power of on-demand pay. Using Openwage allows you to access a portion of your pay when you need it. So there’s no need to borrow money using credit cards or dip into an overdraft when you need a short-term injection of money.

2. With on-demand pay, there’s no risk of missing a repayment

When you borrow on credit cards or take out a payday loan, there’s always a chance that you could miss a repayment.

Penalties for missed repayments can be extremely expensive and they can also stay on your credit record for up to six years. This can affect your chances of obtaining other credit including ‘good credit’ such as a mortgage.

On-demand pay from Openwage has been designed so you can’t access more than you’ve earned. It’s not a loan and therefore there are no repayments to make.

Any earnings you’ve transferred during the month are automatically deducted from your salary on your normal payday. So you receive your salary minus any on-demand pay and the small fee for each transfer. This happens automatically so there’s nothing for you to do.

3. Find your money calm with visibility over your earnings

Feeling more in control of your earnings can help you feel more positive and this allows you to live your best life. With the Openwage app, you can view:

- How much salary you’ve earned so far in your pay cycle

- How much on-demand pay you’ve transferred

- What fees you’ve been charged for any on-demand pay transfers

This visibility enables you to plan your outgoings more easily because you can see exactly how much you’ve earned. On-demand pay is great for those who want to stay in the black too. That’s because you can pay off a bill as soon as it arrives using the pay you’ve already earned that month.

This brings a sense of control over your money which promotes your financial wellbeing.

4. A low, fair fee helps you keep more of your money

Some lenders entice you in with claims that you can be approved for a loan in minutes and receive the money instantly. However, this comes at a high price.

The average APR over the course of the year for a payday loan can be up to 1,500% which compares to around 22% for a credit card.

The reason the percentage is so high with a payday loan is that the lender is taking a big risk in lending the borrower the money. That’s because when you take out a payday loan, you’re spending money you don’t have, at least at that moment.

Compare this with on-demand pay from Openwage, which isn’t any type of loan or line of credit. You’re only accessing the money that you’ve already earned, as opposed to borrowing ‘extra money’ from a lender that you later have to repay.

Find out how much on-demand pay costs.

5. Keep your zen when financial surprises happen

Unexpected costs happen to everyone – and they’re usually expensive. For example, the average cost of repairing a broken boiler is between £100 and £500 and car repair bills can go into the thousands.

This type of financial surprise can be hugely stressful when payday is a long way off and savings aren’t up to the job. In the past, a loan or credit card were usually the go-to solutions. But these involve high interest rates and a repayment schedule that can hang over you for months.

Unlike loans and credit cards that linger in your finances like a bad smell, the nature of on-demand pay means that it resets each pay day.

For example, if you’ve transferred £300 of your earnings for a boiler repair using on-demand pay, then on payday you’ll receive your normal salary minus £303 (£300 of on-demand pay plus a 1% transfer fee of £3).

With on-demand pay, you always know where you stand financially. So you don’t accumulate debt that can spiral out of control.

Life doesn’t wait for payday

In today’s world of flexible working hours and on-demand shopping, why do you have to wait until payday to get the money you’ve already earned?

On-demand pay from Openwage can help you feel more in control of what you earn and what you spend. This is vital for your financial wellbeing. When childcare fees rise temporarily or your energy bill is higher one month, you can meet these expenses without having to resort to expensive borrowing.

If you would like to get paid on your schedule with on-demand pay, you can fill in this form. We’ll get in touch with your HR team and show them how their employees and organisation can benefit from on-demand pay.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.

Salary advance, earned wage access & on-demand pay explained

Have you noticed that the way that employees are paid is changing? If you’re in the business of people, then it’s highly likely you’ve seen the phrases salary advance, on-demand pay and earned wage access flying about. But what do they mean? Let’s push aside the jargon and explain what these terms mean for you.

Monthly pay cycles don’t work for everyone

Most employees in the UK are paid once a month. With traditional monthly pay cycles, employees build up a bank of earnings by the time payday arrives. Then they receive all their earnings at once and have to make them last for the next four weeks, which can be stressful.

With such a long gap between paydays, some employees struggle with short-term cash flow issues.

94% of employees worry about their finances and only 40% feel prepared for unexpected expenses. This might include an urgent car repair or an emergency visit to the vet.

The solution up until now? Getting a payday loan with an extortionate interest rate. Or asking their employer for a payroll loan or a salary advance which they then repay on payday.

Salary advances have been around for ages, haven’t they?

Historically, a salary advance is when an employee and an employer enter a private loan agreement. This typically involves running a credit check on the employee and the requirement to pay it back with interest.

Then there are also payroll loans, which are a personal loans repayable over a period of months. This type of loan is sometimes accessible through a credit union in the UK and interest payments due based on the value of the loan Employees make repayments straight from their pay so that they can’t miss payments.

These loans have been around for ages. The standout feature of traditional salary advances and payroll loans is that the employer is given an advance on pay that they haven’t earned yet. This means that the employee is at risk of defaulting on the loan because they haven’t earned the money.

These loans are time-consuming and complex to administer. Besides this, the traditional salary advance and payroll loan put strain on the relationship between the employer and the employee.

Salary advances are flawed. Flexible pay is the future.

These issues with the traditional salary advance have been recognised and solved, creating a solution that’s probably more accurately described as on-demand pay (or salary advance 2.0).

In a nutshell, on-demand pay allows employees to access their pay as soon as they’ve earned it using an app. Any pay they access during the month is deducted from the next pay packet.

There is no need to actively repay anything at the end of the month because it automatically deducts withdrawals as part of the payroll process.

The likes of Uber pioneered the popularity of on-demand pay back in 2016.

Here’s the big one – because the employee is accessing money they already earned, it’s not a loan. Since on-demand pay isn’t a loan, there’s no credit check and no interest to pay.

What’s in a name?

Salary advance 2.0 and on-demand pay are also called:

- Earned wage access (EWA)

- Early wage access (also EWA)

- Accrued wage access

- Employer salary advance scheme (ESAS) – this is the official UK government term

- Flexible pay

- Instant pay

- Pay on demand

With all of these terms, the concept is the same. It gives employees financial flexibility to access their pay when they need it instead of waiting unnecessarily until the end of the month.

It can be confusing with so many terms to remember. We’re going to call it ‘on-demand pay’ because we feel that reflects the true nature of this product.

On-demand pay is born

The traditional salary advance has morphed into a multi-faceted employee benefit with a strong business case for reducing business costs. While a traditional salary advance involved the company stumping up the cash, on-demand pay is funded by the earned wage access provider (we’ll talk more about this later).

Let’s break this down:

On-demand pay – the perk your employees will love

If you’ve seen any job adverts lately online, you’ll see that on-demand pay is now advertised as an employee benefit. It’s a genuine perk to be able to decide when to get paid. For this reason, it’s being used as a competitive advantage for employers to help them recruit faster.

Boost financial wellbeing with on-demand pay

Bills coming out at different times in the month, unexpected expenses and being paid just once a month can leave us feeling financially vulnerable. But with on-demand pay, short-term cash flow issues can be quickly solved.

Importantly, employees can overcome short-term financial issues by using on-demand pay without having to resort to costly payday loans or expensive credit cards. This is great news for your employees’ financial wellbeing.

On-demand pay helps you keep your staff for longer

Poor financial wellbeing is causing 22% of employers to experience higher turnover rates (Close Brothers’ Financial Wellbeing Index 2019). Employers are now using on-demand pay as a tool to help fight the Great Resignation.

With on-demand pay, employees feel their employer is looking out for their financial wellbeing. This in turn, builds trust and loyalty, two key factors that help minimise staffing losses.

Help your employees worry less about money with on-demand

77% of staff with money worries say this impacts them at work (Close Brothers’ Financial Wellbeing Index 2019). This can lead to lower levels of productivity and reduced performance.

Employees who can get their pay on-demand are more likely to cope more easily with financial bumps in the road. This allows them to focus on their work.

On-demand pay reduces absenteeism

Almost a fifth (19%) of employers reported an increase in absenteeism caused by poor financial wellbeing (Close Brothers’ Financial Wellbeing Index 2019). HR teams are focusing on maximising attendance because of the high cost of financial stress.

On-demand pay gives employees more control over their money, helping to reduce anxieties around waiting for payday.

Who provides on-demand pay?

On-demand pay providers are also called earned wage access providers. Employers typically need to sign up with an earned wage access provider for their employees to access the service.

They integrate with an employer’s payroll and time management systems, in order to enable an employee to take out up to 50% of their gross earned pay before payday.

One of the key differences between earned wage access providers is who pays the fee for each salary advance or on-demand pay transfer.

Some earned wage access providers charge employers for the service while others charge the employee. Some charge both the employer and the employee.

Openwage: On-demand pay at zero cost to your business

Armed with this knowledge, you may well be considering implementing on-demand pay in your company.

By partnering with us, you can put financial wellbeing in reach of your employees at no cost to your business. You don’t have to fund the advances either (because we do that). This means there’s no impact on company cashflow.

Here at Openwage, we designed our on-demand pay solution with employee financial wellbeing in mind. We only charge employees a low, fair fee for each on-demand pay transfer.

Find out how we can help your employees and your business. Request a demo of our on-demand pay app and our cloud-based Employer Portal.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.

How to attract talent in 2022: Smarter ways to recruit

Irreversible changes in how employees perceive work mean that attracting and recruiting talent in 2022 has never been harder. The pandemic has catalysed an evolution in the job market and the old ways of recruiting aren’t cutting it. We’ll let you in on ways you can recruit smarter and fill your vacancies in these challenging times.

The tsunami of resignations continues

When business author Anthony Klotz coined the phrase The Great Resignation back in May 2021, no one realised just how accurate his prediction would be. After two years of working from home, he foresaw employees would no longer slip comfortably back into the routine of long commutes and inflexible office hours.

In the US, a record 4.5 million people quit their jobs in November 2021 (US Bureau of Labour Statistics). Brits are now following suit, quitting their jobs at a rate not seen in over a decade.

According to figures collated by the Chartered Management Institute (CMI), voluntary departures between April and December 2021 were higher than during that same period in 2019. Almost 9 in 10 managers (89%) said their business currently has vacancies. Even more importantly, more than half (55%) said finding new staff is harder now than before the pandemic hit.

So how to navigate these changes and attract talent in 2022?

In this new world, ideas and money are cheap. But quality people are a scarce and sought-after resource. Attracting quality talent is hard right now, and retaining it is proving to be even harder.

This Great Resignation has inspired what is now being called The Great Re-imagination. This is redefining the relationship between employer and employee. Who you hire defines everything – the ability to sell, to service, to innovate and ultimately to win or lose.

The world’s most innovative leaders know this well. Even Steve Jobs considered his primary function at his level to be recruiting, dedicating considerable time and effort to hire the best.

So how do you make sure your business is hiring the best in a world where talent is in short supply? According to Ann Francke, the CEO of CMI, just offering big budget salaries isn’t enough.

In a market where the ability to hire the best separates winning organisations from the competition, here are some of the smartest ways to make sure you’re ahead of the game.

Attract talent by adopting more flexible working

The pandemic has led people to re-evaluate their quality of life and especially that all-important work-life balance. Over the past two years, working from home has meant more time with family and doing things that contribute to quality of life.

Although remote working has given people a greater taste of freedom, many want to return to the office. But even more want the flexibility to choose whether to work from home, the office, or a mixture of the two.

The key term here being flexibility. Klotz predicts that this Great Resignation is not just about quitting a job and getting a new one. He believes it’s about renegotiating the relationship between work and personal life.

Flexibility is one of the leading drivers for employees right now, so building this into your business will undoubtedly help you attract talent in 2022.

“This is a moment of empowerment for workers, one that will continue well into the new year.”

Anthony Klotz

According to research published by the Institute of Practitioners in Advertising, 89% of employees would be happiest with flexible working arrangements.

Today it seems businesses are listening with 63% saying that this is helping them attract the right talent in 2022. That compares to 58% before March 2020 (Four Better or Four Worse, Henley Business School, 2019).

Offer financial wellbeing support

The pandemic brought into clearer focus the effects of financial insecurity and the impact it has on mental health and wellbeing. Security and financial stability are on many people’s minds today and are an important foundation for productivity and creativity at work.

Frighteningly, 50% of young households today cannot afford an unexpected £250 bill and 23 million working-age adults don’t feel confident planning for their financial future.

Providing creative solutions that positively contribute towards financial wellbeing go a long way in attracting, recruiting, and retaining quality talent in 2022. As part of this Great Reset, prospective employees are looking for businesses that offer great packages. Not just in terms of salaries but financial stability and security too.

Consider adopting the four-day week

In 1986 the Bangles sang Manic Monday. But fast-forward to 2022 and it looks like Tuesday is about to become the new start to the week. The pandemic has created a seismic shift that has toppled the supremacy of the Monday-to-Friday tradition.

Working from home gave people the autonomy to live their lives and fit their work commitments around them. If nothing else, the pandemic showed us that life is short. Now, employees want to take more time to focus on what’s important to them.

In response to this, companies in the UK are taking part in a six-month project to trial a 4-day week. They will use the 100:80:100 model, in which employees earn 100% of their salary for 80% of the time.

A report from Henley Business School documenting the impact of a 4 day week revealed some exciting data. Among organisations already offering it, employee satisfaction improved, sickness absence reduced, and savings of almost £92 billion (around 2% of total turnover) were made each year. And there’s gains to be had when it comes to attracting and retaining talent too.

Promote your cause to attract talent

It’s widely recognised that younger talent is attracted by and concerned with social causes more than older generations. People want to feel their work is of value and that their contribution has positive global consequences.

When it comes to recruitment, defining your company’s cause is important, whether it’s diversity, ecological, or philanthropic. The pandemic has made people want to create a better world, and one way of attracting and retaining top talent is to promote how your company does that.

Get social to show off your culture

With offices far from crowded these days, it can be hard to show off your culture to potential recruits. Smart companies have turned to social media to engage with younger talent and showcase the human aspect of their business.

Top talent will be lured by an environment that genuinely cares about the wellbeing and career development of their employees. Showing that your talent is nurtured behind the scenes on a professional and personal level is key.

Connect with candidates on a human level

Have you put yourself in the shoes of your candidates recently? If you haven’t, then it’s time to give it a try. Despite such fierce competition for talent, so many companies continue to cling on to a long and arduous recruitment process. Multiple stages, tasks, tests…..the list goes on.

If a candidate has to go through endless interviews and wait weeks for decisions, they’ll be tempted to go elsewhere. Recruiters are constantly targeting the best talent, and the best candidates don’t hang around for long.

Adopting a more people-focused approach to recruiting can be extremely rewarding. Digital tools like LinkedIn are so much more powerful, interactive, and rewarding than tools of yesteryear.

LinkedIn allows companies to leverage personal connections and reach a broader audience when trying to attract talent and recruit in 2022. By doing this on an ongoing basis, it’s possible to build up a pipeline of talent. This means that that when the next vacancy comes up, you’ve got a selection of great people to consider.

However you find candidates, the need to connect on a human level with them remains. Remember, candidates are people, not CVs.

Close the deal with on-demand pay

By embracing these smarter ways to recruit in 2022, you’ll be ahead of the game when it comes to attracting new talent. But when you’ve got your ideal candidate in sight, how can you ensure you bring them over the finish line?

The benefits your company offers can be a deal-breaker in these situations, so it’s worth benchmarking these regularly. One of the newest and most ground-breaking employee perks is on-demand pay, also known as earned wage access or salary advance.

Giving employees the ability to choose when they get paid helps alleviate the stress associated with worrying about paying urgent bills or those that come out of nowhere. It can also be hugely liberating and empowering for them.

If you’re interested in learning more about partnering with Openwage to offer your employee on-demand pay and hearing about the benefits to your business, please request a demo.

How the pandemic has impacted employee financial wellbeing

Since the COVID-19 pandemic began, financial wellbeing has come into sharp focus for employers and employees. Job losses, financial instability, and general anxiety has made the last two years very tough for many. In this article, we’ll share insights on the impact of the pandemic on the financial wellbeing of UK employees.

High rates of anxiety around money

According to Close Brothers’ Financial Wellbeing Index 2019, 94% of employees are anxious about money, with 39% worrying about their finances nearly all the time. Importantly, the employees interviewed in the study admitted that their financial concerns were affecting them at work.

What does financial wellbeing mean?

Financial wellbeing isn’t about someone’s financial position. It’s about how optimistic and secure they feel about their current and future finances. Understanding how to manage money to enjoy life today and to meet future goals is the key.

Financial wellbeing matters at work

Financial wellbeing has a big impact at work. When employees feel in control of their money and not under financial stress, they tend to be more ‘present’ at work. They are less distracted and therefore more motivated and engaged. Employees who are not under stress are more productive and take fewer sick days.

This is all good news for your business.

How has the pandemic impacted employee financial wellbeing?

The COVID-19 crisis affected most peoples’ finances whether for better or worse. Let’s take a look at some of the key impacts of the pandemic on employee financial wellbeing:

1. Some employees saved more during the pandemic

According to The Guardian, UK households increased their savings to the second-highest level on record between January and March 2021. This was probably due to a combination of people feeling financially insecure and the closing of non-essential shops which limited spending opportunities.

AA Financial Services published a study that found 85% of UK adults spent less during lockdown, saving an average of £617 each month. It was also reported that since the start of the pandemic, 31% of people with savings accounts increased their monthly deposits.

2. Others saw big reductions in their income

But for others, the pandemic wasn’t so rosy. The FCA Financial Lives 2020 survey found that 38% of adults were in a worse financial situation due to COVID-19.

Aviva’s recent study, Thriving in the Age of Ambiguity, revealed that 57% of employees felt they were “just getting by financially”. Worryingly, 24% felt that they made bad debt decisions during the crisis, meaning the pandemic had a negative impact on their financial wellbeing.

This abrupt change in financial circumstances plunged many people into difficulties. According to a recent Citizens Advice study, 2.5 million people are behind on their broadband bills.

The study also found that 700,000 people fell into the red during the pandemic. It highlighted that 18 to 34-year-olds and those with children under 18 were three times more likely to fall behind. Citizens Advice also reported that by the end of 2020, 2.1 million households were behind with energy bill payments.

3. The pandemic highlighted that financial wellbeing can change almost overnight

Aviva’s Thriving in the Age of Ambiguity study shows how sudden events can drastically change people’s financial wellbeing almost instantly. In the foreword, Rob Barker, MD, UK Savings & Retirement at Aviva writes:

“At its core, ambiguity leaves us open to potential losses – to confusion, uncertainty, and doubt – through the risks of the unknown. But it can also open us up to potential gains – to opportunity, growth, and progress – and the ability to thrive in adversity.”

Aviva’s research illustrates that a person’s sense of financial wellbeing is affected by their personality type. Those who are more emotionally resilient, conscientious, and optimistic are more likely to be able to adapt and to turn challenging situations to their advantage.

Whereas individuals who have “less emotional resilience” are more inclined to experience “negative emotions, low financial and mental wellbeing, along with feelings of anxiety.”

4. Employees learned to adapt to changing circumstances

Due to the uncertainty of the last two years, many employees have altered their mindset and learned to adapt. Some turned to solutions such as borrowing money or requesting mortgage holidays. Others capitalised on new opportunities.

People improved their digital skills, realising the capability of new technology. Crafters and artisans seized unique opportunities to build a following on social media selling their products to a wide audience through cost-effective platforms like Etsy.

Employees reflected on what’s most important to them

For many people, the pandemic has been an opportunity to reflect on what means the most to them both at home and at work.

A life outside of work

Some people used COVID-19 lockdowns to further their education, learn new skills, and accomplish lifelong goals. Others began to place higher value on spending time with family and friends. According to Aviva, nearly half of all employees have become less focussed on their careers as a consequence of the COVID pandemic.

Greater demand for flexibility

In Aviva’s report, 69% of employees reported that flexible working will now be an important consideration in their future job or career choices. Interestingly, 64% of employees felt that having complete flexibility with their working hours would increase their productivity.

Taking steps towards improved financial resilience

As a result of the pandemic, a greater proportion of employees now understand the value of financial resilience and are working to improve their situation. This includes saving more, making better use of employee benefits, putting more into their pension, and keeping a closer eye on their money.

Despite this, The UK’s Financial Wellbeing Index reveals that UK employees are susceptible to financial stress and shocks. Plus they’re also “ill-prepared for their financial future” which is a “huge concern”.

Companies now fixed on supporting employee financial wellbeing

Since the pandemic, companies are seeing the value of promoting their employees’ financial wellbeing. Nearly half of all employers (41%) already have a financial wellbeing programme in place. In addition, 27% plan to implement a programme in the next three years.

As part of this, some companies are offering tailored, confidential support to help employees to manage and plan their finances. How does this look in practice?

- There are plenty of free, independent money advice services like Money Helper that can help employees on a practical level like budgeting tools.

- Encouraging employees to take advantage of employee financial benefits can also be helpful. These may include pension contributions, salary advances and on-demand pay, or season ticket reductions using salary sacrifice schemes.

- For 58% of employees, debt is a concern. Signposting employees to free, non-profit debt advice from agencies such as Citizens Advice, National Debtline, StepChange, and CAP is a great start.

There are plenty more ways employers can tackle financial wellbeing at work. A company that understands how important financial wellbeing is to their employees will often take a holistic approach to issues. That means they will put resources in place to offer bespoke practical support to help minimise the impact of stress on productivity.

How can you adapt to employees’ new financial wellbeing needs?

It’s useful to know that 38% of UK employees want more financial wellbeing help from their employer. A lot of employees will have different circumstances and priorities now than they did pre-pandemic.

So when planning a financial wellbeing package, it’s worth finding out what kind of financial wellbeing support your employees want right now. This may include information and advice on:

- Tax planning

- Emergency savings

- Investments and ISAs

- Pensions and saving for retirement

- Debt management

If you’re not sure what to offer, it’s best to ask your employees.

Why you need a financial wellbeing programme

Caring for your employees’ financial wellbeing increases productivity which benefits your business’ bottom line. In addition, when employees feel genuinely cared for and valued by their employer, they’re more likely to stay longer in their role. This means that less money and time is spent on acquiring and training new talent.

Key points when planning a financial wellbeing programme

A financial wellbeing programme should be inclusive of all employees whatever their:

- Role

- Pay grade

- Working hours

- Location

Consideration also needs to be given to how people will be able to easily access support when they need it. This might include for example:

- Live or on-demand online training sessions

- Face-to-face conversations by video call

- A financial wellbeing information hub accessible online 24/7

- Group sessions to discuss universal issues like pensions and retirement

- One to one sessions with qualified and impartial financial advisors

How we can help

When it comes to boosting financial resilience and reducing financial stress, allowing employees to access their pay ahead of payday can be a real game-changer.

On-demand pay allows employees to access a portion of their earnings on their schedule, instead of having to wait for their normal payday. It’s great for covering unexpected costs, like a broken boiler or car repair.

Simply knowing they have access to their pay if they need it can have a positive impact on reducing financial stress among your employees.

If you would like to find out more about how on-demand pay can help promote financial wellbeing among your employees with zero cost to your business, please get in touch to request a demo.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.

Should I use Buy Now Pay Later?

Are you one of the millions of shoppers who has already taken advantage of Buy Now Pay Later (BNPL)? Or perhaps not quite sure whether you should give it a try? In this article, we’ll give you the low-down on BNPL so that you can decide if it’s the right option for you.

BNPL is big business

Often seen as providing quick access to credit, BNPL has rocketed in popularity over the last few years. In fact, the BNPL industry is expanding by around 39% each year and it’s now the fastest growing online payment method in the UK.

Around 5 million people in the UK have accessed buy now pay later services according to the Financial Conduct Authority’s ‘Financial Lives 2020’ report. BNPL providers lent an astonishing £2.7 billion to consumers in 2020 (The Woolard Review, FCA, 2021).

What is buy now pay later?

When considering using buy now pay later as a payment option, consumers need to know exactly what it involves. Does it really offer cheap borrowing and quick access to credit? Are there risks with BNPL? Let’s find out.

Buy now pay later, in simple terms, allows consumers to purchase goods now and to pay for them later. It’s a form of credit. So instead of paying the retailer upfront for your goods, you can choose to spread the payments out over a set period of time, usually weeks or months.

When you’re buying something online and get to the checkout, one of the payment options you’re likely to be given is BNPL. When you use BNPL, your purchase is paid for by the BNPL provider and you then agree to repay them the full amount.

What’s the attraction with BNPL?

BNPL has become a popular way to buy things because it allows people to get the things they want but may not be able to afford to pay for in one go. Or sometimes a consumer simply wants to take advantage of what can be an interest-free way to borrow.

BNPL is seen as cheap borrowing as there are no fees for you to pay to access, and use, the credit. In the background, the BNPL companies make money by charging the retailers.

There’s usually no interest to pay when you use BNPL, but there could be late fees that the BNPL provider adds on to what you owe.

Who offers BNPL?

The UK’s major buy now pay later providers include:

- Klarna

- Clearpay

- Laybuy

- Openpay

They all vary slightly but the overall concept is the same. They all have an app that you can download so that you can keep track of what you owe to which retailer and when your next payment is due.

The BNPL options that are available to you will depend upon the retailer that you are shopping with. Some retailers offer just one provider whilst others offer you a choice of BNPL providers.

To give you a feel for the number of retailers that you can choose from, Klarna alone partners with over 6,500 retailers.

The BNPL market is changing

BNPL has been around for quite a while, but it’s recently had a total rebrand which is why it’s shot to fame. BNPL is now a multi-million pound industry and BNPL providers know it.

So while their claim to fame is get your goods now but pay later, some providers including Klarna have expanded their offering to include a ‘pay now’ service. So with this option, you pay the balance in full when checking out.

When checking out online, you will often see these options listed as ways to pay. You may also see a new service offered by PayPal known as ‘Pay in 3’. There is also a new offering from Monzo which has seen it become the first bank to enter the BNPL market.

BNPL isn’t just online

We have, so far, only referred to BNPL as an online payment option. This was certainly the case when these providers first entered the market.

However the BNPL market has evolved and now it’s possible to use BNPL providers while shopping on the high-street.

How does buy now buy later work?

Here’s how it works:

- Shoppers go to the checkout as normal. In addition to the usual payment methods like paying with a credit or debit card, shoppers will also probably see names like Klarna, Clearpay and Laybuy. Note that sometimes more than one BNPL provider will be listed.

- First-time BNPL users will be automatically directed to the BNPL’s website and asked to set up an account with them. They ask for some basic information and then run some checks.

- The next step is choosing repayment terms like payment date, number of payments etc. Each BNPL will offer something slightly different.

- The purchase will then be completed and the goods sent out. After that, the repayments will go automatically to the BNPL provider in line with the payment schedule selected at purchase.

What checks do BNPL providers carry out?

When you apply for credit with a BNPL provider, they’ll carry out some checks on you. These are partly to confirm your identity, but they’ll also check your credit file.

The important thing to know here is that most BNPL providers do soft credit checks (not hard credit checks). A soft credit check means that it doesn’t leave a footprint that other lenders can see.

The application process is extremely fast. This is what makes BNPL so convenient. It allows quick access to credit that, even with the application process, can see you checking out in just a few minutes. Of course, when your account has been approved, future checkouts are even faster.

How much can I spend using BNPL?

With an account set up, you’re given a credit limit that you can spend up to. This is usually in the hundreds of pounds rather than the thousands that you may be able to access with a credit card.

When you make a purchase, the purchase amount comes off your credit limit. While BNPL started off as a way to pay for big-ticket items, that’s now changed. You can usually use BNPL to pay for goods of any value.

What does BNPL mean for shoppers?

With buy now pay later offering a cheap and quick way to borrow, it’s not surprising it’s become hugely popular. 37% of British shoppers say they’ve used BNPL and 54% of millennials have used BNPL.

BNPL can be great for people who want or need to delay their purchases or spread payments for a big-ticket item. For example, Hayley wants to buy a new TV and the way she can afford this comfortably is by spreading the payments over several months using BNPL.

For others, the pull of BNPL is not having to pay for items you’re likely to return. Let’s take clothes for example. When you’re shopping online for clothes, you can’t try things on. So you may hedge your bets and buy multiple sizes.

You know you’ll return whatever doesn’t fit right and only keep one. Using BNPL for this type of purchase means you don’t have to pay upfront for something you won’t keep.

BNPL can be used to purchase almost anything that you can think of. While its popularity stemmed from clothing, you can now use it for tech devices, jewellery, and even groceries.

Are there any downsides to BNPL?

While cheap borrowing and quick access to credit may seem appealing, there are some downsides that BNPL users need to be aware of.

BNPL is unregulated

The Woolard Review brought to attention the fact that BNPL is unregulated. This means that some BNPL providers don’t carry out adequate affordability checks on the borrower’s financial circumstance before approving the loan.

These affordability checks are important because they help prevent consumers from borrowing more than they can afford to pay back, the precursor to getting into debt.

BNPL means purchases aren’t protected

Another potential problem with BNPL is that the consumer doesn’t get the same level of protection with their purchases as they do with a credit card.

Specifically, Section 75 of the Consumer Credit Act means that your credit card provider must protect purchases over £100 for free. This means you can get your money back if there’s a problem.

With BNPL you don’t get that protection. So if your new TV that you bought through BNPL turns out to be faulty, usually you can’t call on your credit card provider to help resolve the problem or complain to the Financial Ombudsman.

However, it’s still possible to pursue a chargeback if you’re unhappy with a purchase when you pay using BNPL.

Fees for missed payments

BNPL payments should be taken automatically. However there are all sorts of reasons why this might not happen.

It can be easier to spend more than you can afford when BNPL is a payment option. Because the affordability checks the BNPL providers do are patchy, you might end up borrowing more than you can comfortably afford to pay back.

So if you don’t budget correctly one month and there’s not enough in your account to cover the BNPL payment, it usually means a late fee. Missed or late payments can also be reported to credit reference agencies so it could count against you when you try to apply for credit in the future.

Risk of overspending

BNPL is quick and convenient. This means that some shoppers may be less likely to reflect on whether they’re buying more than they can afford to repay. The pressure to live for today makes BNPL highly appealing.

But using BNPL to pay for goods online doesn’t make them cheaper. You’ll have to pay for them eventually, so be sure to know how much you can comfortably repay.

BNPL isn’t for everyone….what other options are available?

Of course there is a wealth of credit products available to many people depending on their credit score and other financial circumstances. Credit cards, overdrafts, and payday loans are just some examples of loans.

Want to avoid loans? Try on-demand pay

With loans there are nearly always interest rates, late payments, time-consuming checks and, the big one, the risk of debt. But not everyone wants to take the risk of getting a loan, especially if it’s just a small amount of money that they need.

For those wanting to avoid loans, there is an alternative. It’s called on-demand pay. Basically it means you can get the money you’ve earned before your usual payday. It’s not money in addition to your salary, it is your salary – you’re just getting some of it sooner.

Get paid when you want with Openwage

On-demand pay isn’t a loan either, because you can only get a portion of the money you’ve already earned. Future earnings aren’t accessible. This safeguard helps keep our users financially safe.

You can get your earnings instantly into your bank account with just a few taps. There’s just a simple fee of 1% of the amount you transfer.

Any money that you take ahead of payday comes off your salary at the end of the month. If you’re interested in getting paid when you want, refer your employer and we’ll contact them (you can remain anonymous if you like).

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.

Top 5 employee thank you gifts to avoid (and what to do instead)

’Tis the season to be jolly, but what will you be doing this year to thank your employees for their hard work? We all have good intentions when it comes to choosing employee thank you gifts. But sometimes organisations inadvertently get it terribly wrong. Read on to discover the top 5 employee thank you gifts to avoid and some great alternative ways to say thank you.

Why thank your employees at Christmas?

Christmas gifts for employees aren’t just a ‘nice to do’: they are a vital part of keeping your employees motivated and productive. The need to be recognised and appreciated is a basic human one and one that gets magnified in the workplace.

Employee appreciation is also important when it comes to retention due to the positive impact on employee engagement that recognition has. One report shows that 85% of engaged employees plan on sticking around compared to 27% of disengaged employees (BlessingWhite, 2008, The State of Employee Engagement).

Happy employees are good for business

A recent study at Oxford University revealed that there was a direct link between happy employees and productivity. When employees are happy their productivity leaps by around 20%. So prioritising your employees’ happiness is good for business too.

Since 2021 has become known as the year of the Great Resignation, organisations need to focus on increasing levels of employee engagement in 2022. One of the key ways to tackle employee engagement is ensuring that employee rewards and recognition forms part of your HR strategy.

One thank-you gift for a diverse workforce?

Finding meaningful ways to thank your employees has always been, and continues to be a challenge. With a workforce diverse in age and interests, there are countless employee thank you gifts you should avoid.

As well as a diverse workforce, you probably have employees working across different locations too. There’s been immense growth in hybrid working and 2 in 5 employers are expected to embrace this by 2023 according to research by Willis Towers Watson (2021).

Consequently, organisations need to ensure that employee gifts resonate with everyone, whether they work from the office or from home.

Employee thank you gifts to avoid

With a clearer understanding of why thoughtful employee gifts are so important, you’re probably now thinking what makes the perfect gift?

To help make your job of deciding how to thank your staff this year easier, we’ve compiled a list of the top 5 employee thank you gifts to avoid:

5. Trivial dress down days

Dress down days always bring back memories of non-school uniform days as a child. For some, this was the perfect opportunity to show off but not everyone enjoyed having to decide on the perfect outfit.

Your employees may still have these mixed feelings today when it comes to dress down days. When there’s a dress code or uniform, everyone knows what to wear and everyone knows how to fit in. Take this away and you can make colleagues stand out in ways that make them feel uncomfortable.

If employees value the freedom of choosing what they wear, why not consider organising a day out instead? Then employees can dress for that rather than worrying about being perceived differently at work.

4. Bring-your-own-food workplace events

When you’re looking for employee gift ideas, try to focus on what employees will really appreciate. Often this is being made to feel special or even getting some of their precious time back.

So when organising events like after-work drinks at the office or Christmas buffets, take a minute to think about what you’re asking your employees to do. Often these types of events call for some food, but asking your employees to bring their own tends to put a damper on it.

Your employees work hard all year, so giving them more work to do by way of making or buying food for events isn’t going to make them feel appreciated. The chance to relax goes a long way, so bring in the caterers and spoil them. This will be received much better and is far more likely to make your employees feel valued.

3. Company merchandise

From pens and mouse mats to stress balls and mini jenga sets, company merchandise is definitely eclectic, but it’s often poor quality. While company-branded merchandise might be perfect for handing out at events and while networking, the real value of these items is normally pretty low.

Using this kind of merchandise as a gift for your employees is unlikely to go down well with your employees. Now, if you decide to invest in some high-quality company products like company swag, then that’s a different story. But be sure to put real thought into it.

2. An expensive Christmas party

A Christmas party in itself isn’t an automatic fail when it comes to showing employee appreciation. They can be a great way for your teams to bond and to be made to feel special.

But have you stopped to consider the cost implications for employees attending the Christmas party (at an already expensive time of year)? Dazzling your colleagues at the Christmas party can be expensive when you consider costs such as:

- Travel

- Hotel rooms

- Hiring or buying evening wear

- Drinks

What starts as a fun idea can actually be the cause of a lot of stress for employees who are likely to have many other expenses at this time of year. Before planning your Christmas party, think about your employees and their financial situations. Involving your employees in party planning decisions can be a great way to ensure you nail it.

1. A pay rise

Pay rises are a vital part of employee reward and can have an extremely positive effect on staff motivation and productivity. Employees will always be grateful for a pay rise but using pay rises to thank employees may leave them feeling undervalued. So what’s a better alternative?

An end of year bonus is a great way to show your employees you appreciate all their hard work during the year. Seeing that their hard work translates to company success, and that company success brings personal financial reward can be really motivating for employees.

Don’t go abandoning pay rises by the way! Just avoid using these as an employee thank you gift.

Key takeaways

Employees aren’t necessarily looking for high-value gifts at Christmas. All that they really want is something that has meaning and something that makes them feel appreciated. This needn’t cost the earth.

Choose something simple and thoughtful that has genuine value to thank your employees.

“It’s the thought that counts” holds a great deal of truth when considering Christmas gifts for employees. Anything that shows your employees that you truly appreciate them and their efforts will be chalked up as a win.

How we can help

Are you considering more strategic ways to recognise and reward your employees? Giving your employees the freedom to choose when they get paid can be a real game-changer.

Christmas should be a time of enjoyment, but for many, it can also be a cause of financial stress. By offering your employees the ability to access their pay when they need to, it shows your employees that you care about their wellbeing.

Using the Openwage app and at no cost to your organisation or impact on cash flow, employees can access a portion of their earned pay. This flexible approach to pay means that employees aren’t left feeling stressed out while waiting for payday.

If you’d like to know more about this financial wellbeing benefit, get in touch now and we’ll be happy to show you the ways on-demand pay can benefit your employees and your organisation.

How to promote financial wellbeing in your workplace

More than ever, companies are realising how important it is to promote financial wellbeing in the workplace. Financial wellness has become a key focus area for employers who are looking to create the ideal work environment. Let’s take a look at how you can promote financial wellbeing in your organisation with some practical tips.

Financial wellbeing: Why should employers care?

The financial wellness of your employees can have a major impact on their performance at work. This is because feeling financially well means that employees are likely to be less stressed and more focused while at work.

There is also a direct link between financial wellbeing and absenteeism.

Financially stressed employees are more likely to be absent than those who feel financially secure.

It’s widely accepted that increased financial stress can have a negative impact on mental health. Money worries can lead to sleep problems, anxiety and depression. Over time, this can lead to long term absence from work.

Don’t know where to start? You’re not alone

More and more HR teams are waking up to the potential business gains of promoting financial wellbeing at work.

But what stops many of those teams from taking action to promote financial wellbeing is not lack of intention. It’s because they don’t know exactly how to do this and importantly, where to start.

Your employees are financially stressed (but you probably don’t know it)

Employers believe that 88% of employees have money worries (Close Brothers’ Financial Wellbeing Index 2019).

In fact, the same study revealed that 94% of employees admit to having money worries, and 77% of them say that it impacts their work performance.

So some of your employees will be financially stressed, but most are far too afraid to admit this. This is because of something called ‘money shame’ and the fact that it’s still considered a taboo to talk about money.

Planning your financial wellbeing strategy

One key thing to remember is that your financial wellbeing strategy needs to be specific to your workforce and your company.

You need to consider the specific needs of your employees, and what your company wishes to achieve from a financial wellbeing strategy so that you stay on target.

Consider these questions to help you get started:

- What financial challenges are your employees facing? How can you address these with your strategy?

- Do you have a vision of how your strategy will look; what objectives will you work towards?

- Does your workforce respond better to online resources or Q&A sessions?

- What do your employees want and need from this strategy? Surveys are a useful tool for this part.

- Have you defined the outcomes you want to achieve?

- How will you measure the success of your strategy, by gathering data before and after implementation?

Designing your financial wellbeing strategy

Your planning has allowed you to discover what your financial wellbeing programme is going to achieve, but what exactly will it look like? How can you break these objectives down into actions you can work on?

The key to designing your financial wellbeing strategy is to include your employees. Ultimately you are implementing this to benefit their financial wellness. So it makes sense that they are involved in the early stages.

Here’s a few key areas your strategy may focus on:

Review your benefits and rewards package

Besides pay, benefits have the potential to provide a lot of value to your employees. They rank pretty highly in terms of affecting a candidate’s decision to join a company.

Many employees have been adversely affected financially by the pandemic, so the benefits packaged you designed pre-COVID may not be what employees post-COVID really want or need. Flexibility has catapulted up employees’ agenda since the pandemic, so that’s a great place to start.

How could you improve or expand your existing benefits package in ways that promote financial wellbeing? What benefits do your employees value the most?

As well as introducing new benefits, you should revisit existing ones. A key area that’s worth redesigning is your company pension scheme to ensure that it offers your employees long-term security and stability.

Target financial education

It’s also vital to consider financial education as part of your financial wellbeing programme. Your company can address financial education in many ways:

- Offering an online learning portal

- Holding in-person seminars

- Offering regular advice sessions with independent financial advisors

- Giving advice that focuses on pensions or what health plans can offer