Salary advance, earned wage access & on-demand pay explained

Have you noticed that the way that employees are paid is changing? If you’re in the business of people, then it’s highly likely you’ve seen the phrases salary advance, on-demand pay and earned wage access flying about. But what do they mean? Let’s push aside the jargon and explain what these terms mean for you.

Monthly pay cycles don’t work for everyone

Most employees in the UK are paid once a month. With traditional monthly pay cycles, employees build up a bank of earnings by the time payday arrives. Then they receive all their earnings at once and have to make them last for the next four weeks, which can be stressful.

With such a long gap between paydays, some employees struggle with short-term cash flow issues.

94% of employees worry about their finances and only 40% feel prepared for unexpected expenses. This might include an urgent car repair or an emergency visit to the vet.

The solution up until now? Getting a payday loan with an extortionate interest rate. Or asking their employer for a payroll loan or a salary advance which they then repay on payday.

Salary advances have been around for ages, haven’t they?

Historically, a salary advance is when an employee and an employer enter a private loan agreement. This typically involves running a credit check on the employee and the requirement to pay it back with interest.

Then there are also payroll loans, which are a personal loans repayable over a period of months. This type of loan is sometimes accessible through a credit union in the UK and interest payments due based on the value of the loan Employees make repayments straight from their pay so that they can’t miss payments.

These loans have been around for ages. The standout feature of traditional salary advances and payroll loans is that the employer is given an advance on pay that they haven’t earned yet. This means that the employee is at risk of defaulting on the loan because they haven’t earned the money.

These loans are time-consuming and complex to administer. Besides this, the traditional salary advance and payroll loan put strain on the relationship between the employer and the employee.

Salary advances are flawed. Flexible pay is the future.

These issues with the traditional salary advance have been recognised and solved, creating a solution that’s probably more accurately described as on-demand pay (or salary advance 2.0).

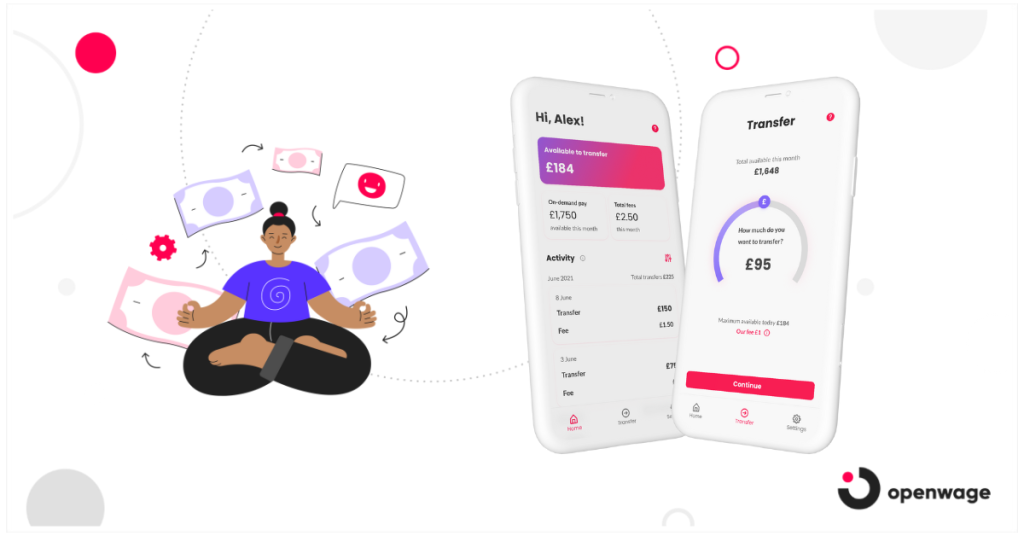

In a nutshell, on-demand pay allows employees to access their pay as soon as they’ve earned it using an app. Any pay they access during the month is deducted from the next pay packet.

There is no need to actively repay anything at the end of the month because it automatically deducts withdrawals as part of the payroll process.

The likes of Uber pioneered the popularity of on-demand pay back in 2016.

Here’s the big one – because the employee is accessing money they already earned, it’s not a loan. Since on-demand pay isn’t a loan, there’s no credit check and no interest to pay.

What’s in a name?

Salary advance 2.0 and on-demand pay are also called:

- Earned wage access (EWA)

- Early wage access (also EWA)

- Accrued wage access

- Employer salary advance scheme (ESAS) – this is the official UK government term

- Flexible pay

- Instant pay

- Pay on demand

With all of these terms, the concept is the same. It gives employees financial flexibility to access their pay when they need it instead of waiting unnecessarily until the end of the month.

It can be confusing with so many terms to remember. We’re going to call it ‘on-demand pay’ because we feel that reflects the true nature of this product.

On-demand pay is born

The traditional salary advance has morphed into a multi-faceted employee benefit with a strong business case for reducing business costs. While a traditional salary advance involved the company stumping up the cash, on-demand pay is funded by the earned wage access provider (we’ll talk more about this later).

Let’s break this down:

On-demand pay – the perk your employees will love

If you’ve seen any job adverts lately online, you’ll see that on-demand pay is now advertised as an employee benefit. It’s a genuine perk to be able to decide when to get paid. For this reason, it’s being used as a competitive advantage for employers to help them recruit faster.

Boost financial wellbeing with on-demand pay

Bills coming out at different times in the month, unexpected expenses and being paid just once a month can leave us feeling financially vulnerable. But with on-demand pay, short-term cash flow issues can be quickly solved.

Importantly, employees can overcome short-term financial issues by using on-demand pay without having to resort to costly payday loans or expensive credit cards. This is great news for your employees’ financial wellbeing.

On-demand pay helps you keep your staff for longer

Poor financial wellbeing is causing 22% of employers to experience higher turnover rates (Close Brothers’ Financial Wellbeing Index 2019). Employers are now using on-demand pay as a tool to help fight the Great Resignation.

With on-demand pay, employees feel their employer is looking out for their financial wellbeing. This in turn, builds trust and loyalty, two key factors that help minimise staffing losses.

Help your employees worry less about money with on-demand

77% of staff with money worries say this impacts them at work (Close Brothers’ Financial Wellbeing Index 2019). This can lead to lower levels of productivity and reduced performance.

Employees who can get their pay on-demand are more likely to cope more easily with financial bumps in the road. This allows them to focus on their work.

On-demand pay reduces absenteeism

Almost a fifth (19%) of employers reported an increase in absenteeism caused by poor financial wellbeing (Close Brothers’ Financial Wellbeing Index 2019). HR teams are focusing on maximising attendance because of the high cost of financial stress.

On-demand pay gives employees more control over their money, helping to reduce anxieties around waiting for payday.

Who provides on-demand pay?

On-demand pay providers are also called earned wage access providers. Employers typically need to sign up with an earned wage access provider for their employees to access the service.

They integrate with an employer’s payroll and time management systems, in order to enable an employee to take out up to 50% of their gross earned pay before payday.

One of the key differences between earned wage access providers is who pays the fee for each salary advance or on-demand pay transfer.

Some earned wage access providers charge employers for the service while others charge the employee. Some charge both the employer and the employee.

Openwage: On-demand pay at zero cost to your business

Armed with this knowledge, you may well be considering implementing on-demand pay in your company.

By partnering with us, you can put financial wellbeing in reach of your employees at no cost to your business. You don’t have to fund the advances either (because we do that). This means there’s no impact on company cashflow.

Here at Openwage, we designed our on-demand pay solution with employee financial wellbeing in mind. We only charge employees a low, fair fee for each on-demand pay transfer.

Find out how we can help your employees and your business. Request a demo of our on-demand pay app and our cloud-based Employer Portal.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.