How does a pay advance work?

Over half of employees worry every single month about how they’re going to make their salary stretch. But financial problems don’t vanish when work begins. Employers should embrace a more proactive approach to increase employees’ financial wellbeing.

Personal debt, increasing financial commitments, and stagnant savings rates are causing employees to struggle financially

You’ve probably witnessed it. Being distracted, ducking out to take personal phone calls, and showing signs of stress can all be symptoms that an employee is struggling financially.

Employees with money worries are less productive, more likely to be off work, and their mood may affect other members of their team. These are genuine issues that affect your employees and your wider business in a profound way.

The good news is, this problem can be tackled by exploring ways to boost your employees’ financial wellbeing. In this article we’ll be taking a look at an increasingly popular employee benefit; pay advances.

What is a pay advance?

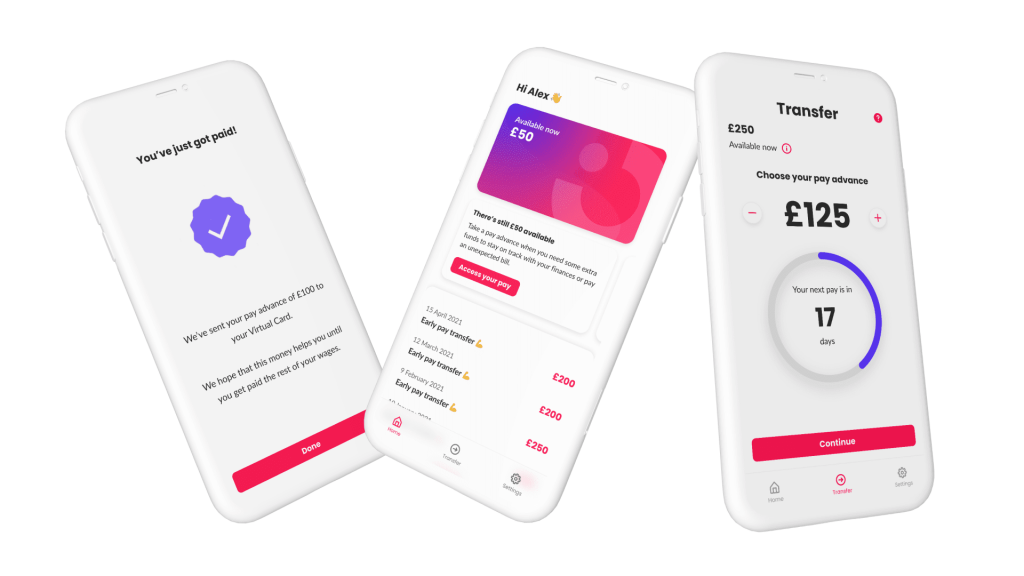

A pay advance (also known as on-demand pay, early pay access, earnings on demand, early wage access) allows your employees to access their pay before their scheduled payday.

Over the last decade or so there has been a major shift in the way that people are paid. It was once commonplace for employees to be paid either weekly or fortnightly. But by 2019 by far the most common frequency of pay was and still remains, monthly.

A monthly pay cycle makes sense for a business as it reduces costs and increases the efficiency of its payroll department. For employees, however, it presents them with budgeting challenges.

Offering a pay advance or on-demand pay can help ease these challenges and have other wide-ranging benefits for both employees and you as a company.

Let’s be clear. A pay advance is not a loan. It’s simply access to money that an employee has already earned, but not yet been paid. It’s not a loan because the employee doesn’t need to pay it back. They simply get their pay, minus any pay advances and fees, on payday.

With Openwage, there is no interest to pay when an employee chooses to take a pay advance. There is simply a low, transparent transaction fee. So employees won’t be out of pocket if they need access to extra funds once in a while.

This is a welcomed contrast to high-cost credit like payday loans, credit cards, and overdrafts that charge extortionate rates of interest and fees.

Borrowing using these methods puts your employees at risk of falling into debt. This causes them further personal stress but also impacts their workplace performance.

Employers can offer Openwage to their employees at no cost to their business.

4 steps to offering your employees a pay advance

Many employers recognise the benefits of offering their employees access their pay on demand. This includes reducing financial stress and the absenteeism and distraction that often accompanies it.

But is a salary advance scheme easy to implement? The answer is yes. By selecting Openwage as your pay advance partner, you won’t face a bureaucratic or administrative nightmare. Here’s how it works:

1. Sign up to Openwage

Making contact with Openwage is the first step towards offering your employees access to their pay before payday. It’s free for employers to offer Openwage.

We’ll set up your account and then you can add your employees. Openwage doesn’t impact your payroll systems and it won’t affect your cashflow, as we provide the funds for all pay advances.

We like to keep things simple and avoid any unnecessary complications that create additional work for you and your team.

2. Brief your employees

For your employees to benefit from a salary advance then they are going to need to know about it! Briefing your employees and getting their buy-in is vital.

We can help with this. Be sure your employees understand that they are accessing a portion of their pay. It’s not a loan.

The uptake will be greater and you’ll be reducing financial stress for a larger percentage of your team.

3. Payments: How they work

We use Open Banking to get an accurate picture of each employee’s financial health. This ensures we act responsibly and in the best interests of your employees.

We provide the funds for all pay advances, so there’s no impact on your company’s cashflow.

Employees receive their pay advance directly to their bank account and pay a small transaction fee at the end of the month for each pay advance.

4. Assess take-up

To allow you to see the benefits of offering your employees flexible access to their pay, we’ll send you a monthly report.

These reports are anonymised but will allow you to see how many of your employees are using the service.

Why should you offer employees a pay advance?

We’ve already looked at how employees are struggling financially and how, for the majority, monthly pay cycles just don’t work.

As an employer, clearly you’re not entirely responsible for every employees’ financial wellbeing. But as an employer, it makes sense to care for your employees as this benefits both parties. Out of 1,000 employees surveyed about financial wellbeing, only 1 in 20 would be comfortable approaching their manager for assistance.

Perhaps even more concerning is the fact that only 3% would approach their HR team. The fact that employees are feeling like this perhaps explains the level of absences when they are worried about their finances.

Offering your employees access to their pay early can deliver valuable benefits to your business:

- Employees in control of their finances will be less distracted at work, leading to higher levels of productivity.

- Offering pay advances as an employee benefit can help you stand out as a forward-thinking business, making the recruitment process easier.

- Employees will value the flexibility in accessing their pay when they want, and be more likely to stay with your business for longer because of it.

- By empowering your employees to access their pay when they need it, they are less likely to suffer from financial stress which can lead to workplace absences including sickness.

- You are demonstrating your commitment to promoting your employees’ financial wellbeing and taking active steps to address most people’s number one concern: money.

For more information about how your company could benefit from implementing this financial wellbeing benefit at zero cost to your company, visit our Employer page.

Frequently asked questions

Is a pay advance a loan?

No. Employees access their pay when they need it. They don’t have to repay it – instead they receive their pay minus any pay advances on payday.

How does it affect our payroll?

By partnering with Openwage, there is no impact on your payroll. Any pay advance is made by us straight to your employees.

Do our employees need to be credit checked?

No. This is not a loan facility and so there are no credit checks for employees.

How we can help

We’d love to chance to speak to you about how Openwage can benefit your employees’ financial wellbeing. To find out more, please get in touch.

The information in this article is for general information only. It does not constitute professional advice from Openwage. Openwage is not a financial adviser. You should consider seeking independent legal, financial, taxation or other advice to check how the information in this document relates to your unique circumstances.